Matthew Ball Says Gaming Is Losing The Attention War. Here's The Counterpoint.

Matthew Ball Says Gaming Is Losing The Attention War. Here's The Counterpoint.

Blogs

•

February 20, 2026

•

Colan Neese

Matthew Ball Says Gaming Is Losing The Attention War. Here's The Counterpoint.

Blogs

•

February 20, 2026

A few quick things before we get into it.

First, for those of you finding this via Substack... welcome. I also do a lot of content on LinkedIn.. follow me here

Second, GDC is coming up fast and honestly my calendar is already a bit of a disaster. If you’re going to be in San Francisco and want to grab coffee, lunch, a drink, or just talk shop... attention economy, mindGAME Data, what we have cooking for the rest of the year... hit me up. Wednesday and Thursday are my most open days right now. DM me and we’ll make something work.

GDC Calendly: https://calendly.com/colan_screenengine/in-person-coffee

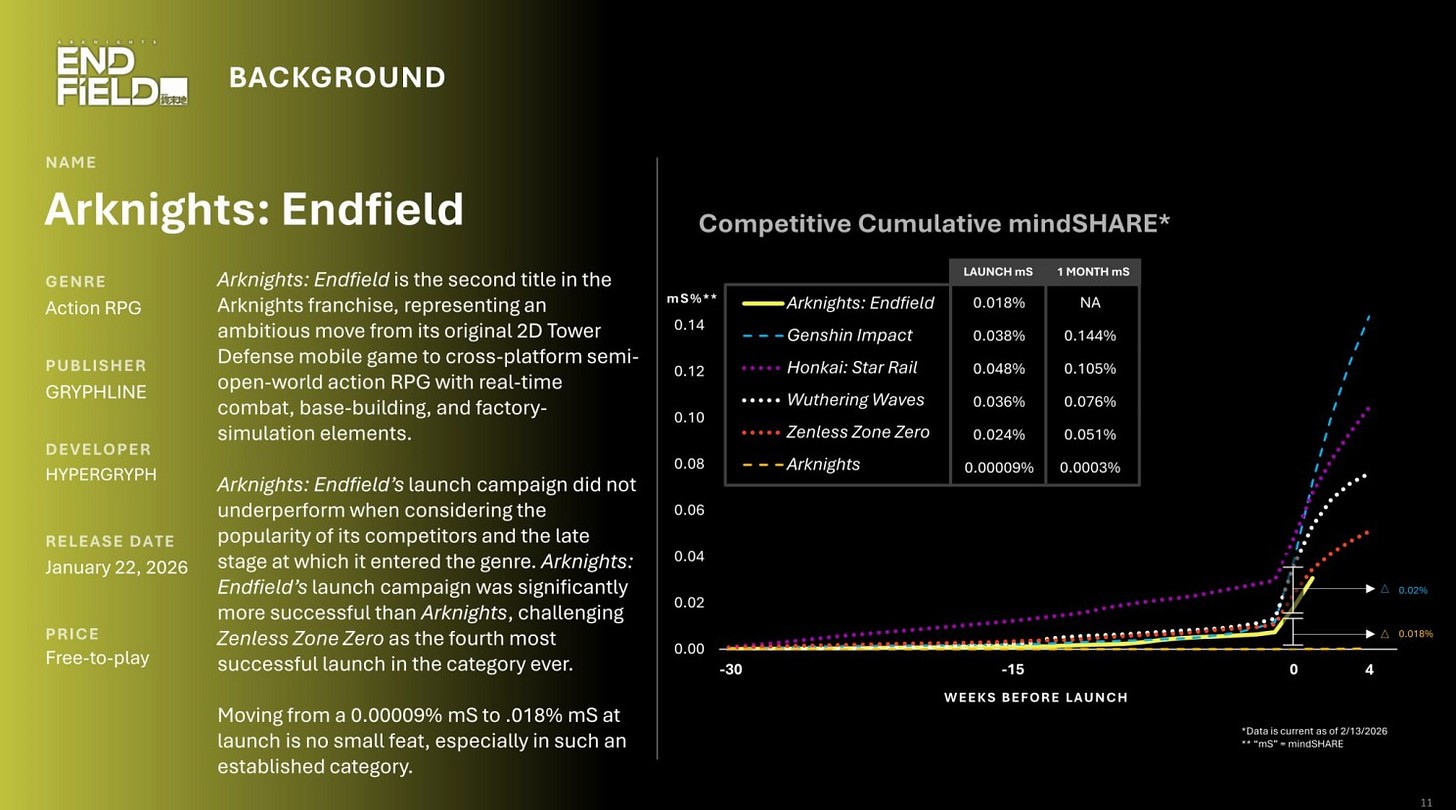

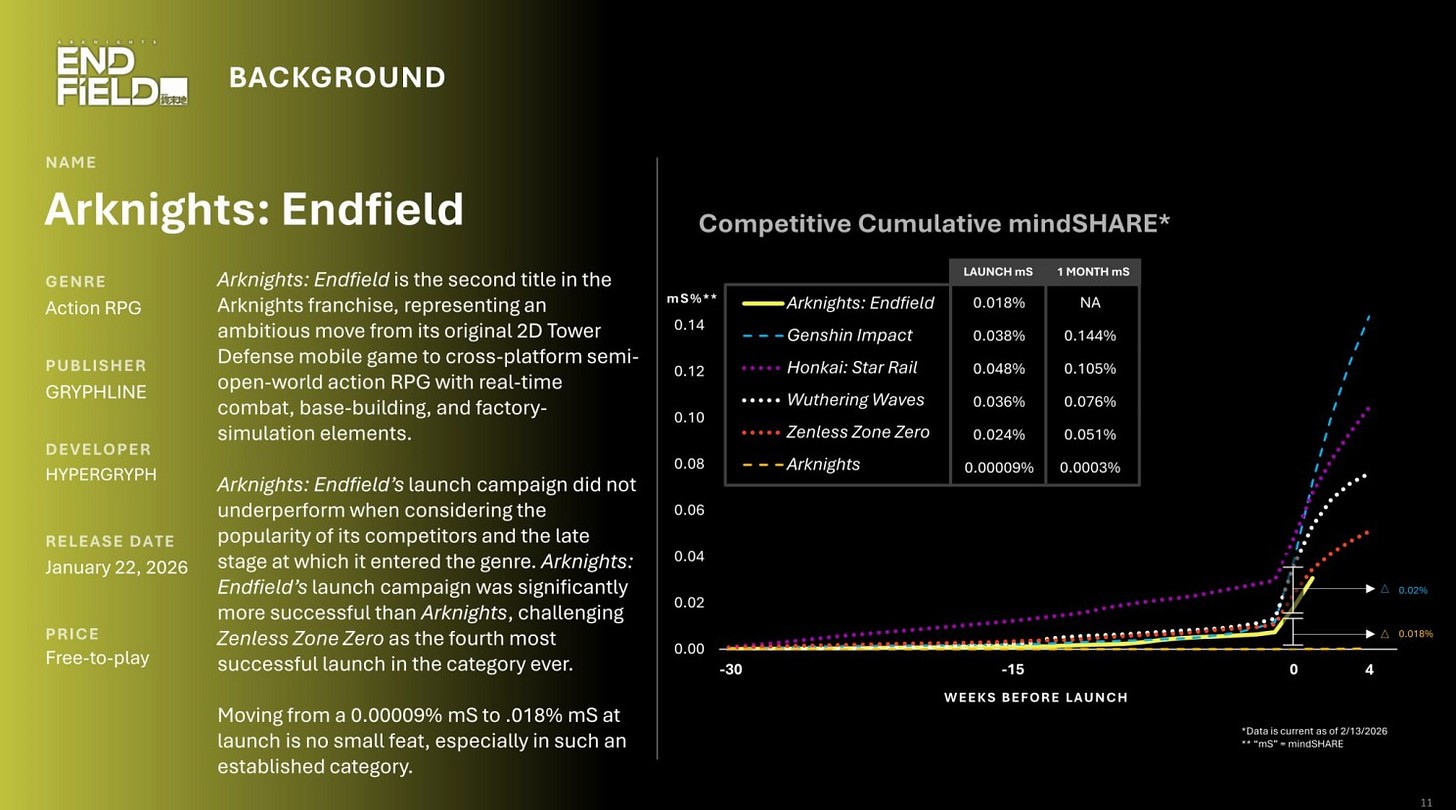

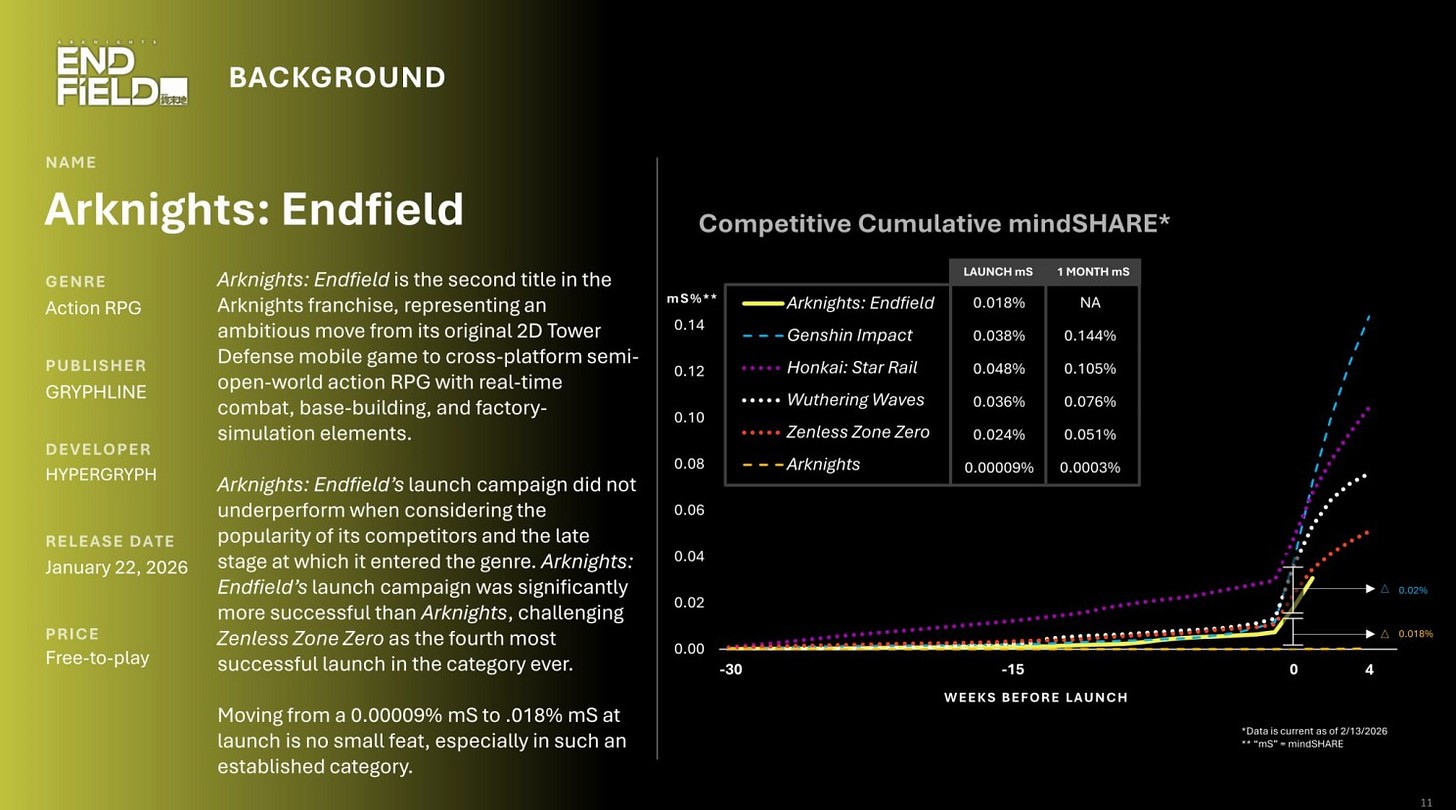

Arknights: Endfield - Launch

Third, quick shoutout to my team. We just wrapped a case study on the Arknights Endfield launch... specifically how their marketing strategy actually managed to break through the attention economy and turn into a real hit, all things considered. If you want a copy, it’s free.

