Blogs

•

January 13, 2026

•

Colan Neese

Happy 2026, I hope you all had a real holiday break, the kind where you actually unplug… or at least pretend to.

I Played At Least 30 Hours Of This Game Over The Holidays...

I did my own little social media sabbatical, At first I toyed with the idea of squeezing out a Patch Notes over the break, then I remembered I have a family and they enjoy seeing me occasionally, so I took the time, recharged, played a lot of LEGO Star Wars: The Skywalker Saga, and tried to come back into this year with a little more intention.

Thanks for reading! Subscribe for free to receive new posts and support my work.

That said, I never really stop thinking, and what I kept coming back to over the break was a simple question, was 2025 a one off, or was it the new baseline.

Because 2025 was chaos, in the best way and the worst way. Games, announcements, shadow drops, hits we called early, hits nobody could have called, and a lot of very expensive attempts at “breaking through” that never really got there.

And now… 2026 already looks like it wants to do it again.

Biggest Hit This Year OR Will This Be Pushed To 2027?

Just off the top of my head, we’re staring at Resident Evil Requiem, the always whispered Grand Theft Auto VI (I don’t know if you’ve heard of it), Marvel’s Wolverine, LEGO Batman: Legacy of the Dark Knight, 007 First Light, Marathon, plus a grab bag of other things that feel like they could swing from “nice quarter” to “cultural moment,” like Crimson Desert, Total War: WARHAMMER 40,000, and Phantom Blade Zero.

So the real question isn’t “is 2026 stacked,” it’s “what actually cuts through,” what earns attention, what converts that attention into time, and what turns time into money… in a year where the feed never ends.

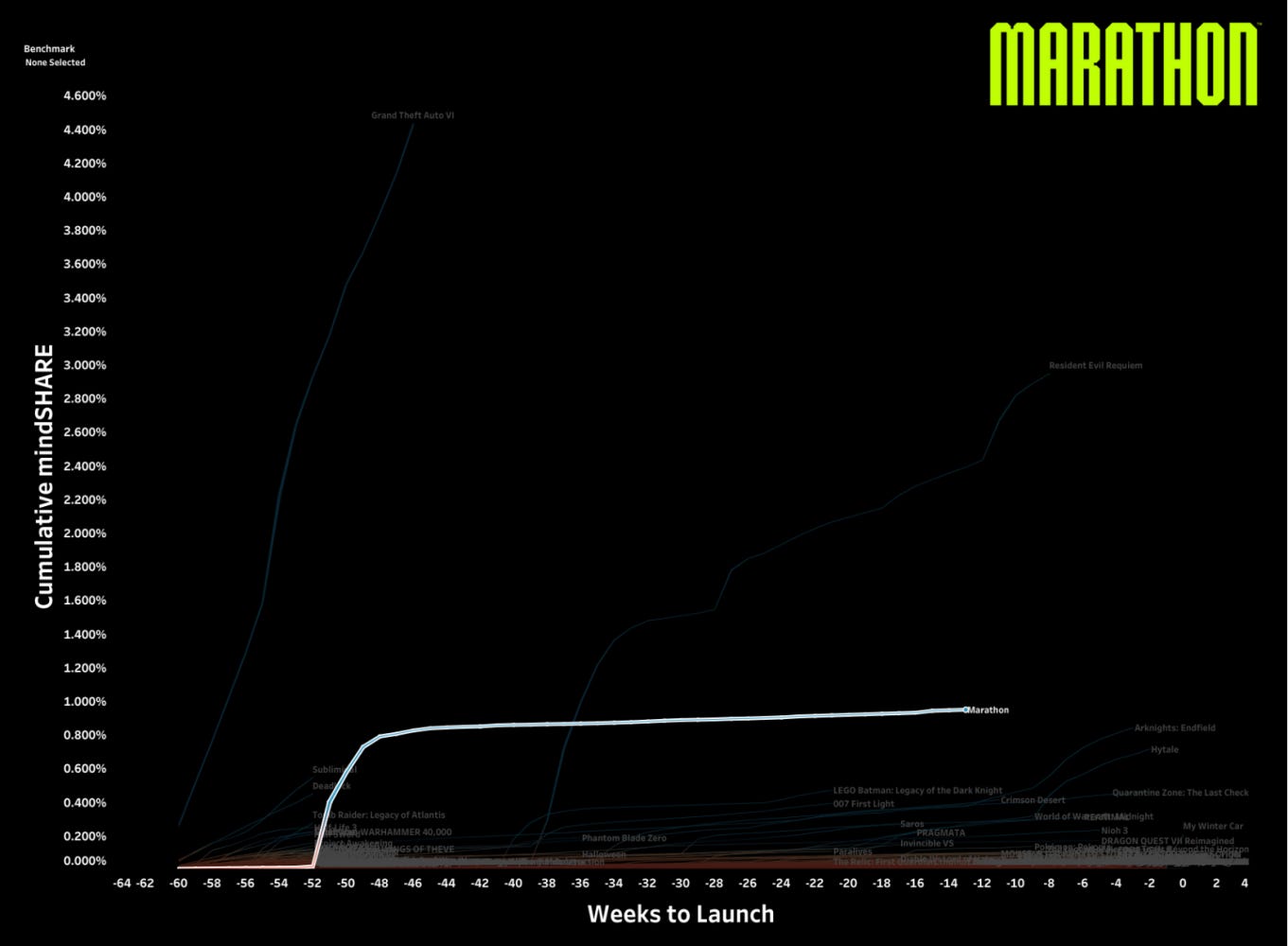

We got a few things very right last year here at mindGAME Data. We were early on Clair Obscur: Expedition 33 as one to watch, and that one aged beautifully. We had the right read on Monster Hunter Wilds being a monster (yuk yuk). We flagged ARC Raiders as a real breakout well before launch... even though I was worried they might have gone too quiet before launch but that clearly was the right play and it paid off.

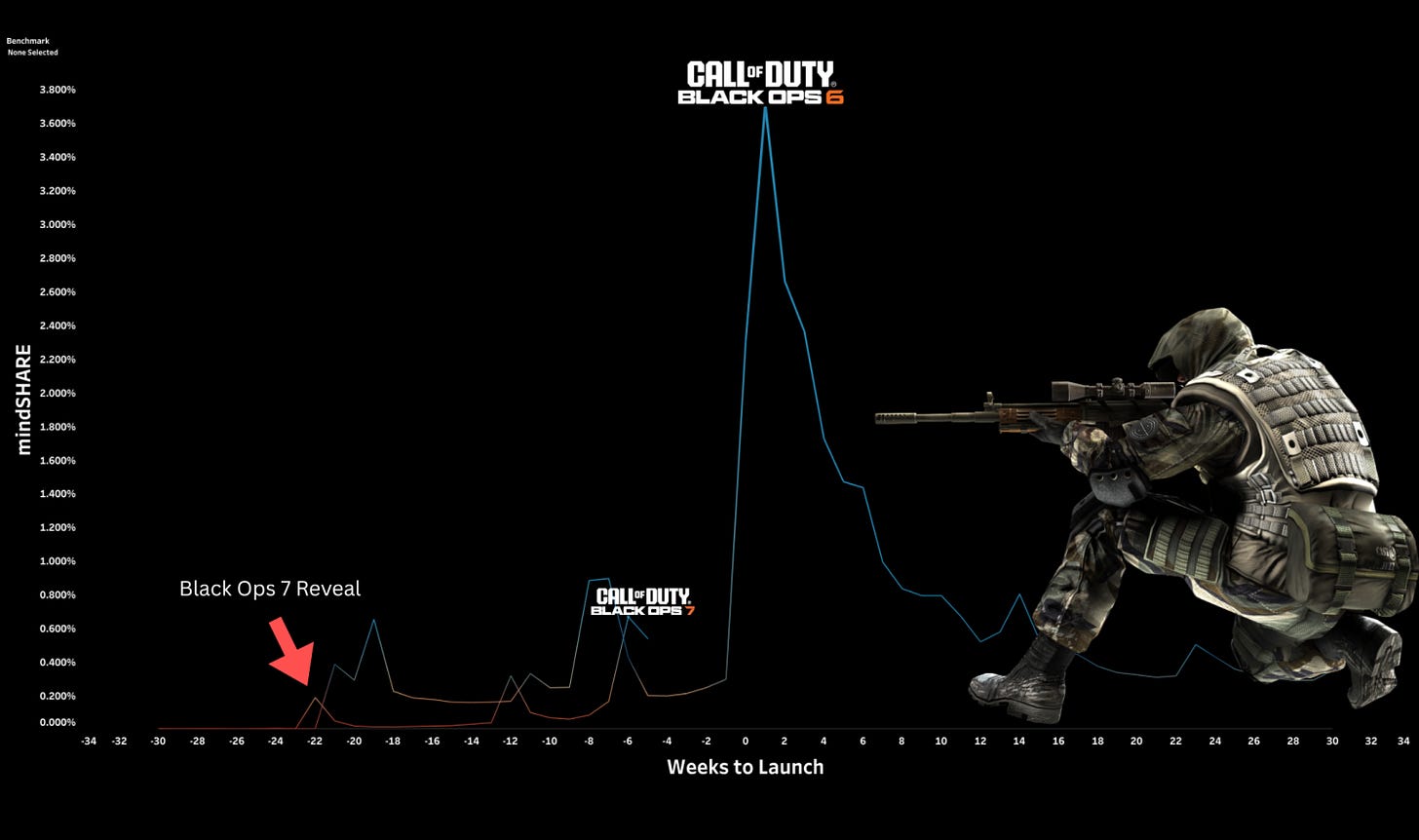

We also got reminded that nobody has perfect information. Nobody predicted The Elder Scrolls IV: Oblivion Remastered would just… appear. And we were as surprised as anyone watching Call of Duty: Black Ops 7 stumble, even though our data had been warning us it was coming.