Password: X0YJg170jPrM

Okay. On to the thing I literally could not stop thinking about this week.

I was originally going to go deep on the Sony PlayStation catalog this week. Had my notes, had my angle, had the data queued up. And then Matthew Ball dropped his 164-slide State of Video Gaming report and... yeah, that went out the window pretty fast.

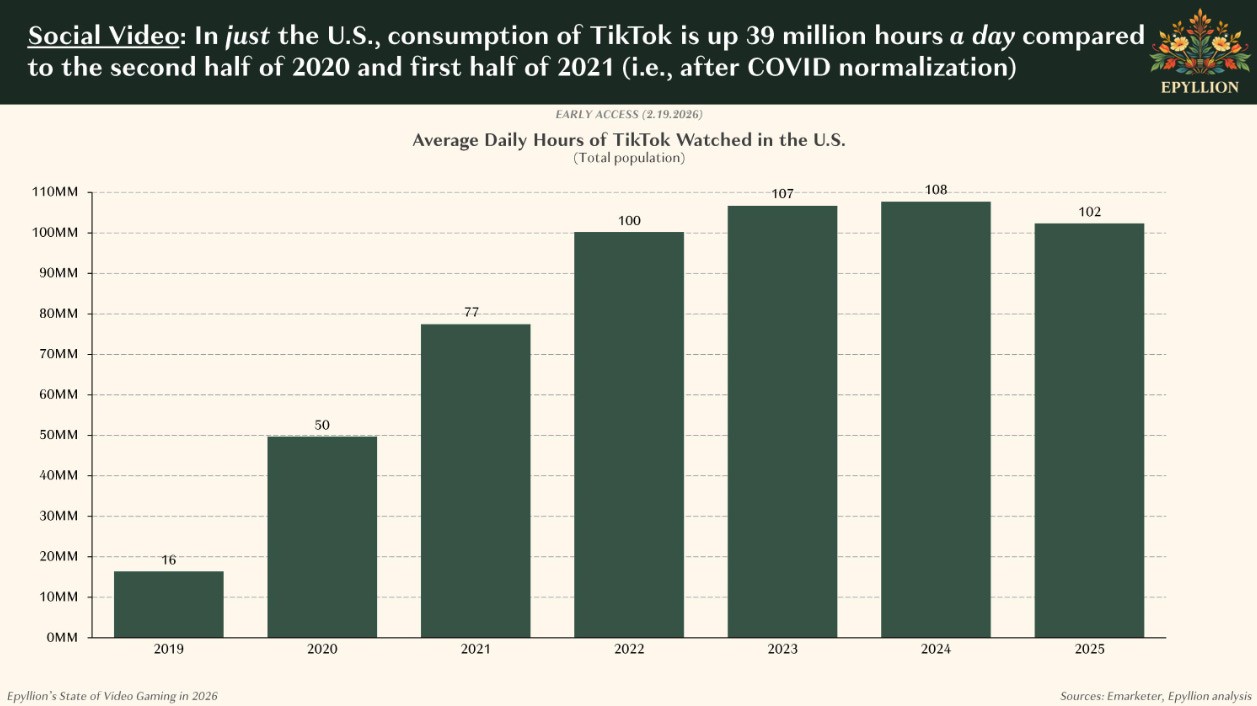

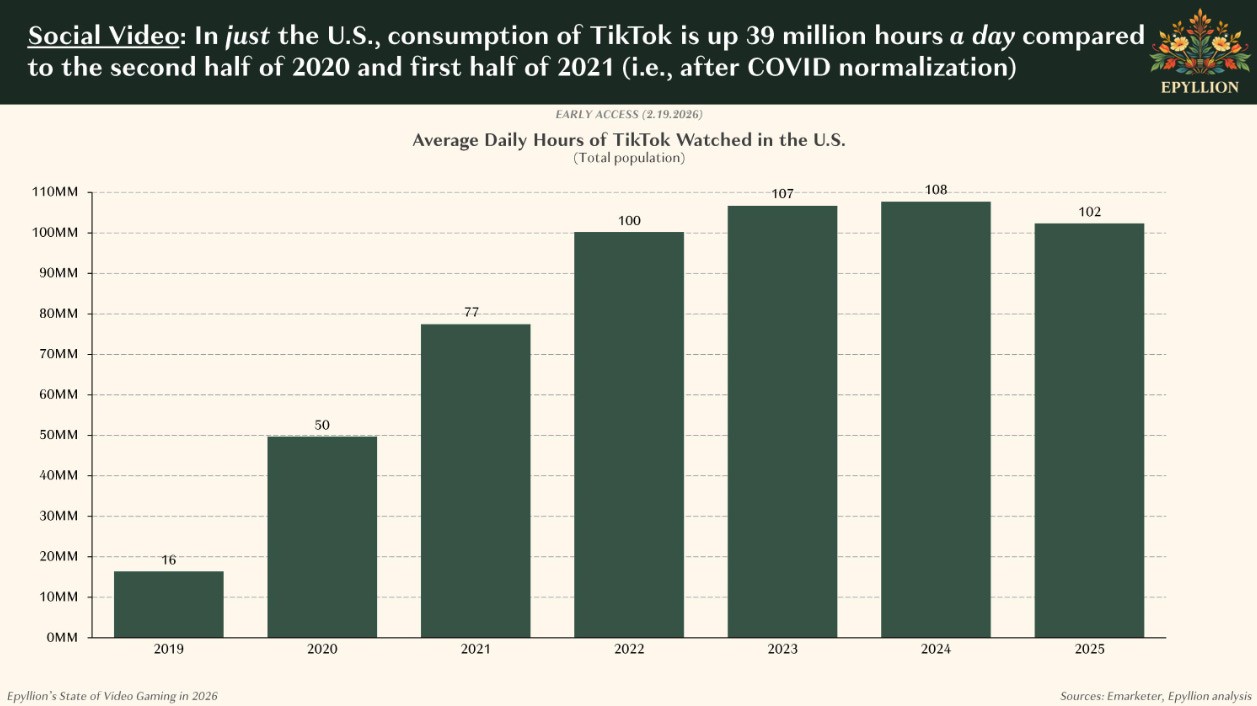

I always find Ball’s work genuinely interesting, even when I don’t fully agree with where he lands. And this year, there’s one specific thing he said that I haven’t been able to shake. His framing is that gaming is losing the attention economy. Not to a better game. Not to a better platform. To everything else. TikTok. Sports betting. Crypto. OnlyFans. Prediction markets. The argument is that all of these have quietly moved into the same psychological territory that games used to own, and they’re winning.

I both agree and disagree with that. And I want to be fair to his case before I get into my own thinking, because the data he’s working with is real, and the trend he’s identifying is real. Where I start to push back is on the conclusion.