Signs of the Call of Duty Miss Were There... Starting At SGF

So for this first Patch Notes of 2026, I’m trying something slightly different.

I started by making a list of “games I’m excited about,” felt too obvious. Then I tried going full high level trends, felt too abstract. So I’m splitting the difference.... things on my mind where the “game” and the “theme” are basically the same object. Some of these are predictions, some are open questions, all of them are musings, my attempt to map the year before it happens.

Alright… let’s get into it.

Capcom’s Calendar Advantage

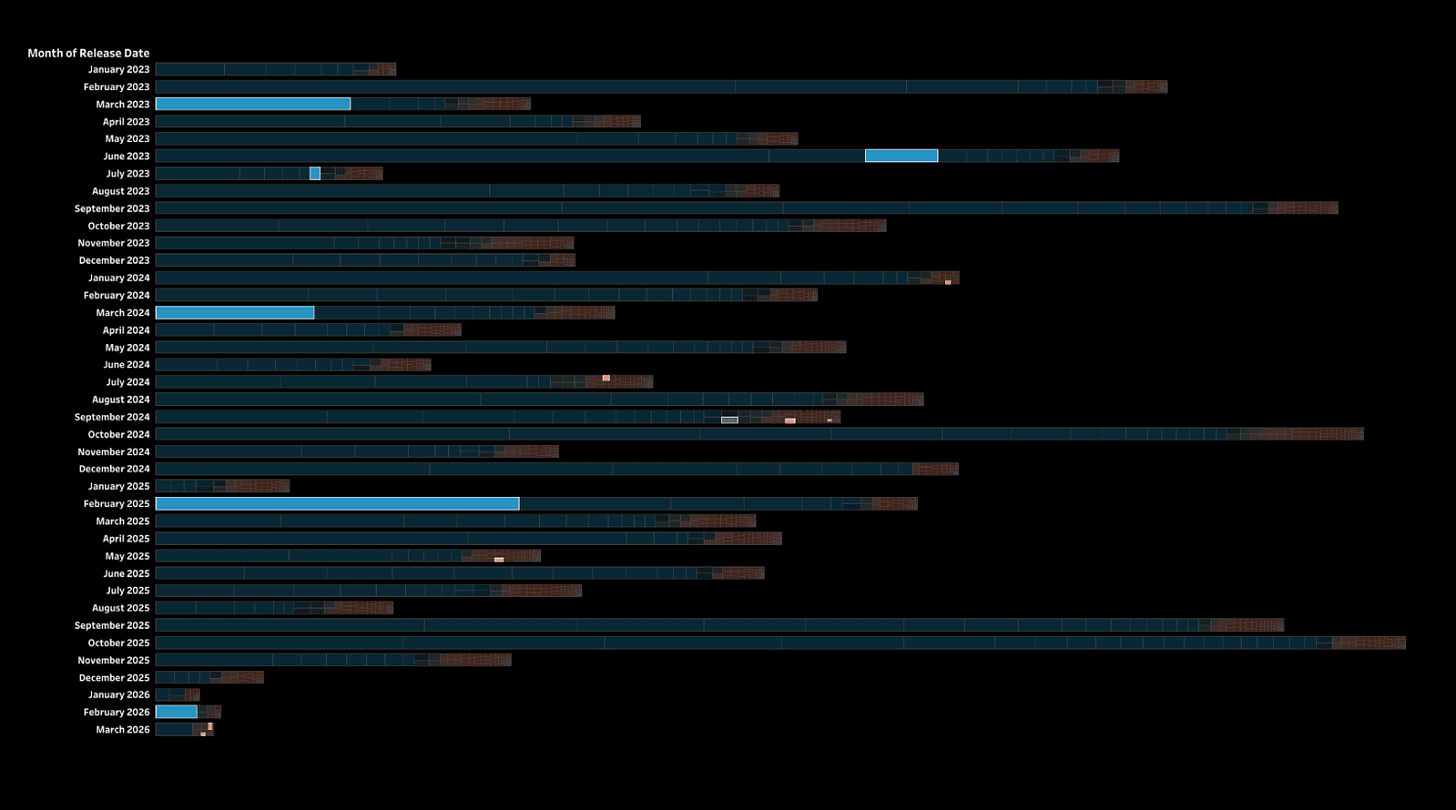

Capcom has quietly built one of the cleanest, most repeatable calendar advantages in the industry, they show up early, they show up loud, and they do it when the calendar is still relatively calm.

Since the start of 2023, they’ve had a major tentpole in Q1 that’s either the dominant release of the quarter, or at worst, right there in the conversation.

The Q1 Pattern

In March 2023, the Resident Evil 4 remake landed and hit a mindSHARE peak of 2.04%, an absurdly strong launch by any standard. The only reason it didn’t walk away with the “biggest game of Q1” crown was that Hogwarts Legacy was a once-in-a-cycle phenomenon, and ended up the #1 selling game of 2023.

In March 2024, Capcom ran the play again with Dragon’s Dogma 2, which peaked at 1.66% mindSHARE. It was the biggest release in its month, beating out headlines like Call of Duty: Warzone Mobile on a global basis. Was it the biggest game of the quarter, no, because Palworld showed up as a black hole of attention and sucked up an outsized share of demand. Even with Helldivers 2 in the mix, a different kind of hit with a longer tail, Dragon’s Dogma 2 still reads like one of the defining launches of that quarter.

Then 2025 made the pattern impossible to ignore. Capcom shifted forward into February with Monster Hunter Wilds, and it peaked at 3.8% mindSHARE, it didn’t just win Q1, it lapped the field. No one was in the same zip code, it outpaced releases like Assassin’s Creed Shadows and even more critically lauded titles like Kingdom Come: Deliverance II. Monster Hunter Wilds was a commercial beast, and the funniest part is that we collectively moved on fast because that’s what the feed does now.

The 2026 Opener, Resident Evil Requiem

Which brings us to 2026, and why this section is the opener.