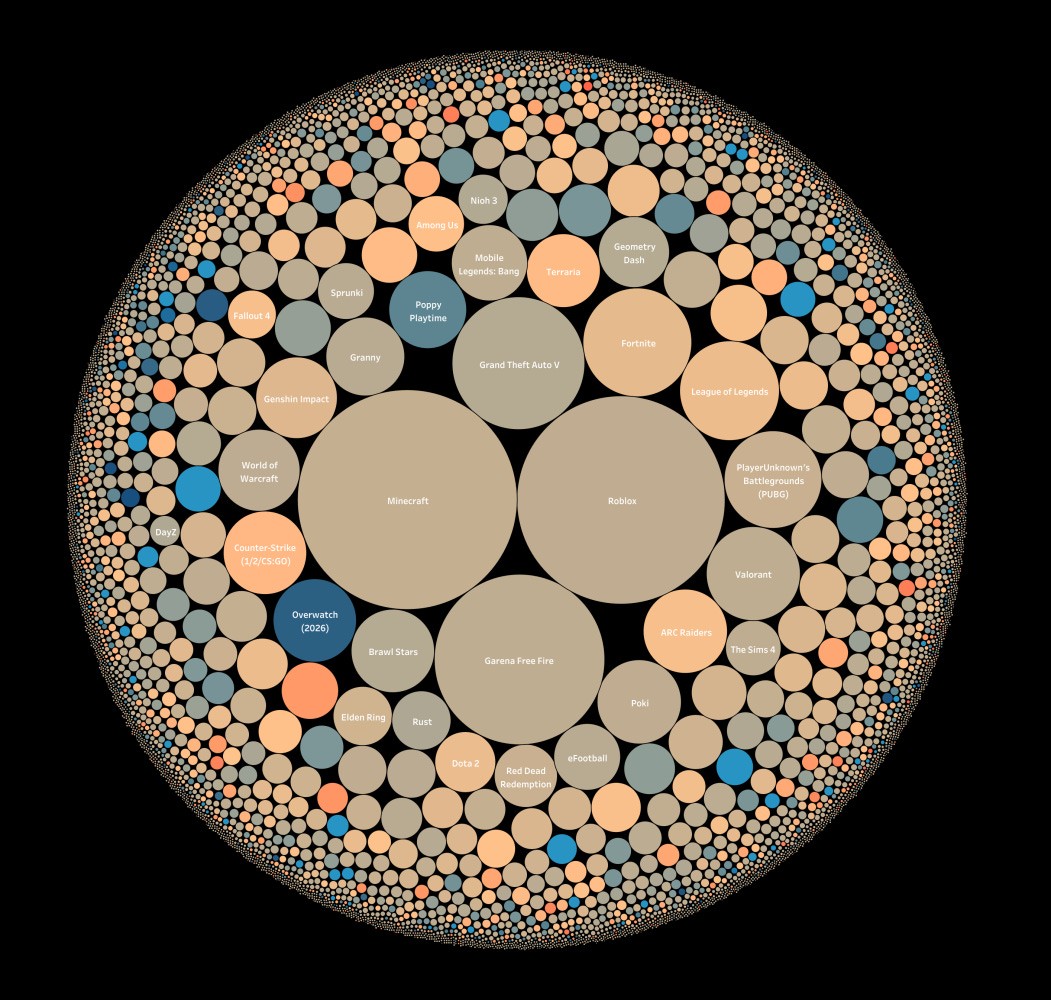

Data is data.. but what this marco picture misses are clear winners and losers

Because when Ball says gaming is losing the attention war... I think the more precise thing to say is that some games are losing it. A lot of games, actually. Big ones. Publishers that genuinely should know better. But other games are not losing it at all. Other games are winning it decisively, and they’re doing it because they understand what war they’re actually in.

That’s the gap I keep running into in conversations, whether I’m talking to a big publisher or a small indie team. There’s still a widespread assumption that if you build something good, people will find it. Or that the marketing tactics from 2015 are going to generate the same ROI in 2026. They won’t. The war has changed, the economy has changed, the way you earn attention has completely changed. And the studios that haven’t internalized that yet are the ones showing up in Ball’s data as casualties.

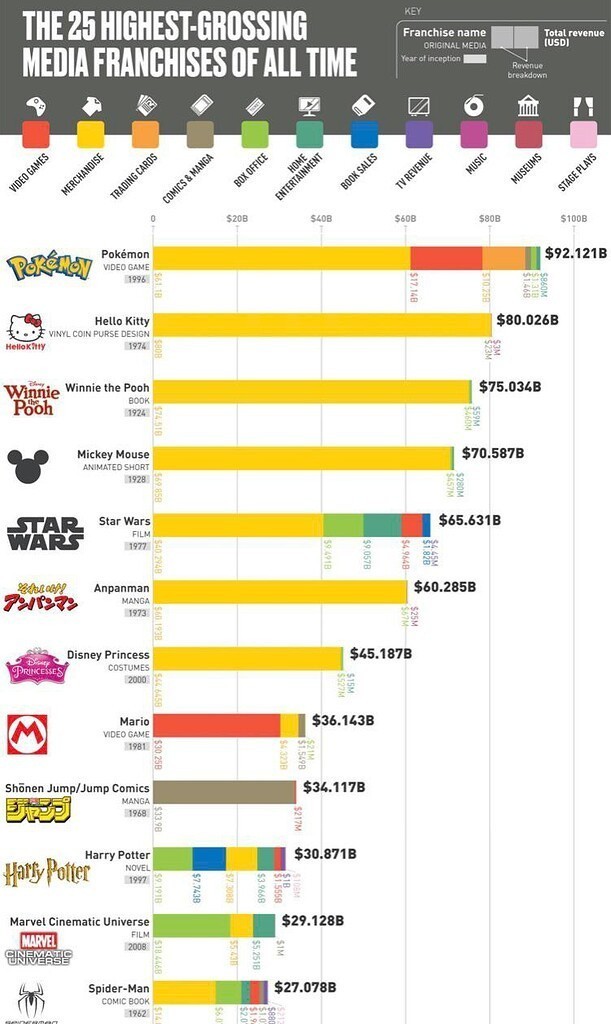

I’ve written about this a few times now. In “Content Is Discovery” I made the case that the biggest games in the world aren’t just competing in the attention economy... they’re feeding it. And in the Highguard piece and Microsoft piece, you can see exactly what it looks like when teams either don’t understand the war they’re in or fundamentally misread the playbook.

So let’s do this in two parts. First, I want to lay out Ball’s case as cleanly as I can, pulling from his conversations with Ben Thompson at Stratechery and Christopher Dring at The Game Business. Then I’ll get into my perspective... which is that the games winning the attention economy right now aren’t winning despite the current environment. They’re winning because they figured out what game is actually being played.

Ball’s Case: Gaming Is Losing The Attention War

Ball making the case

Ball has been building toward this argument for a couple of years now, but this year he sharpened it. The headline, delivered pretty plainly in his interview with Christopher Dring at The Game Business:

“Video gaming has been a loser in the attention wars over the last half decade.”