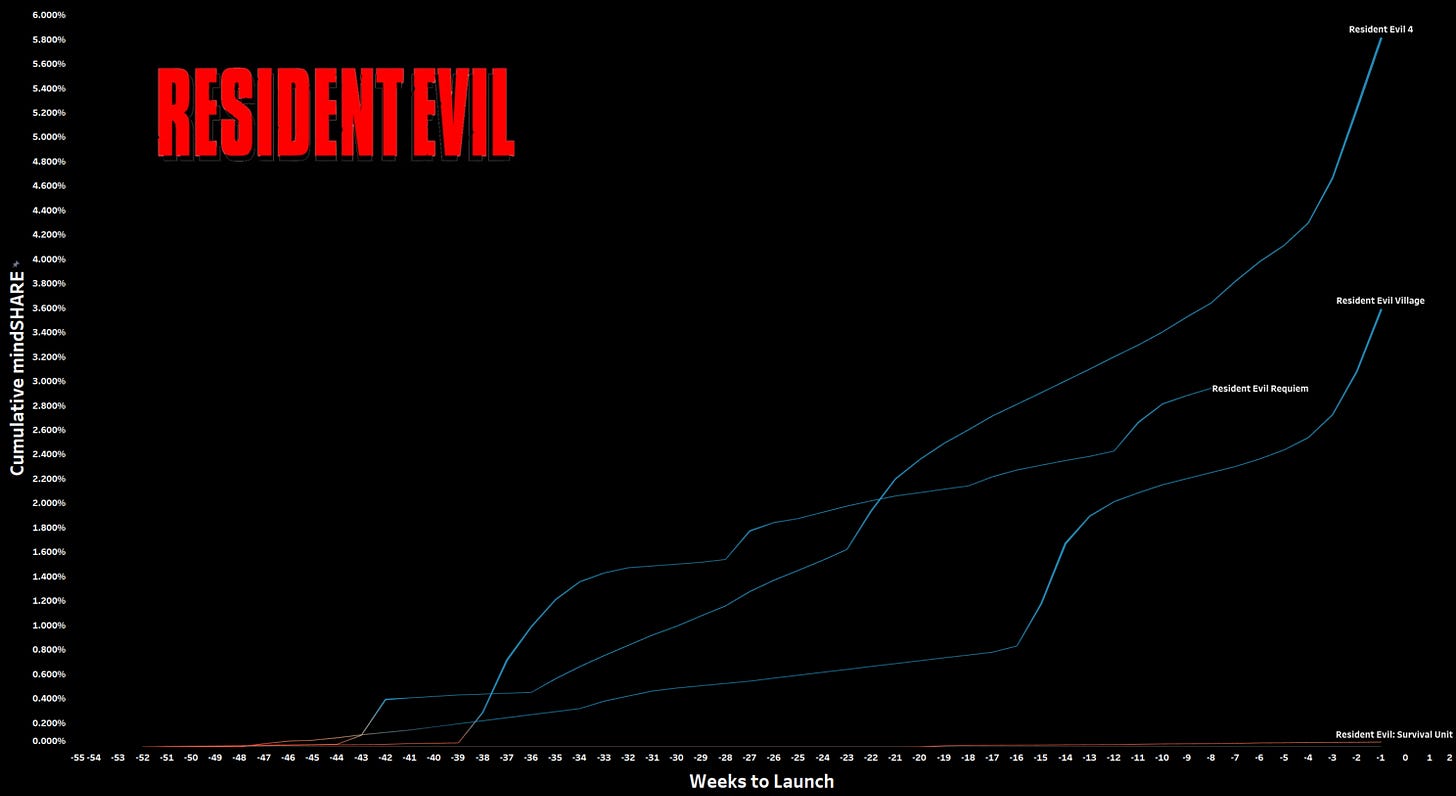

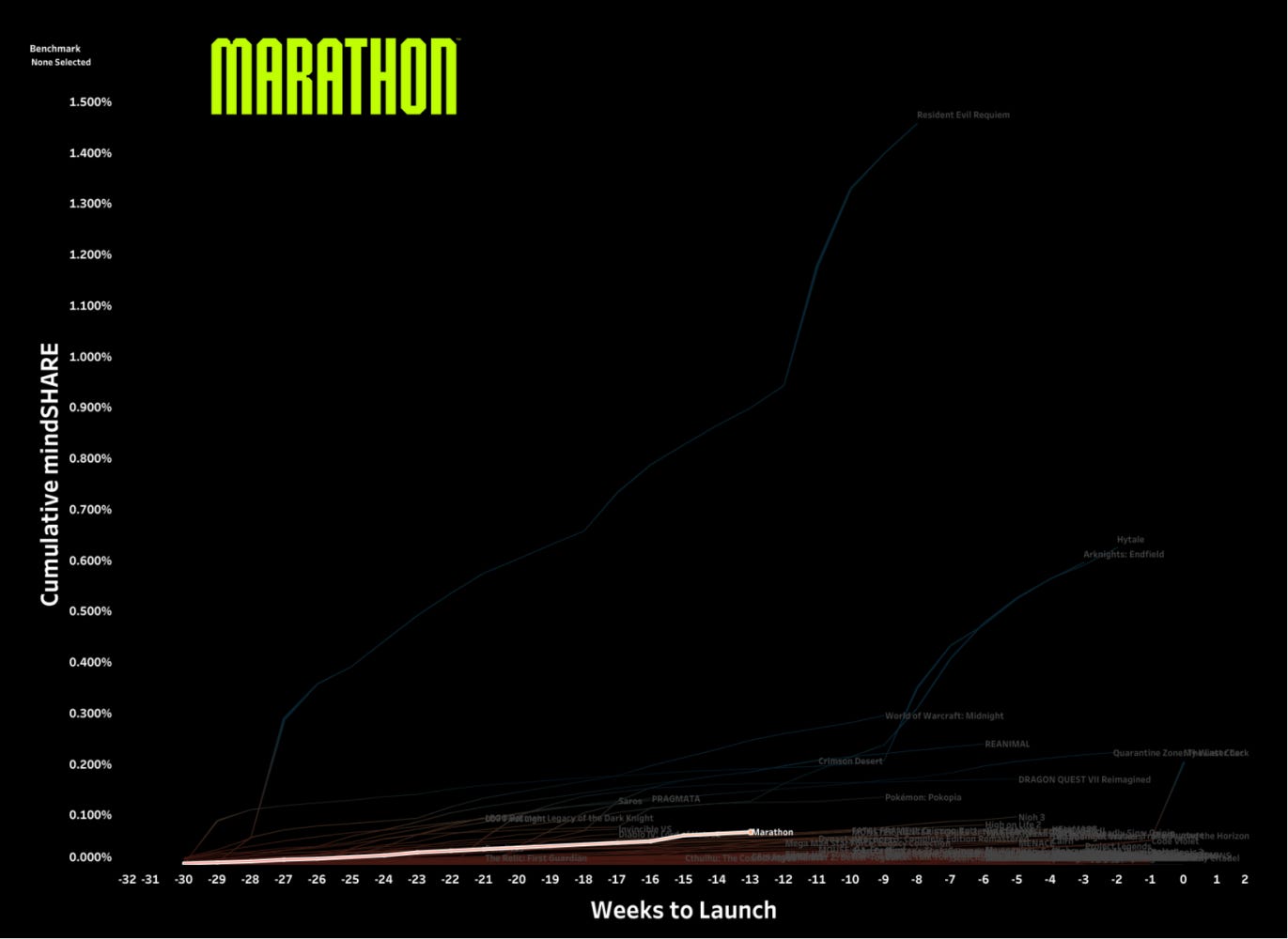

Resident Evil Requiem isn’t just shaping up as a dominant game of Q1, it looks like it wants to be the dominant game of Q1. At least right now, there’s no meaningful competition anywhere near its pre-launch trajectory… and the micro data is why I’m comfortable saying that out loud.

Right now, Resident Evil Requiem sits at 2.926% cumulative mindSHARE, pacing ahead of Resident Evil Village at 2.2%, and sitting just behind Resident Evil 4 at 3.621%. In plain English, it’s tracking above the last modern, non-remake mainline launch, and just below the most successful entry in the series’ modern era. That’s a huge win for Capcom, and an even bigger tell for how 2026 is going to start.

The other signal I can’t stop staring at is TikTok.

Among unreleased games, Resident Evil Requiem is already sitting at #5 on our list, north of 600M lifetime views and closing in on 650M, backed by 27,000 plus videos. The views are impressive, but the video count is the real tell, because most unreleased games struggle to even crack 10,000 videos. This isn’t just passive consumption, it’s creators choosing to make the game part of their output before it even ships.

And the franchise context matters here, not because you need a history lesson on Resident Evil, but because it sets the floor.

Resident Evil 4 is one of Capcom’s defining games, between the original and the remake it’s cleared the “over 20 million copies sold” bar. The remake alone has already surpassed 10 million units sold, and Resident Evil Village crossed 10 million too, which is the real story of the modern era, this franchise has become a repeatable 10M plus seller.

The Capcom Playbook

So yes, saying “Resident Evil is going to be big” is not exactly a profound prediction. The musing is what it implies about Capcom.

Capcom has become the company that’s figured out the obvious, then actually operationalized it.

They put their biggest bang-for-buck titles into the quiet calendar window, then they plant the flag, take the oxygen, and let everyone else fight over April, May, September, October, and November.

You can see it in the release calendar if you zoom out.

Yes, Street Fighter 6 launched in June 2023, and it did well, but it didn’t land anywhere near the Q1 impact of the Resident Evil 4 remake.

In 2024, they shipped Kunitsu-Gami: Path of the Goddess in July, and later the year brought releases like Dead Rising Deluxe Remaster and MARVEL vs. CAPCOM Fighting Collection: Arcade Classics, good projects for the right audiences, but not Q1-scale, headline tentpoles.

In 2025, they shipped Capcom Fighting Collection 2 in May, again, real product, real fans, but nowhere close to what they did earlier in the year with Monster Hunter Wilds. And the move from March into February is the loudest tell of all.

Capcom isn’t just releasing into Q1, they’re optimizing for it, because they know a strong early-year launch isn’t just a sales event, it’s a conversation event.

Capcom doesn’t just make hits, they stage them.

Amazon Strikes Back & 2000s Energy Is Back

If Capcom is playing calendar chess, there’s another company that might be about to flip its story in 2026.

I wrote about this in Can Big Tech Be Good at Gaming, and the short version was, Amazon tried to make games the Amazon way, instead of simply making games people would want to play.

Bloomberg’s 2021 reporting captured the vibe perfectly, every project needed to be a “billion dollar franchise,” teams were understaffed, leadership pushed its own Lumberyard engine, and the organization kept prioritizing metrics over the one mandate that actually matters… find the fun.

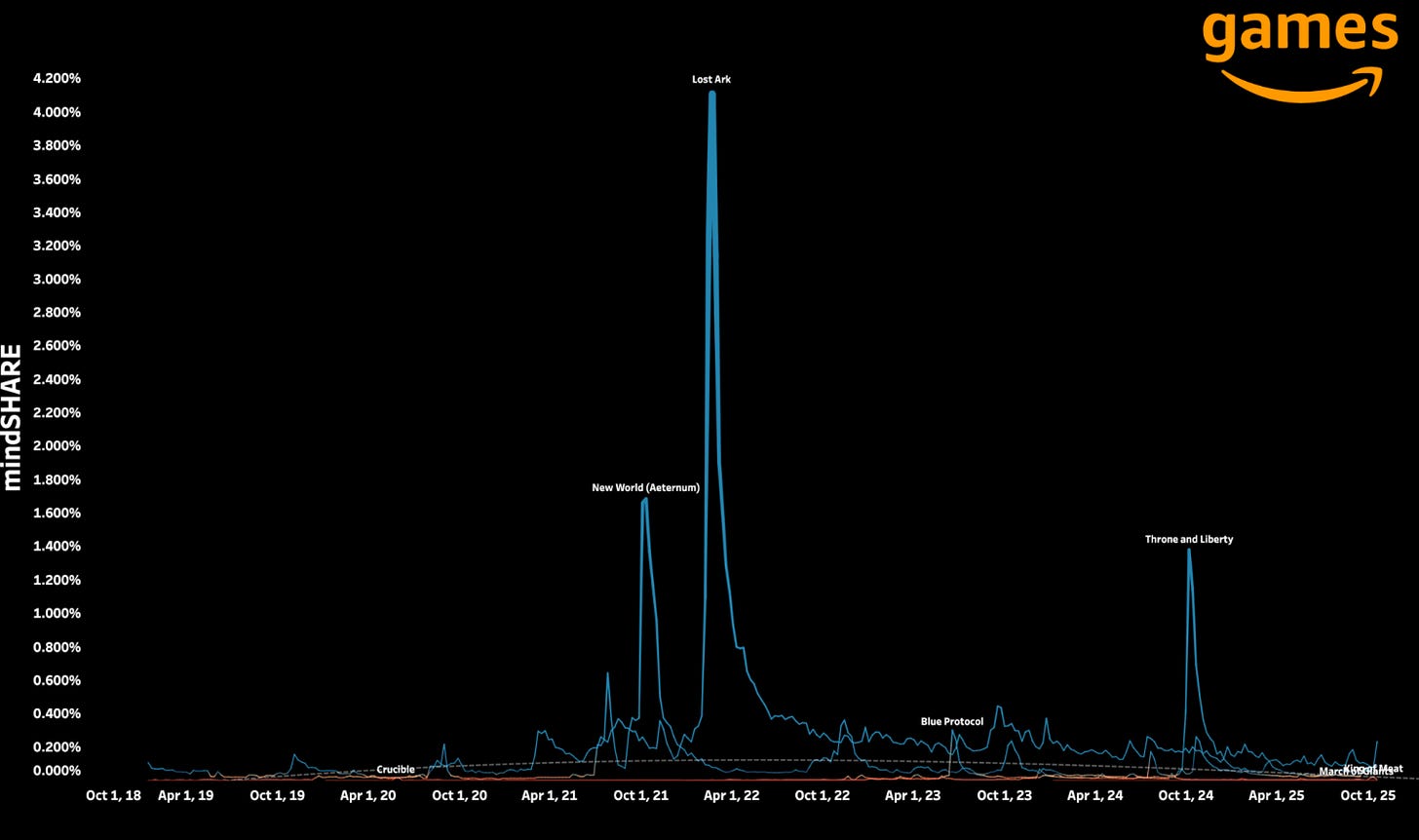

The chronology tells a cleaner story. It starts with New World (2021), a solid first step, 5.55% cumulative mindSHARE. The next swing was bigger, Lost Ark’s Western launch became the high-water mark at 11.973% cumulative mindSHARE, the moment it felt like Amazon might have cracked the code.

From there, momentum faded, not overnight, but steadily. Blue Protocol (2023) landed well below that bar (0.6763% cumulative mindSHARE), Throne and Liberty (2024) found a meaningful, but smaller, audience at launch (around 2.67%) only to fall, then the long-tail experiments like King of Meat and March of Giants (now with Ubisoft) have trended closer to niche than to breakout.

Which is why the move Amazon made at The Game Awards matters… but not in a vacuum.

Not long after I wrote that piece, my heart kind of broke as a former Amazonian.

In October 2025, Amazon confirmed roughly 14,000 corporate cuts. And while that headline isn’t “Amazon Games” specific, the downstream impact was hard to miss, momentum inside the org froze, priorities snapped tighter, and a meaningful chunk of first party AAA development, especially on the MMO side, got paused, reshuffled, or outright canceled.

It’s awful for the people impacted, full stop.

But strategically, it also reads like an inflection point. Less “we’re going to brute force our way into becoming a top tier internal studio,” more “we’re going to lean into what Amazon can actually do well.”

And what Amazon can do well is leverage. Not leverage in the abstract, leverage in the form of iconic IP, proven teams, and distribution pipes that can turn a franchise beat into a cultural beat.

So when Amazon shows up at The Game Awards with Tomb Raider, it doesn’t feel like a random trailer drop. It feels like a reset button. A minor pivot. Yes, these games were already moving forward, but they’re not being built in-house by Amazon Game Studios. They’re being built by world-class partners, with Amazon in the publishing seat, picking flags to plant, and stacking the deck with everything else Amazon owns.

The Tomb Raider Moment

Two Tomb Raider reveals at The Game Awards didn’t just land, they collectively broke through. And the more interesting part is what happened after the show.

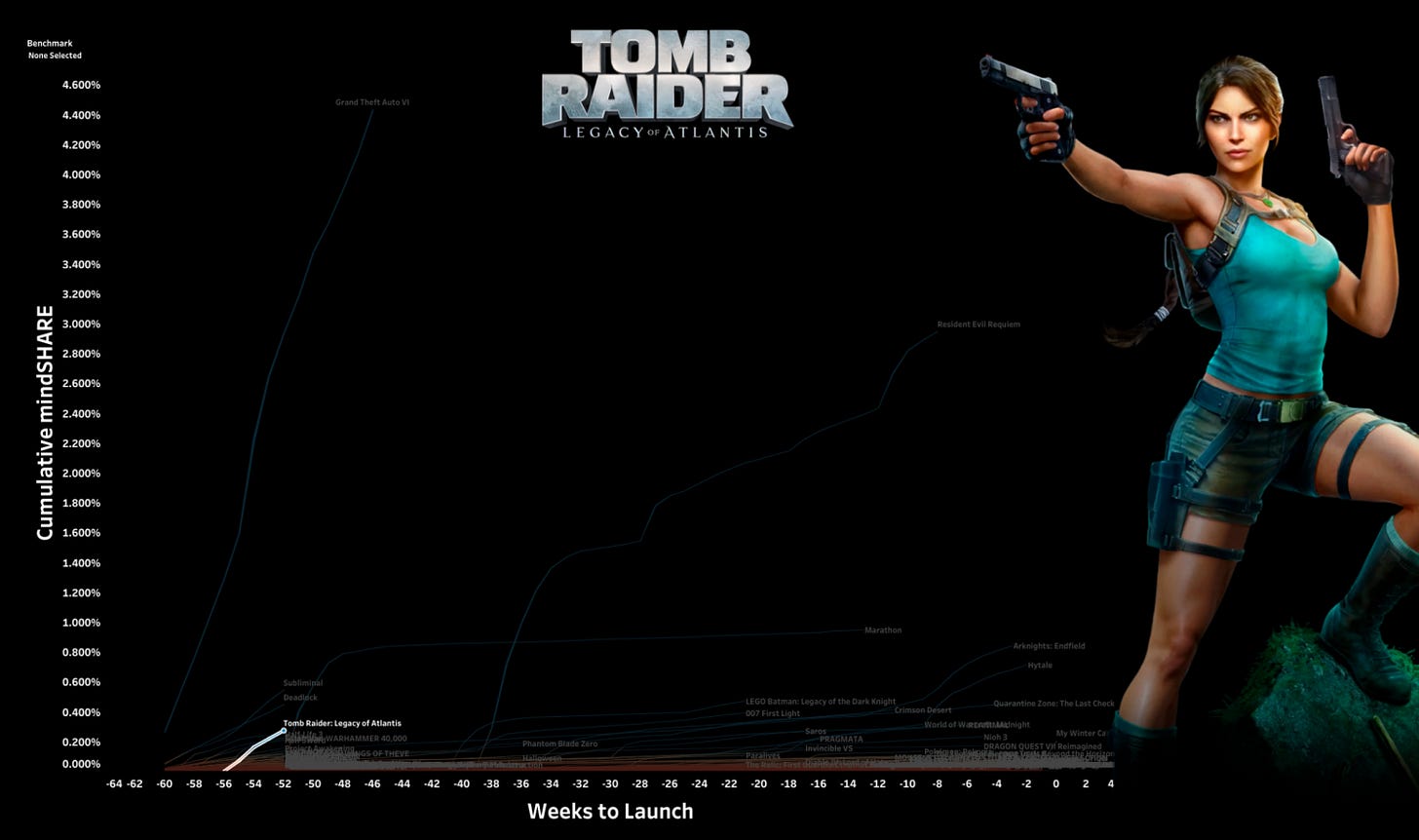

With a little time post-TGAs, Tomb Raider: Legacy of Atlantis didn’t fade, it kept climbing. The curve stayed healthy, up and to the right, the kind of sustained, compounding interest you usually only see when something is tapping into a real cultural appetite.

In mindGAME, we’ve got Legacy of Atlantis sitting at 0.273% cumulative mindSHARE right now. Yes, the launch date is still a placeholder in our tool (12-31-2026), but that’s the point, this is a TBD title that’s already holding its own in the noise.

For a rough sense of scale, Total War: WARHAMMER 40,000 (SEGA) is sitting around 0.222% cumulative mindSHARE, which is a pretty respectable “treading water” number for an unreleased strategy entry. And zooming out, Legacy of Atlantis is still pacing ahead of other “big name, date TBD” titles like Fable (0.022% cumulative mindSHARE), Forza Horizon 6 and Project Awakening.

That is not normal for a game that, at this stage, is basically living off a trailer and a vibe.

And when you sanity check it across platforms, you see the same story.

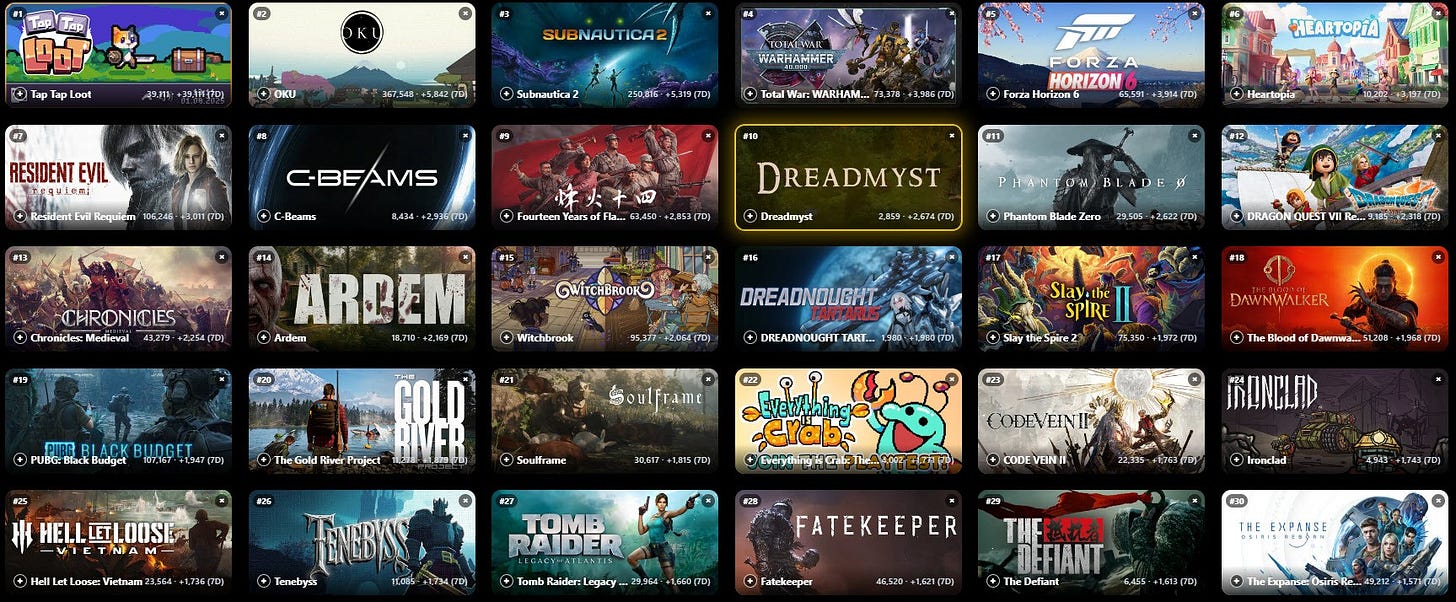

On TikTok, Tomb Raider is already at 9M lifetime views across 300 videos. That’s not “viral,” but it’s also not nothing, it’s early momentum, and it’s already showing signs of creator curiosity.