Matthew Ball, The Game Business, February 2026

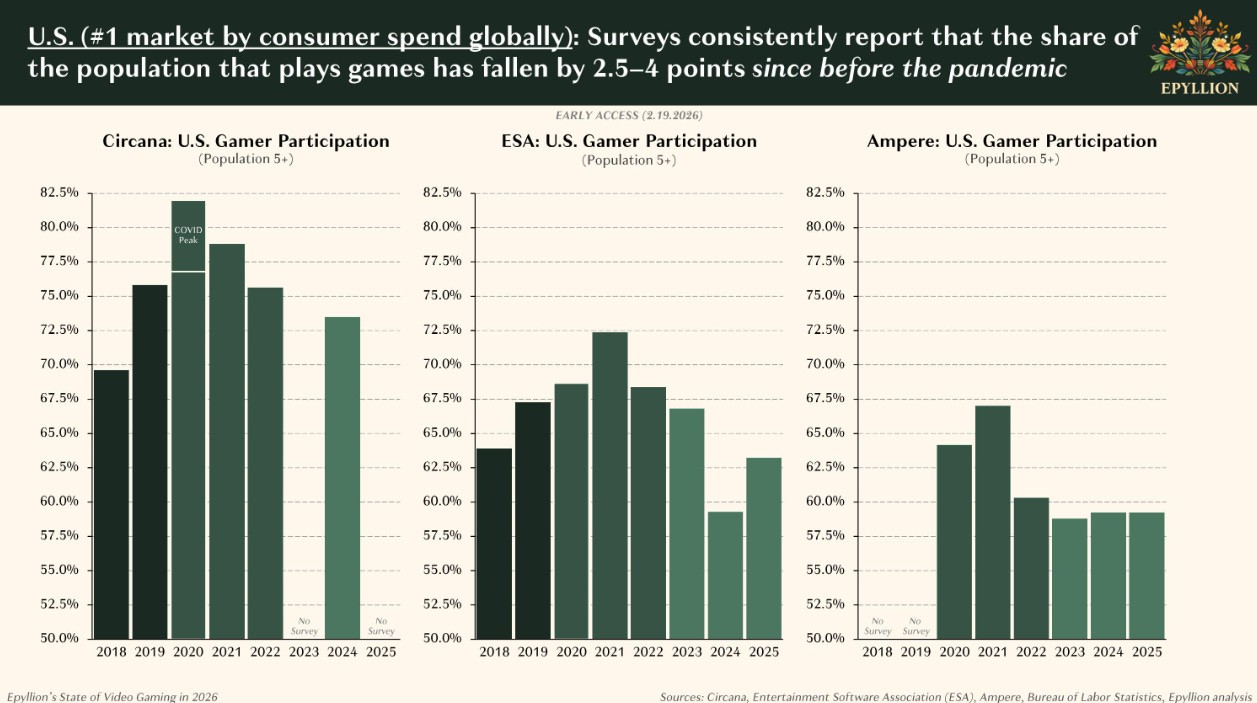

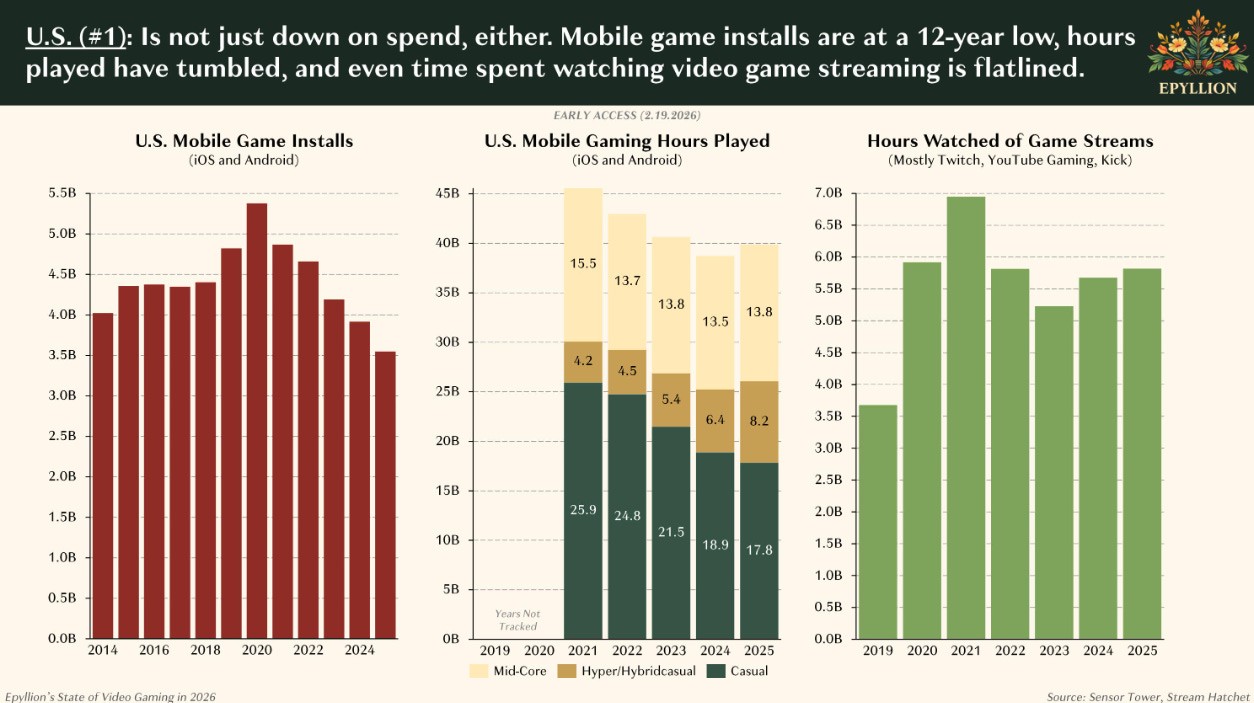

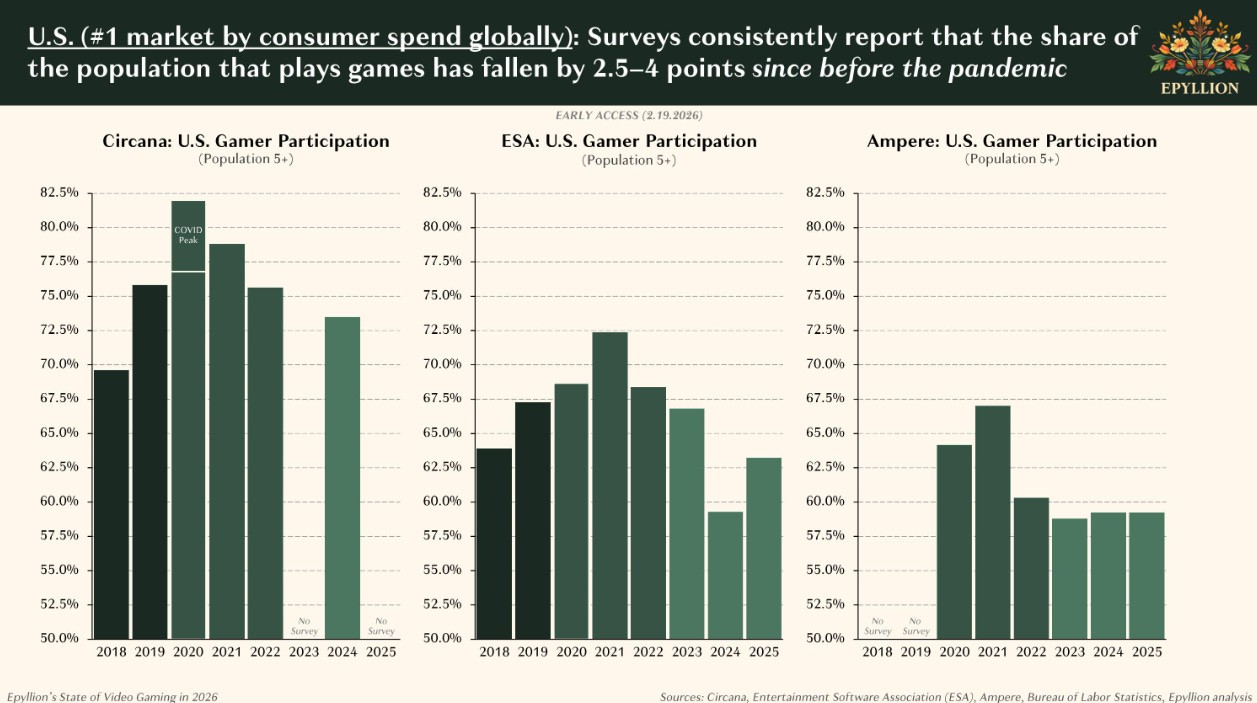

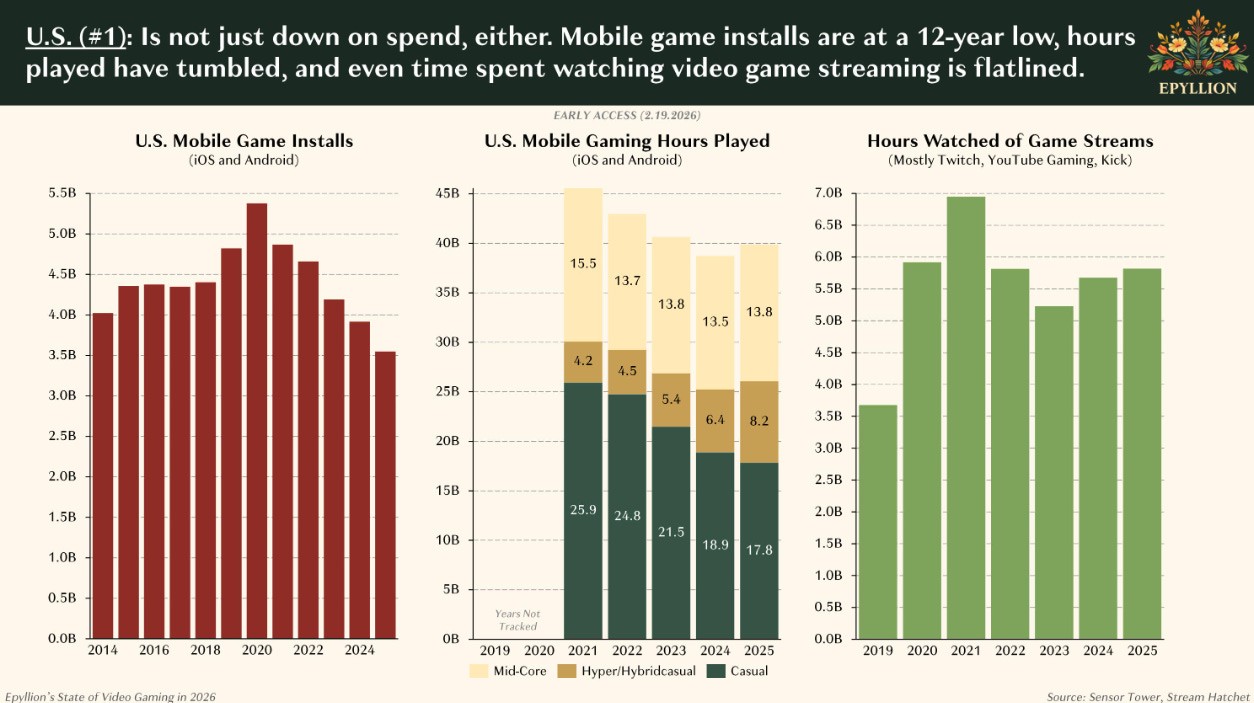

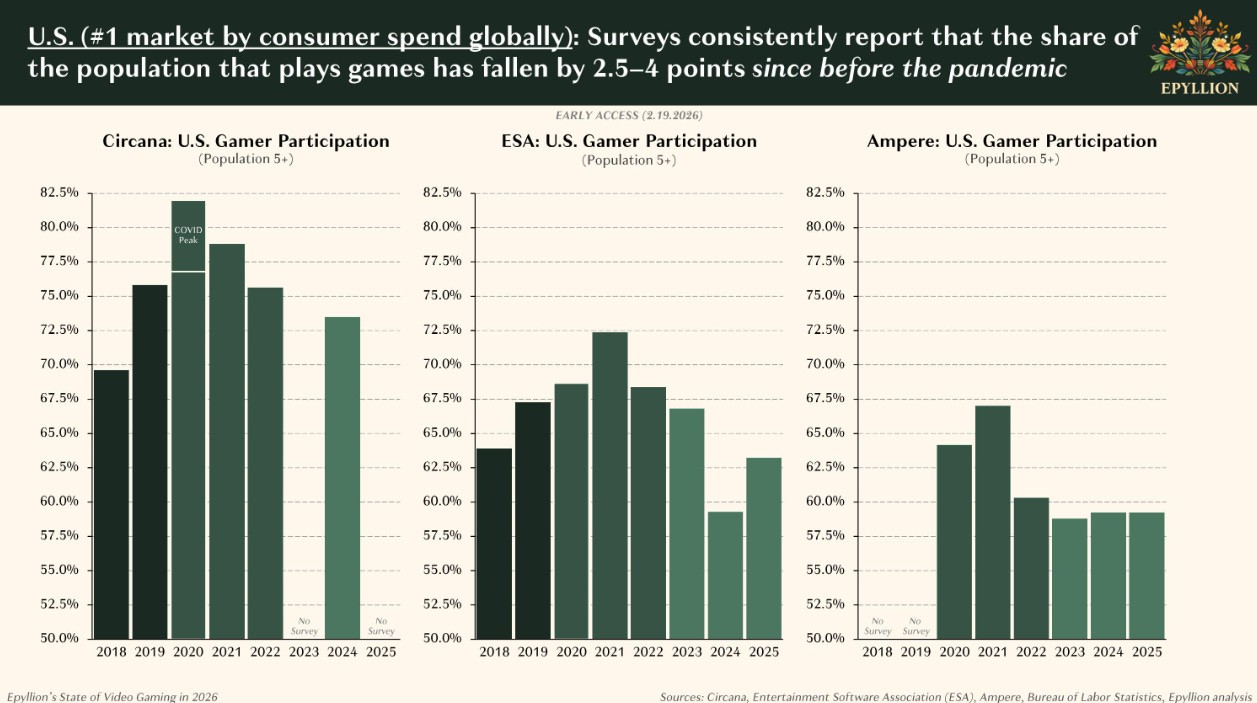

That’s a jarring thing to read in a year when the industry just hit an all-time revenue high. But Ball’s argument isn’t really about revenue, at least not at first. It’s about time. And specifically about where