On Steam, it’s still in the top tier of weekly follower growth, sitting at #27 over the last 7 days. Again, not busting through the door, but very solid for how far out this is.

Then you zoom out one more click, and you remember the context that matters for this section.

Amazon Game Studios is publishing these games. Crystal Dynamics is developing them, the same studio that built the modern Tomb Raider trilogy under the Square Enix era. In other words, this isn’t Amazon trying to will a franchise into existence from scratch, it’s Amazon betting on an iconic IP, with a team that’s done it before.

And that last part matters, “everything else Amazon can bring,” because Amazon is one of the few companies in games that can turn a release into a multi-screen moment.

The Transmedia Flywheel

Amazon’s live-action Tomb Raider series is already in the works for Prime Video, led by Phoebe Waller-Bridge, with Sophie Turner cast as Lara Croft, plus a supporting cast that includes Sigourney Weaver and Jason Isaacs.

That matters because Amazon is one of the few companies in games that can stack touchpoints across screens, not just spend more. When the show hits, the game is right there, and Amazon can turn “I watched it” into “I played it” without asking the audience to go hunting.

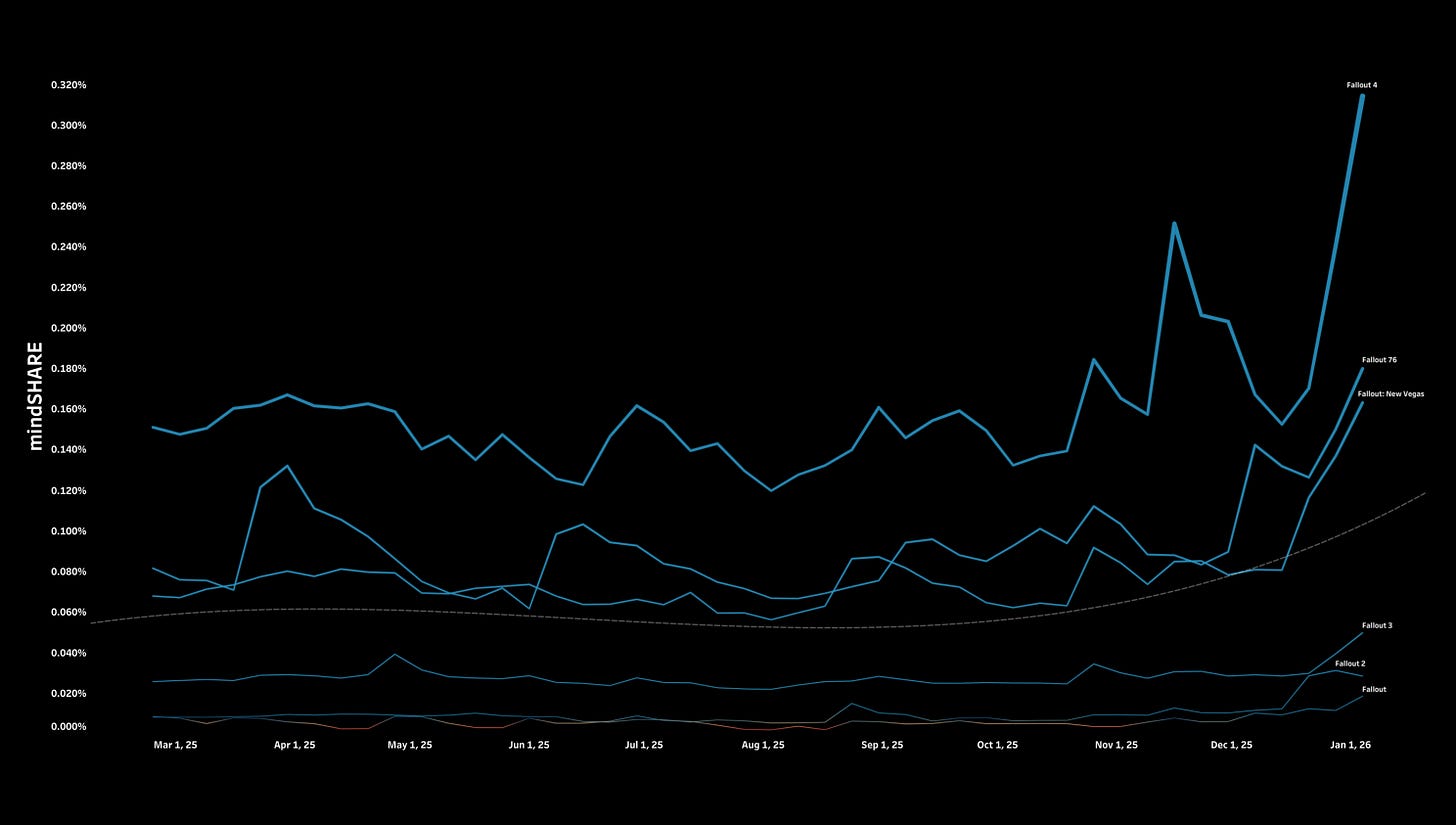

We’ve already seen what happens when a Prime Video hit collides with a game franchise, Fallout is the obvious example. When the timing is right, attention converts into time fast, and then the money follows.

So the Tomb Raider opportunity is pretty straightforward. Amazon doesn’t just have the show, they’re also in the publishing seat. If they can line up a season beat and a release beat in the same window, they’re not just buying reach, they’re engineering relevance.

Because marketing is expensive, and the hardest part of shipping a game in 2026 isn’t building it, it’s teaching the world to care at the exact moment you need them to.

I think there’s a bigger cultural shift sitting underneath this, I’ll come back to it, but first, there’s one more franchise that fits the same pattern.

Bond is a historic property across film, obviously, but it also has real history in games too, GoldenEye 007 is still the cleanest example of a licensed game becoming a genuine cultural artifact.

Bond As The Next Signal, 007 First Light

007 First Light isn’t an Amazon Games publishing play, it’s developed and published by IO Interactive. But it still belongs in this section because Amazon now has creative control over the Bond franchise through Amazon MGM, a deal with the Broccoli and Wilson camp that reportedly included a $20M payment for that creative control.

And this is a big moment, culturally.

This is the first major “next era” Bond swing since Daniel Craig closed the chapter, and whoever Bond is after Craig, the tone, the fantasy, the modern update, all of that has to be re-taught to the market. Games are now big enough to help do that reset.

In mindGAME, 007 First Light is already sitting around 0.391% cumulative mindSHARE, which is very solid for a premium single-player action-adventure that’s still in the hype-building phase.

I’ve been bullish on this game from the jump. If it shipped in March it was going to be a hit, and if it ships in May it’s going to be a hit.

The date shift from late March to May 27 does put it closer to LEGO Batman: Legacy of the Dark Knight, which is its own nostalgia wave, especially if it’s really tapping into that Arkham energy. But I don’t actually think that’s a problem, these two can live side by side.

Because the appeal of 007 First Light is incredibly clear, Bond being Bond again. Not a sad Bond, not a tortured Bond, just the fantasy, the Aston Martin, the gadgets, the spycraft, the globe-trotting set pieces, the whole point of the character.

And IOI is the right studio to do it. You can feel the Hitman DNA in the way the game frames competence and craft, but the shape of the experience scratches a different itch, it reads closer to an Uncharted-style cinematic adventure, with modern stealth and systems layered underneath.

Also, Bond has history in games, and it’s messy. Outside of GoldenEye 007, the franchise never really found a lasting footing in the medium. This is a chance to reset that legacy with a new tone, a new Bond, and a modern, authored single-player blockbuster at a moment where the market is quietly hungry for exactly that

And yes, even if Amazon isn’t publishing the game, they’re going to take some of the flowers if this lands, because Bond is now part of their broader franchise machine.

Now, let’s zoom back out, because Amazon is catching a broader cultural tailwind… and Tomb Raider and 007 First Light are two of the cleanest signals.

The Cultural Shift, A Return To Fun

Here’s the musing.

I think we’re swinging back toward early 2000s adventure energy, bright, pulpy, a little bit ridiculous in the best way, heroes doing hero things, not apologizing for it.

You can see it in Tomb Raider. Lara looks like she’s back to puzzles, tombs, set pieces, color, momentum. Not tortured, not gritty, not spending the whole runtime processing trauma, just… adventuring.

You can see it in 007 First Light too. We’ve gone from the late Daniel Craig era, where Bond ends as a bruised, heavy, tragic figure, to a version of Bond that’s selling the fantasy again. Aston Martin, gadgets, spycraft, competence, style, the whole point.

And you can see it outside games.

Over the holidays I did what the rest of the internet did, fell into the Avengers: Doomsday teaser rabbit hole. The Steve Rogers beat was cool, the Thor beat was cool, but the one that actually made me sit up was the X-Men beat, the X-Mansion, Magneto, Professor X, and then Cyclops in a blue and yellow suit finally doing Cyclops things, firing an optic blast like the world is ending.

That moment clicked for me because it wasn’t subtle, people want escapism again. They want heroes they’d actually want to hang out with, not another two hours of guilt, isolation, and sadness. My biggest gripe with the MCU’s recent run is how often it’s been “sad heroes doing sad things,” which even culminated in Thunderbolts* leaning hard into mental health themes, with the villain, The Void, serving as a personification of depression, among other things.

So if we’re really snapping back toward fun, and toward that 2000s blockbuster energy, then Amazon is in a great spot to benefit, not just because they’re in the right place at the right time, but because they can stack the whole machine behind it.

And if you want one more “keep an eye on it” call, if early 2000s nostalgia is actually back, don’t sleep on Halo: Campaign Evolved landing on PlayStation. Master Chief is basically the mascot of that era, and the timing could be perfect.

That’s the cultural layer… now let’s talk about the other kind of 2026 magic trick.

Not the nostalgia reboot, the resurrection.

Second Life

Do You Believe In Second Lives?

Games that look dead… aren’t always dead. Games that get “canceled”… aren’t always gone. Sometimes the thing that looks like an ending is actually the beginning of the only story that matters, the comeback.

Now, to be clear, this isn’t a guarantee. Gamers are historically skeptical of anything that reads unfinished, unpolished, or confused about what it wants to be. We’ve seen what happens when a team tries to drag a project across the finish line without earning trust. Suicide Squad: Kill the Justice League is the easy recent example, the stink was visible in the data, the audience wasn’t buying the pitch, and the game never found its footing.

But “second life” is still real, with the right communication, the right community backing, and the right willingness to ship, listen, iterate, and rebuild confidence in public.

A perfect example, Hytale.

Hytale

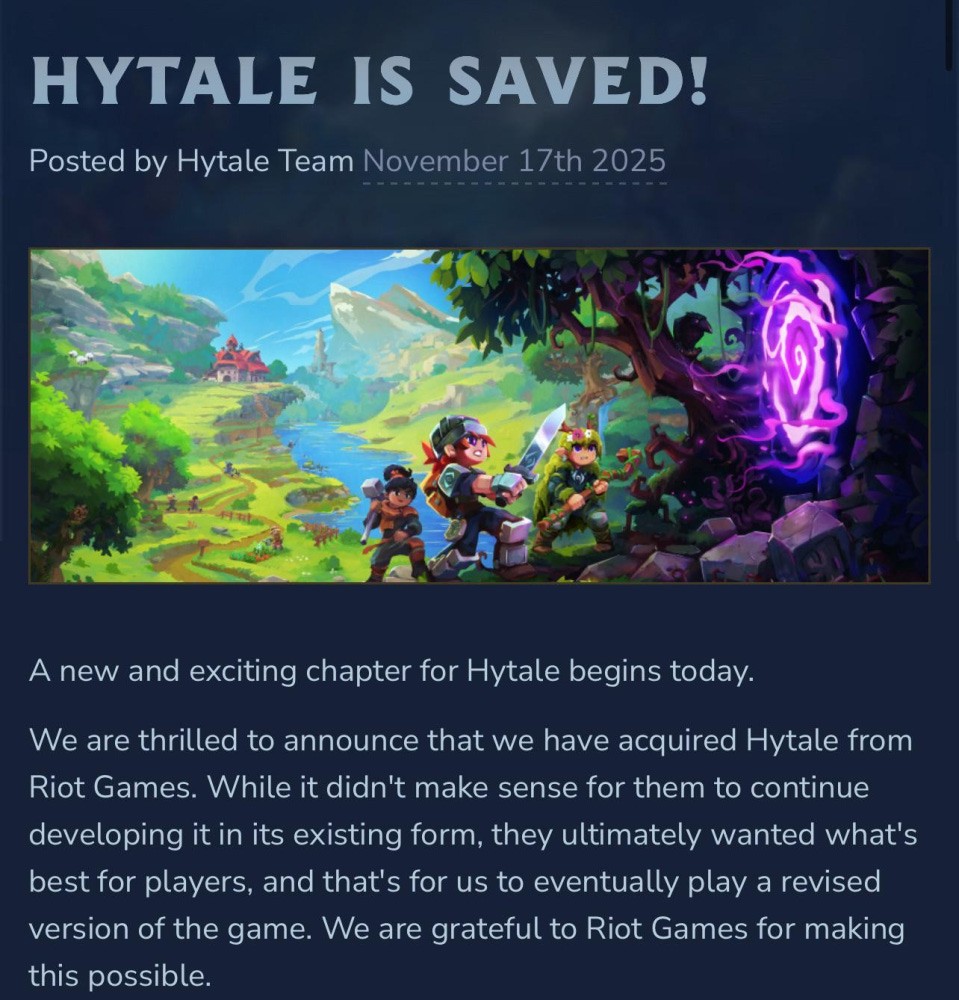

Hytale from Hypixel Studios is the optimistic version of this story.

It spent years in development limbo after Riot Games acquired Hypixel Studios, then in June 2025 Riot pulled the plug and shut the studio down. That should have been the end.

Instead, the community reaction basically forced a second act. The original founder, Simon Collins-Laflamme, bought the project back, rehired a smaller team, and repositioned the whole effort around one simple idea, gameplay first, ship something real, and earn your way back.

And the funniest part is that the “cancellation” may have been the best marketing beat Hytale ever got.