the time of the demographic that built this industry is actually going.

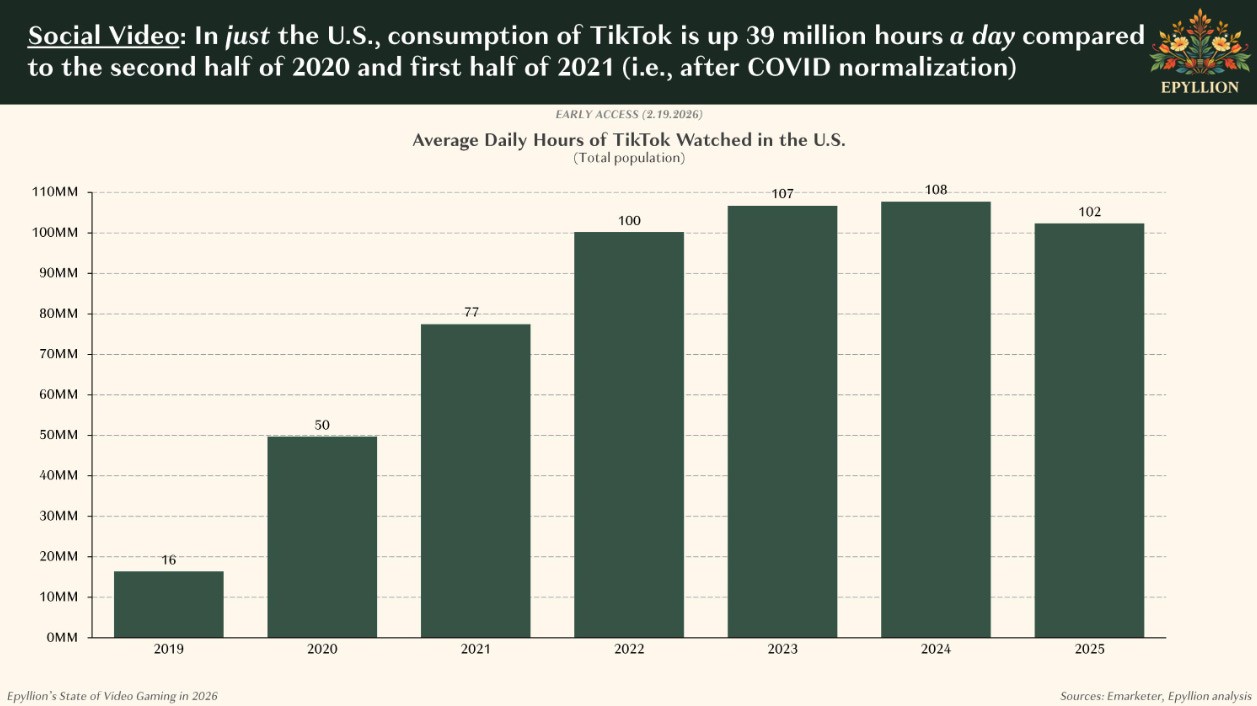

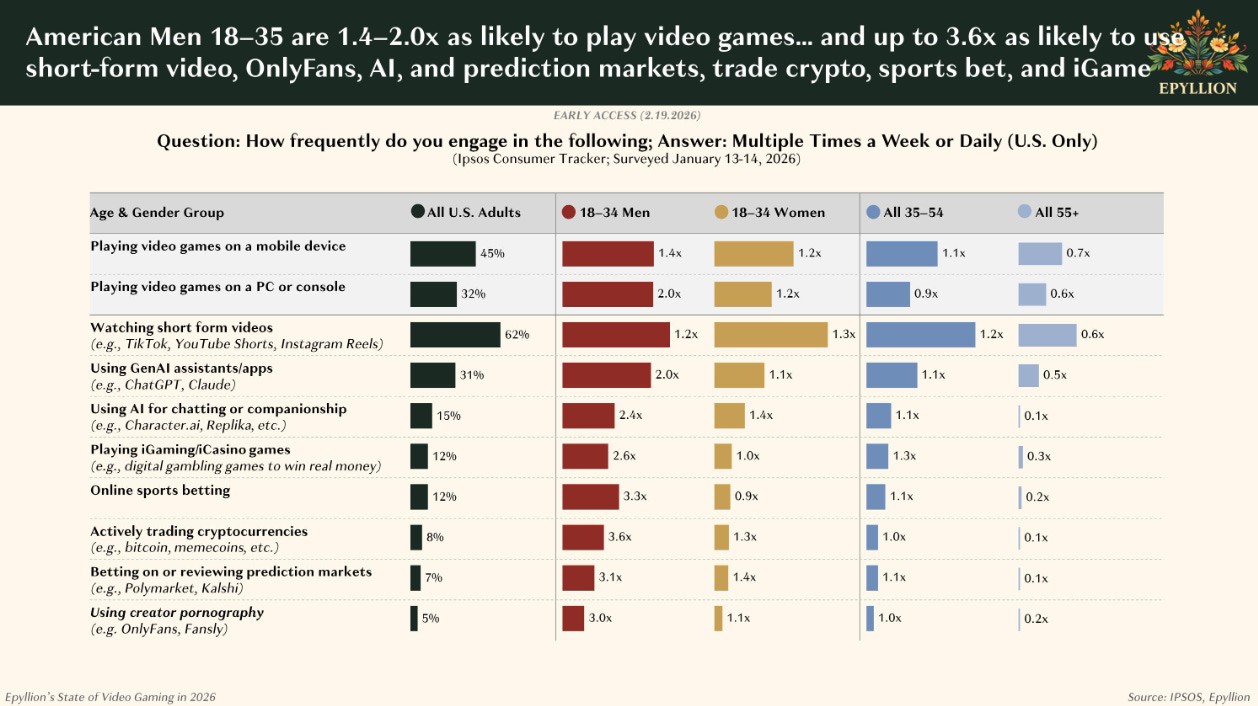

The core of his case is that the attention economy restructured pretty significantly after 2019, and gaming, particularly in the mature markets that built the industry, ended up on the wrong side of that. The competition didn’t show up with better games. It showed up with better hooks.

The “bad” guys to gaming.