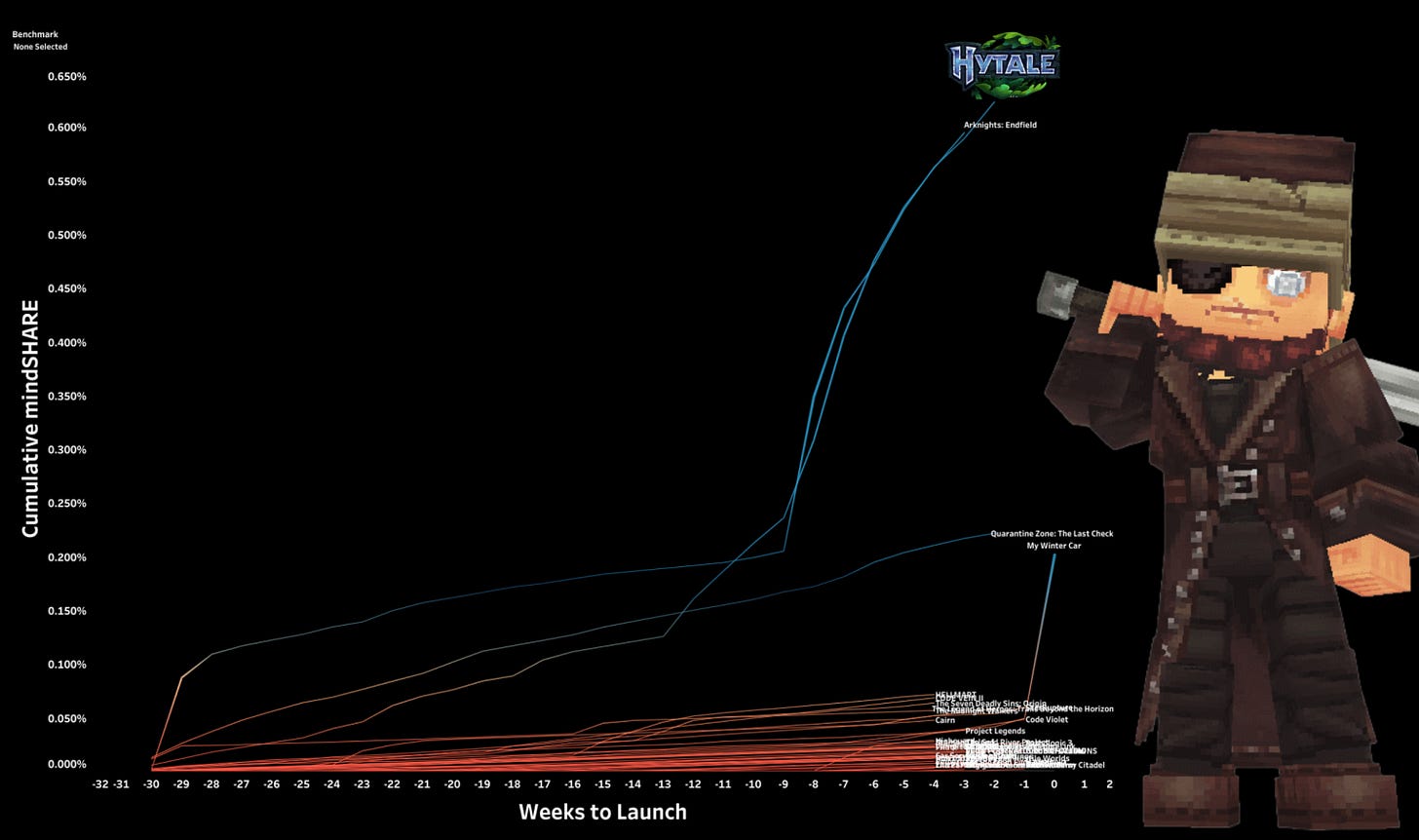

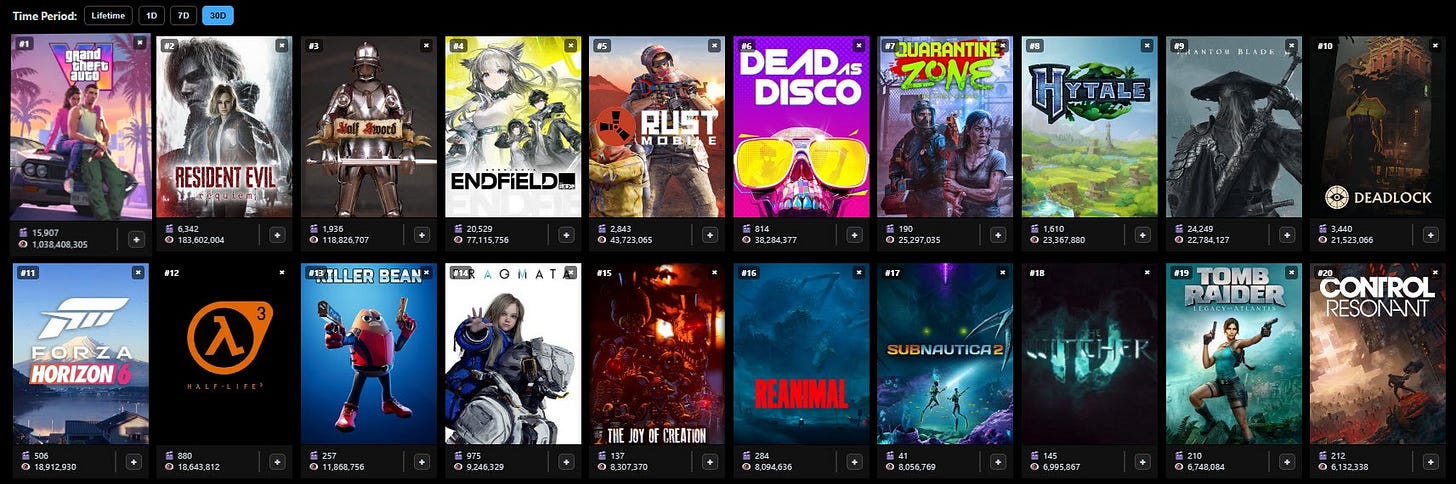

In our data, Hytale is now tracking as the #1 or #2 game of January at launch, and early access is slated for January 13, which is basically next week.

Heading into launch, it’s sitting at 0.623% cumulative mindSHARE, and the curve has been ticking up week over week since the cancellation and comeback saga re-entered the conversation. At worst it’s the second biggest launch of the month. The only real competitor for attention is Arknights: Endfield, slated for January 22, which is going to be a monster in its own right.

Geographically, the interest isn’t narrow. Hytale is showing real pull across North America, LATAM, Western Europe, and even Russia has a notable beat, which is part of why it reads like a “real” global moment, not a niche PC curiosity.

TikTok backs up the same story.

Over the last 30 days, Hytale is the #8 unreleased game by views with 23M views, trailing only the obvious giants like Grand Theft Auto VI and Resident Evil Requiem, plus a few other heavy hitters I’ll save for later in this piece. And if you zoom out to lifetime, it only drops to #18, which tells you this isn’t a one-week spike, it’s been quietly building.

So here’s the chicken-or-egg question I can’t stop thinking about.

Did Riot make a mistake canceling Hytale, or did canceling Hytale create the conditions for it to finally become what it always promised to be.

We don’t know what Riot saw internally, or what the cost curve looked like, or what the build quality actually was. But we do know this, giving the project back to the original founder, and letting the community rally around a comeback narrative, created a moment.

And sometimes a moment is all a game needs. I’ve said this before, and I still believe it, every month should have a game. Gamers play all 12 months of the year. January doesn’t have to be a dead zone. This January, it looks like the month belongs to Hytale in the West… and Arknights: Endfield in China.

Now let’s flip the coin to the other kind of second life.

Marathon

If Hytale is a community-driven comeback, Marathon is a studio-driven restart.

Bungie’s extraction shooter was one of the easiest “watch this” flags on the board after the initial reveal. It looked like it was lining up as a real second-half contender, then the curve started to sag, and the closed alpha put the game into the public conversation in a way Bungie probably didn’t want.

The reception was messy, the fantasy wasn’t landing cleanly, and then the plagiarism controversy around art assets poured gas on the moment.

Out The Gate, Marathon Shined Above Everything, Including Arc Raiders

Bungie delayed the planned September 23 release, went back into the lab, and the story basically became, “we’re going to re-tinker this until it’s worthy of the Bungie name.”

So here’s what the data is saying right now.

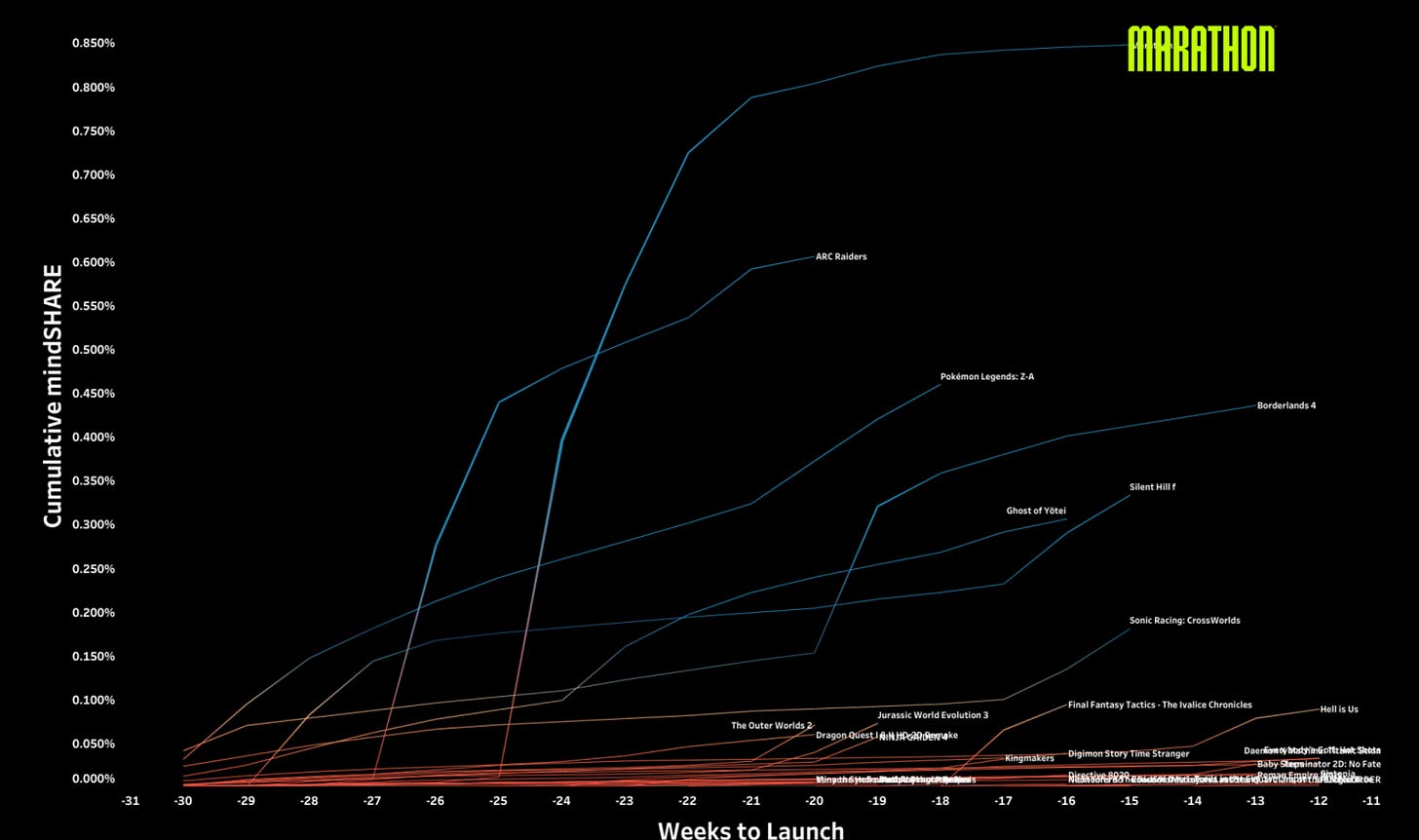

If you only look at the most recent window, the last 30 weeks, Marathon looks dire. It’s sitting at just 0.065% cumulative mindSHARE, which trails a bunch of other “first half” contenders like Crimson Desert, World of Warcraft: Midnight, and Pokémon Pokopia.

But that 30-week view is the most honest snapshot of the current moment, Bungie hasn’t really restarted the marketing engine yet, so the recent curve is naturally going to look low. It’s been mostly quiet, mostly a press release cadence, while Bungie tries to rebuild the product and the plan.

If you zoom out to the last 60 weeks, you get the fuller truth.

Marathon sits at 0.947% cumulative mindSHARE across that longer arc, and that number is only topped by Resident Evil Requiem among the first-half slate.

Of course, there’s a catch.

That 0.947% includes the giant spike from the initial reveal and early beats, it’s a reminder of what the ceiling looked like before the flatline set in. Since then, the curve has been basically dormant, and on platforms like TikTok it’s close to non-existent. Steam followers are not nothing, but they’re not where you’d want them to be for a shooter with Bungie prestige and Sony backing.

Still, the opportunity is real.

This reminds me a little bit of the ARC Raiders story in structure, not in sentiment. ARC Raiders had the long flat stretch after a big playable moment, but the vibes stayed positive, then the next access window brought the curve roaring back.

Arc Raiders’ Launch Curve

With Marathon, the flatline came with distrust. Which means the comeback requires one thing above all else.

Bungie has to let people play the game.

They don’t have the option to “message” their way out of this. They need a playable moment that shows the changes, shows the new direction, and lets creators and players feel the difference. Shooters don’t get revived in blog posts, they get revived on Twitch.

That’s the playbook now.

You run tests, you let streaming breathe, you let clips and creators do the work, then you measure the part that actually matters, earned attention after the paid push fades. Because that’s the secret to shooters, and it’s also the hurdle.

Can Marathon earn an audience, not just buy one.

And that’s why this “second life” window matters. The first half of the year is relatively open outside of Resident Evil Requiem, and Marathon has the marketing cannon, the Bungie brand, the Sony platform, and the right genre to be the other big AAA moment… if they can reintroduce the game in a way people actually believe.

LEGO Detour

Alright, time for a quick detour into my hobby horse… the LEGO Group .

This is the part where the non-LEGO fans in the audience roll their eyes, but if you’ve made it this far into Patch Notes, you’ve earned the occasional sidebar.

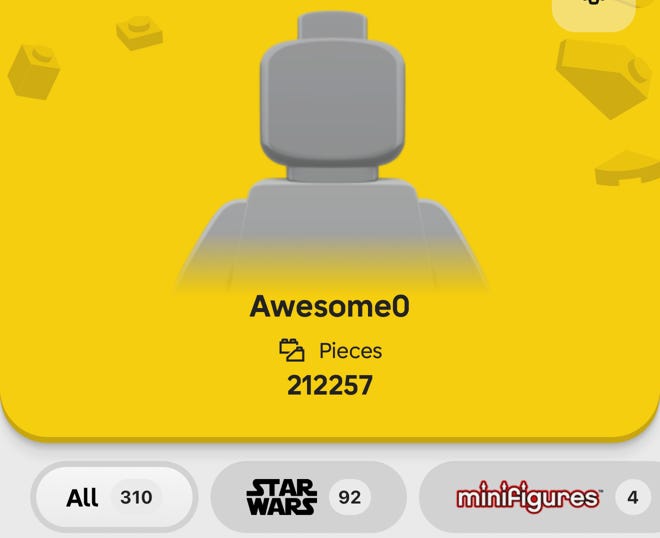

For context, I’m not a casual LEGO enjoyer. In the LEGO Builder app I’ve registered 310 sets (and that’s without doing all the manual back-catalog work), my top sub-series are Marvel Super Heroes at 102 sets, and Star Wars at 92, and the app has me sitting on 212,000+ registered bricks in the house.

A lot of pieces, right?

So when LEGO showed up at CES 2026 and unveiled LEGO® SMART Play™ and its new “Smart Brick” platform, I paid attention.

And I’m not a fan.

To be clear, the engineering is impressive. LEGO’s Smart Brick is basically a computer packed into a 2x4, with sensors, lights, and sound, designed to make builds respond to motion and play. The first wave is Star Wars sets, with Smart Play versions of an X-Wing and a TIE Fighter, plus a higher-end duel set, shipping in early March.

But the hot takes about this being the “most consequential LEGO innovation in decades” just don’t land for me.

If we’re talking truly consequential LEGO moves, my top tier is still licensed IP, full stop. LEGO itself has repeatedly called out entertainment IP themes like LEGO® Star Wars™ and LEGO® Harry Potter™ as best-selling themes in recent years.

And then right behind that, I’d put the stuff that expanded the product from “toy” into “collectible system,” things like the Collectible Minifigures line, which kicked off in 2010 and permanently changed how minifigs and customization worked.

UCS and modular buildings matter too, because they helped blow the doors open for the adult collector market. Those were real platform shifts.

So yes, I’m all for LEGO experimenting with new forms of play. They do this all the time. Sometimes it’s a hit, sometimes it’s a weird cul-de-sac, and then they remember what they’re best at… making great interlocking bricks.

What rubs me the wrong way here is the price.

The Smart Play Star Wars sets come with a premium, and I get it, there’s tech in the brick. But the value proposition feels shaky when you’re staring at a $69.99 TIE Fighter and an $89.99 X-Wing, and you’re basically paying for sound effects when you swoosh the ship through the air. That’s a console game’s worth of money for “play feature.”

And this is where it loops back to gaming.

LEGO has already tried “digital-meets-physical” at scale, the Mario partnership is the obvious example, and those sets did well, especially early in the pandemic when everyone was stuck inside and parents were desperately looking for something, anything, to do with their kids.

My working hypothesis is that Smart Play is not really about Star Wars.

Star Wars is just the safest launch vehicle.

The real endgame is Pokémon.

LEGO and The Pokémon Company announced their partnership back in March 2025, with sets slated to arrive in 2026. And if you squint at Smart Play through that lens, it suddenly makes more sense. A Smart Brick inside a LEGO Pikachu, interacting with another Smart Play Pokémon on a battle arena, reacting to movement, lights, sounds, “battling” without a screen, that’s an actual toy concept, not just a gimmick.

Am I sold yet, no.

But I can at least see the product logic.

Now, back to the part of LEGO that actually matters for this newsletter.

LEGO Batman, What It All Means

It’s been a minute since I checked in on LEGO Batman: Legacy of the Dark Knight, and it’s worth doing, because this game still looks like one of the cleanest “nostalgia plus modern execution” bets on the calendar.

The reveal at Gamescom did exactly what it needed to do, it signaled Arkham energy without pretending it’s literally Arkham, and it reminded everyone that LEGO games can still be main-event comfort food when the tone is right.

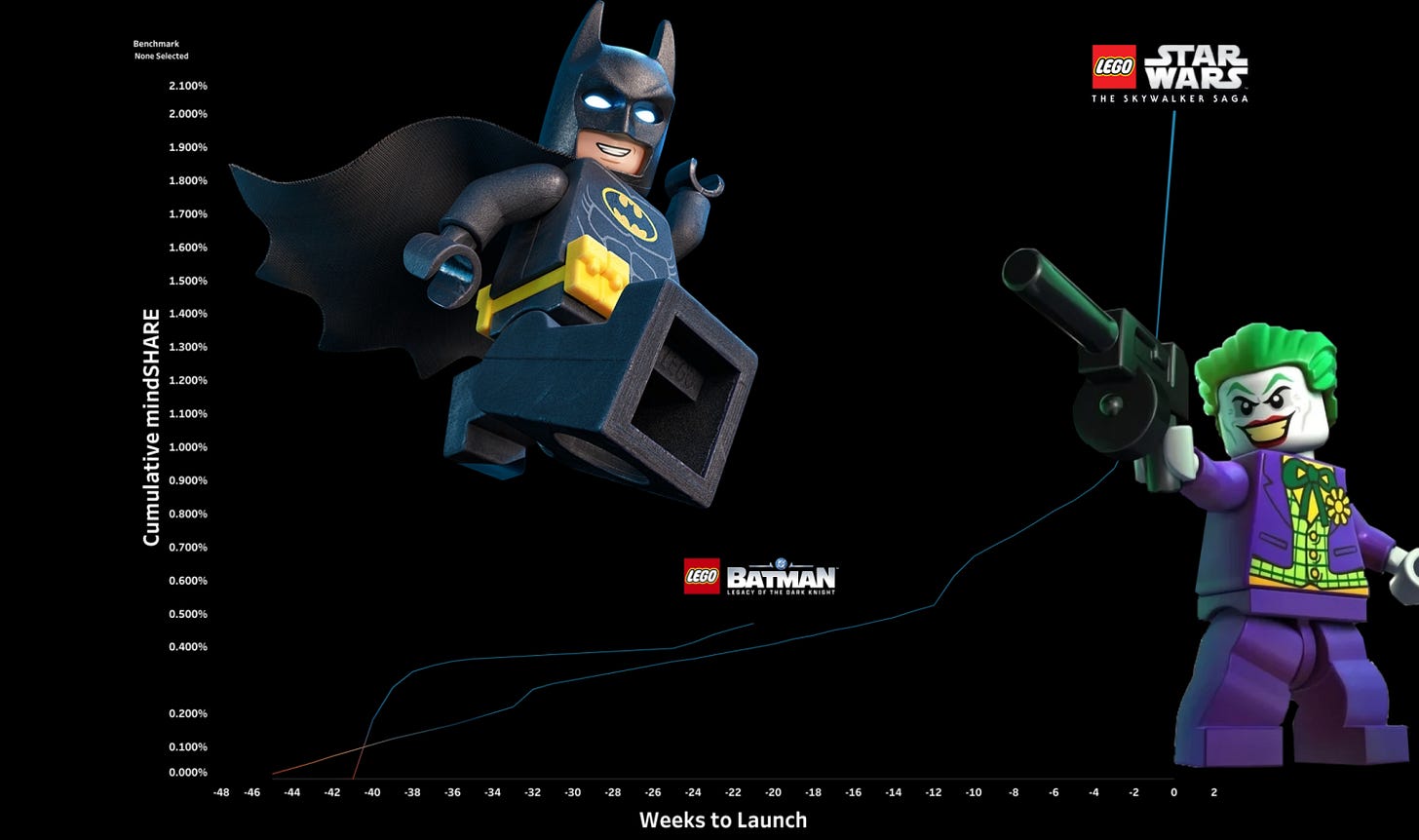

In mindGAME Data, LEGO Batman: Legacy of the Dark Knight is sitting at 0.094% cumulative mindSHARE at -21 weeks from launch.

For the comp, I like using LEGO Star Wars: The Skywalker Saga because it’s the cleanest modern “LEGO blockbuster” benchmark. At the same point in the cycle, The Skywalker Saga was at 0.107%.

LEGO Batman... Returns

So what’s the takeaway, we’re basically splitting hairs. They’re neck and neck.

If anything, what’s been encouraging is the recent slope. LEGO Batman is curving up a bit faster in the most recent weeks than The Skywalker Saga did at the same point, which is exactly what you want to see this far out.

My bold bet is simple, this is going to be a real hit, especially with kids.

My son wants to play nothing more than LEGO Batman, and I’m pretty sure he represents the median voter here.

And if LEGO ever wants to take interactive seriously beyond licensing games out, I still think the obvious long-term move is owning more of the stack. In a world where TT Games is the core factory for LEGO video games, it’s not crazy to imagine LEGO eventually wanting that capability closer to home. I’m not saying it’s going to happen, but it’s the kind of strategic move that would actually fit the “LEGO is a platform” thesis.

Read More From Colan: https://substack.com/inbox/post/184364956?r=c92ob&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true&triedRedirect=true

Share

Copy link