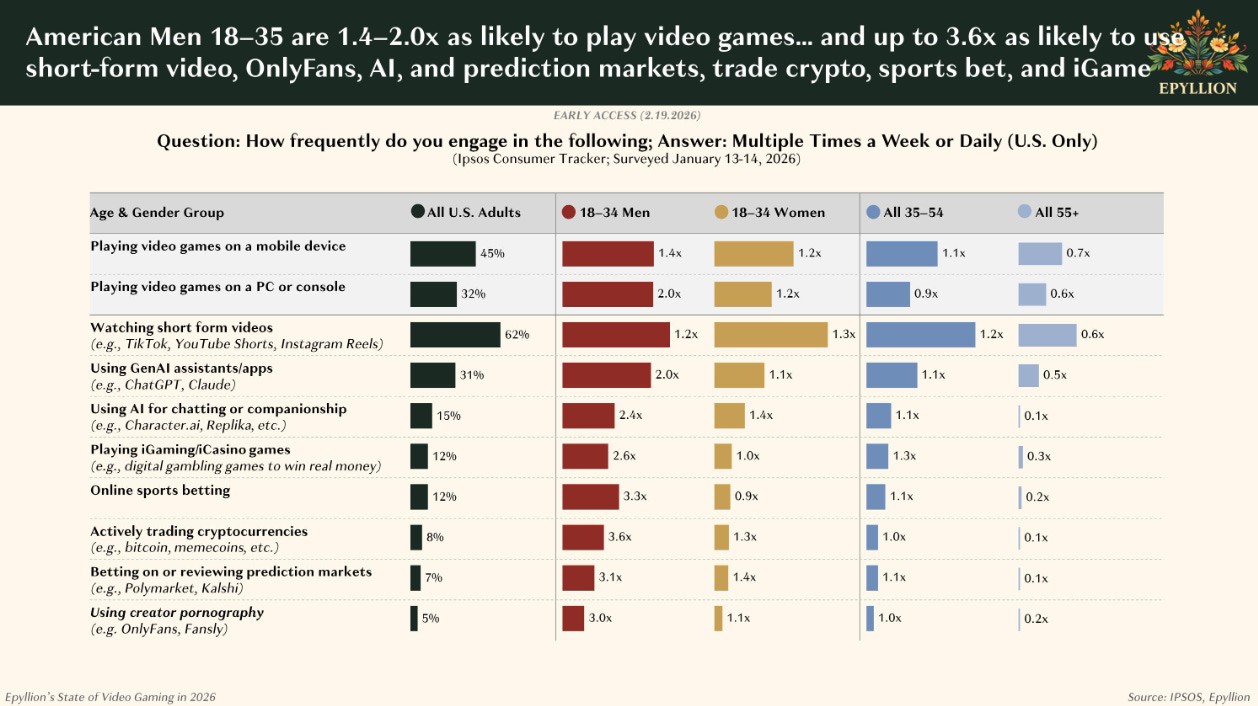

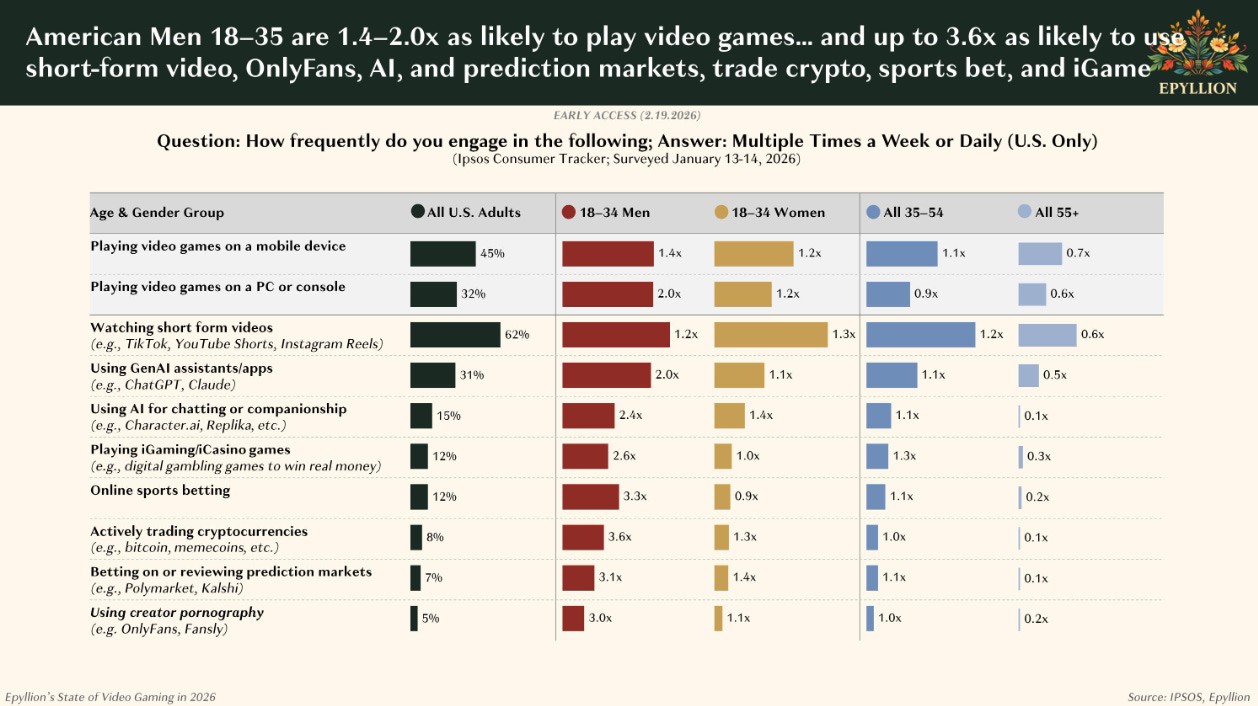

TikTok. Sports betting. OnlyFans. Crypto. Prediction markets. On paper none of these look like they’re competing with a 60-hour RPG or a ranked shooter. But Ball’s point is that they’re all fishing from the same pool... 18-to-34-year-old men, the exact demographic that has driven PC and console spending for two decades. And these alternatives don’t just steal time. They steal it more efficiently, because they’re engineered for a world where attention is fractured and multitasking is the default.

He put the structural problem plainly in his conversation with Ben Thompson at Stratechery:

“One of the things that I hear a lot from the ecosystem now is that what we often believed was one of the unique strengths of the industry, massive attention, singular attention, is in many ways the Achilles heel, because when you take a look at the time of use, you say Americans engage with 30 hours of content per day, and that’s because we’re multitasking. The one challenge here is I can be on TikTok and Twitter and Polymarket while watching television, but I can’t actually have both hands on controller in a live multiplayer match while multitasking.”

Matthew Ball, Stratechery, February 2026

That’s the whole structural problem in one paragraph. Gaming almost uniquely demands full presence. Both hands on the controller. Active decision-making. Real-time response. And in a world where every other form of entertainment has figured out how to stack... that full-presence requirement has quietly become a liability.

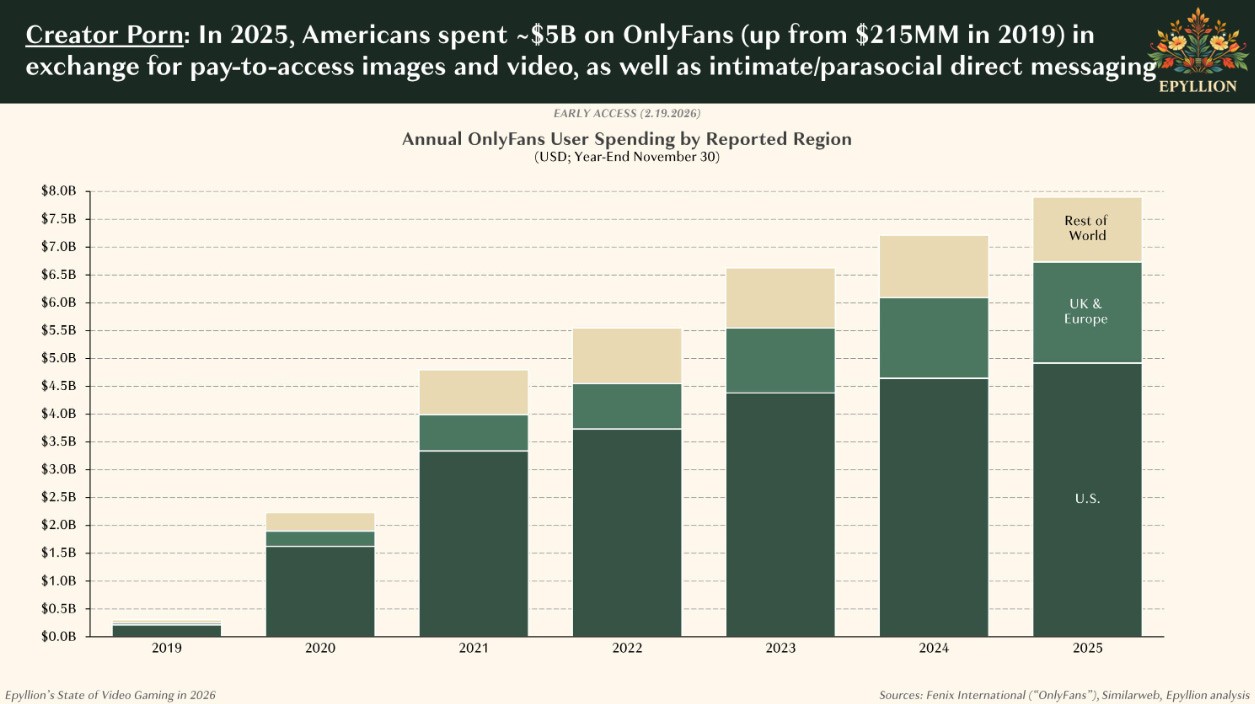

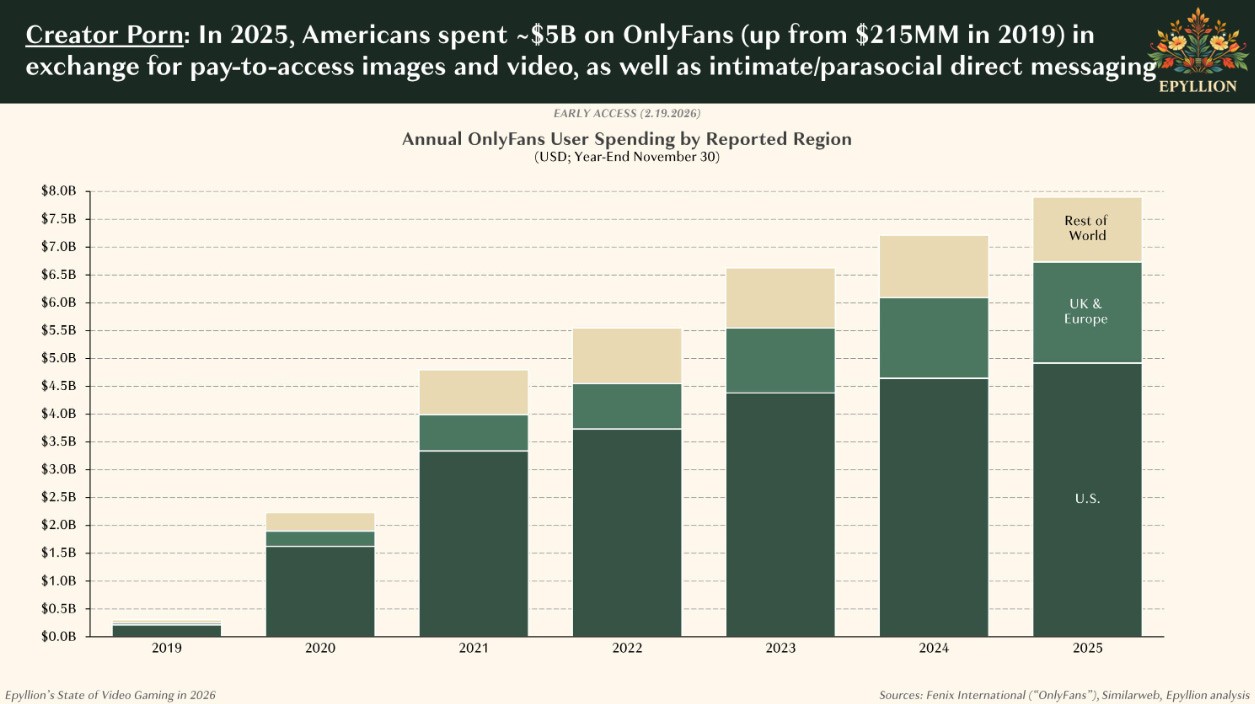

A chart I never thought I would see or share.

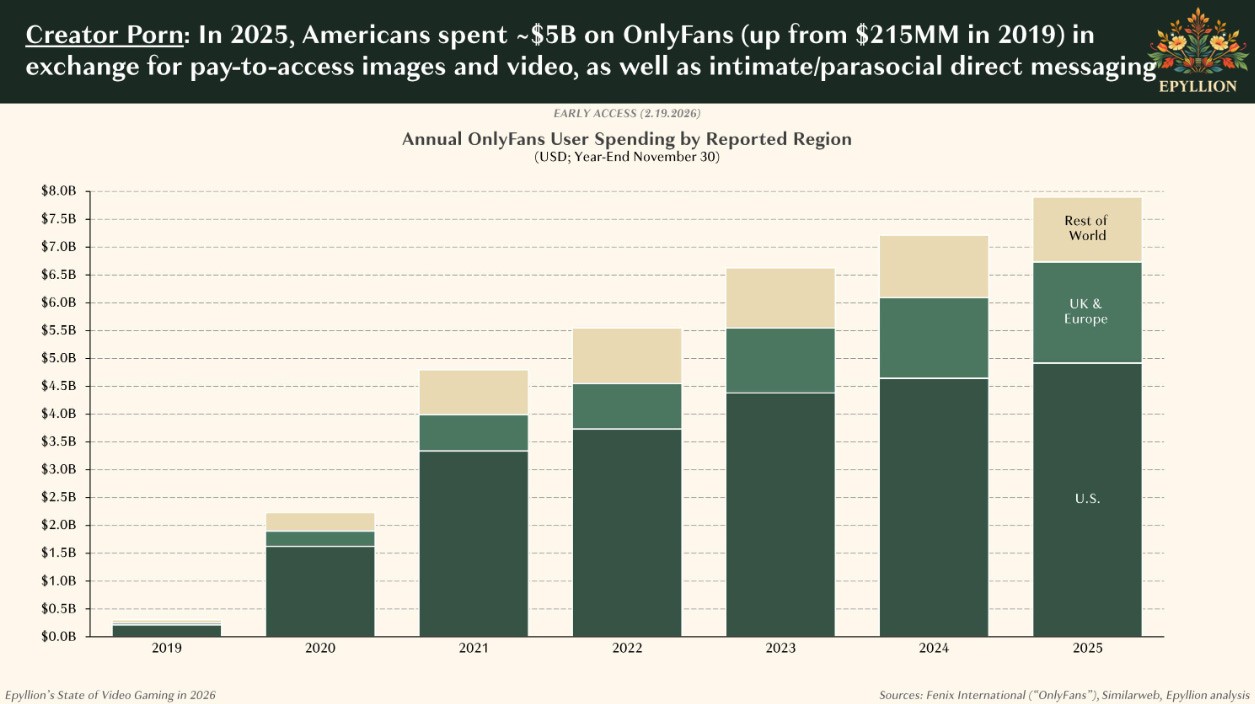

The competing platforms aren’t subtle about it either. Ball’s data on the alternatives is pretty striking. Online sports betting generated roughly $17 billion in net losses across 35 states last year. iGaming hit $11 billion, and that’s only legal in seven states. OnlyFans has around 12 million American users spending $5 billion annually, roughly half of them in that 18-to-34 male bracket. These aren’t fringe behaviors anymore. They’re mainstream. And they’re all engineered around the same psychological triggers games used to own almost exclusively... progression, risk, social signaling, the feedback loop that tells you you’re winning.

The part that makes this uncomfortable to wave away is the multitasking angle. Sports betting gives you a live stake in something that just runs in the background. Crypto gives you a ticker you can check between meetings. Prediction markets give you the feeling of applying skill to real-world outcomes without ever having to clear your schedule. These things don’t ask you to commit. They’re ambient. They travel with you. And when they interrupt a game session... the interruption wins.

Ball put it bluntly to Thompson:

“It could just be you just lost 100 bucks, it could just mean you won 1,000 bucks, or it can be the OnlyFans star that you subscribe just told you a new pay-per-view video is available. Guess what? A lot of those people are gone, and they can multitask in other ways, but not that.”

That’s the threat in one sentence. It’s not that games got worse. It’s that the cost of demanding full presence in a fractured world keeps going up.

And Ball isn’t wrong about the underlying numbers. The Major Market 8... US, UK, Germany, Japan, Korea, France, Italy, Canada... have been flat for five years. The 18-to-34 core is measurably pulling back. The structural forces are real, and they’re not going away.

Scary... without context

Where I start to push back is on what all of that actually means for the games that are winning right now. Because Ball’s framing, taken literally, would suggest the industry is basically in a defensive crouch with limited options. And I just don’t think that’s what the data shows when you look at the right titles.

Some games aren’t losing the attention war at all. Some games winning the war and are dominating all forms of entertianment in the process.

And that’s where we’re going next.

Some Games Don’t Compete For Attention. They Generate It.

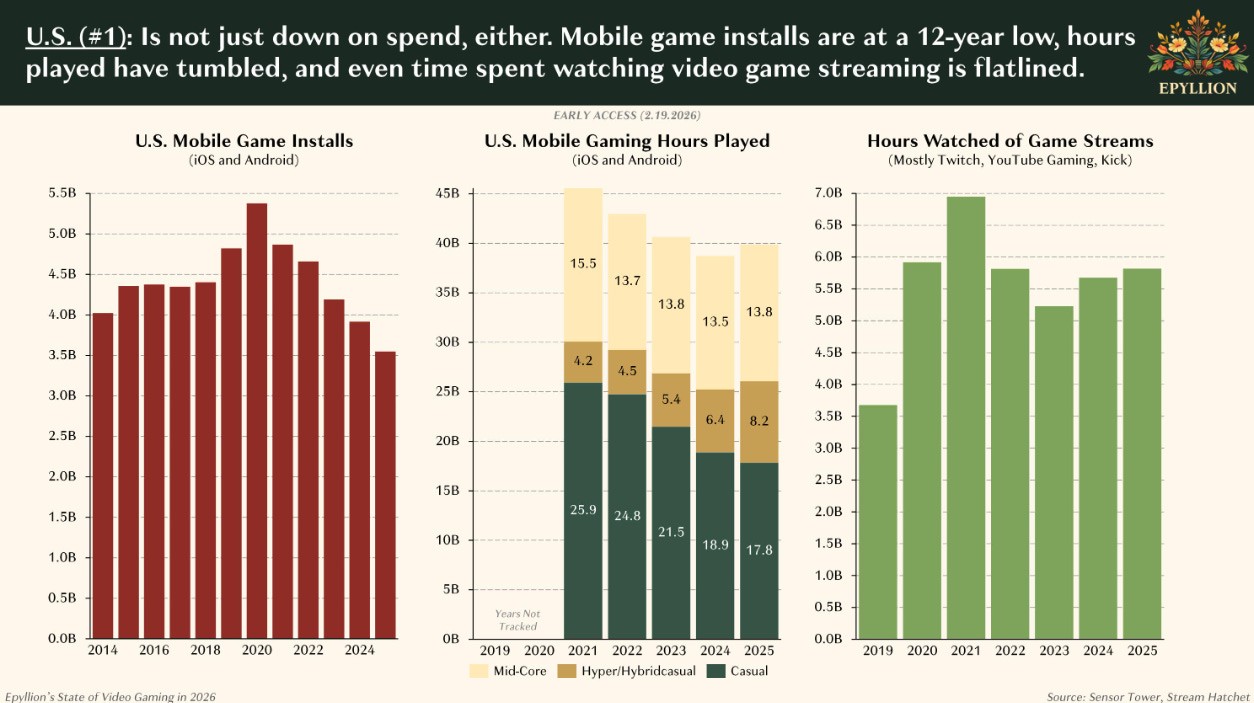

All this chart tells me is the death of Twitch / Livestreaming.. which I agree with.. but that is a Twitch problem.

Ball’s attention economy argument is directionally right. The war is real. The competition is real. The structural disadvantage of demanding full presence in a multitasking world is real.

But there’s a version of his argument that I keep tripping over, which is the implication that all games are fighting the same losing battle. Because when you actually look at the games sitting at the very top of the attention economy right now... some of them aren’t losing to TikTok at all. Some of them own TikTok. And some of them have built content universes so large they don’t compete with the platforms Ball cites as threats. They use them.

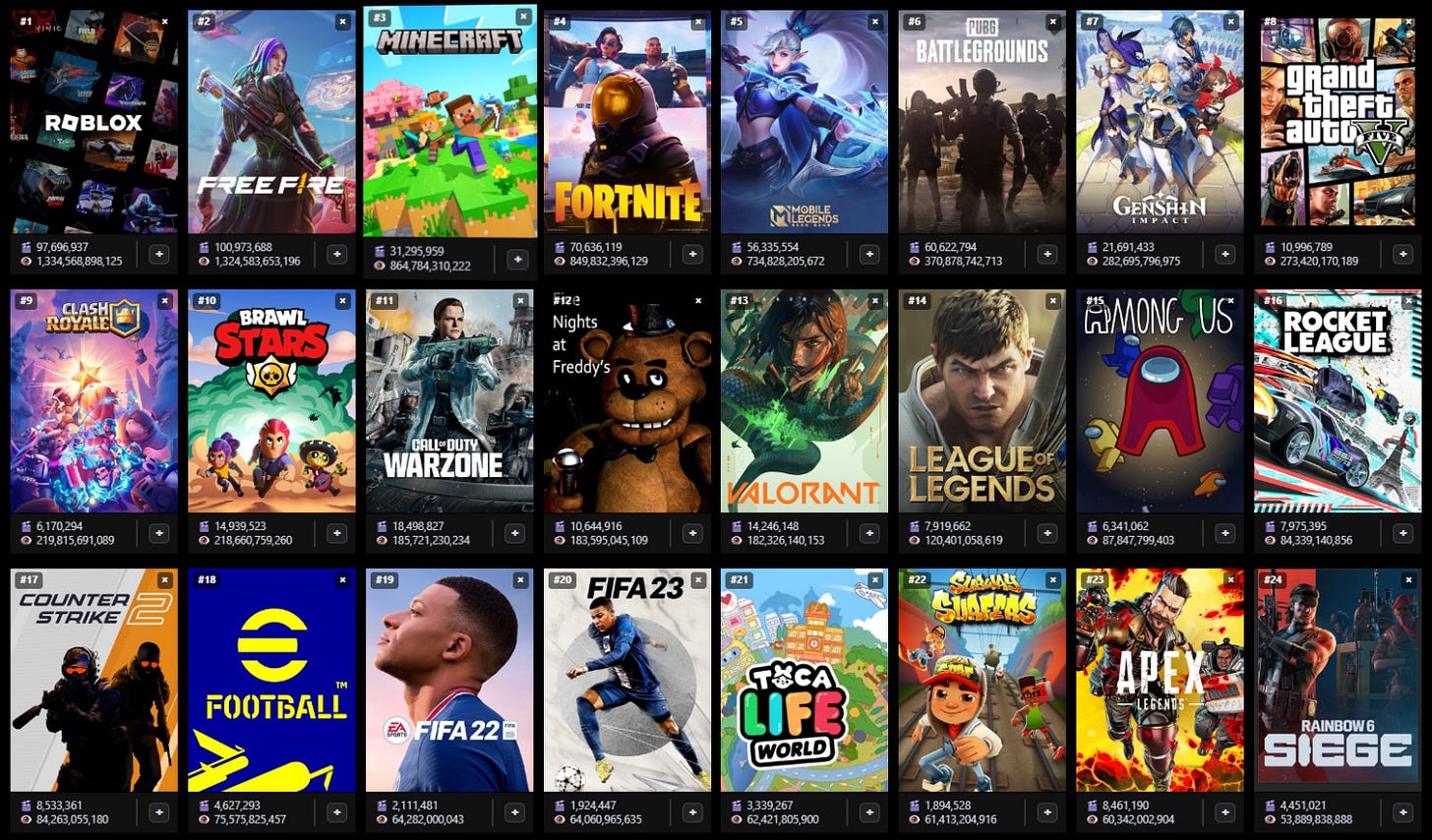

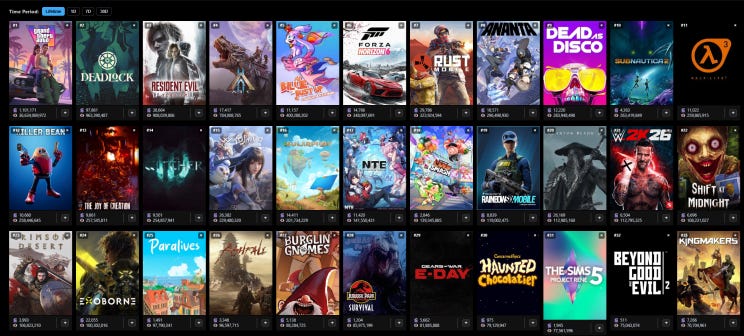

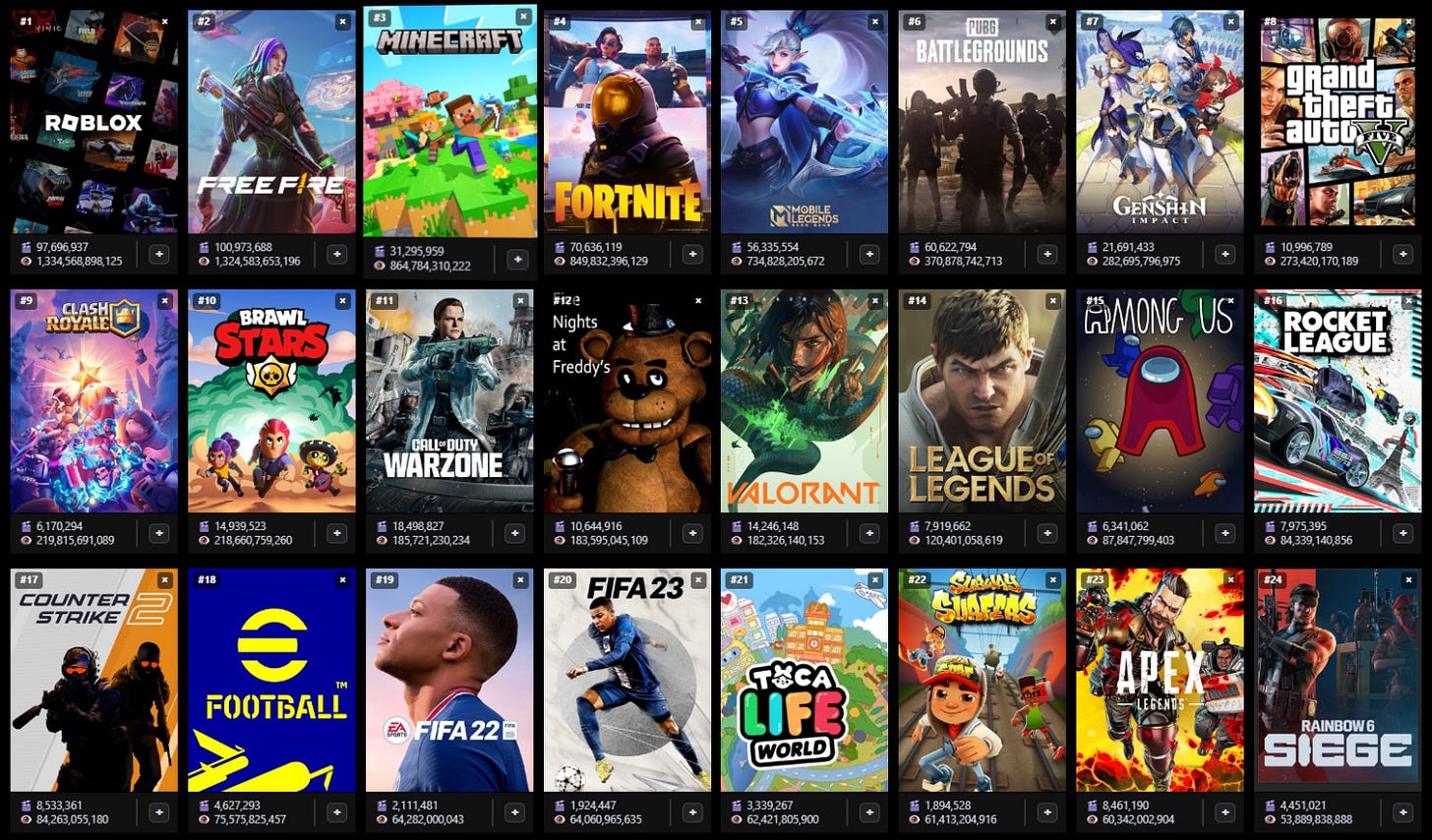

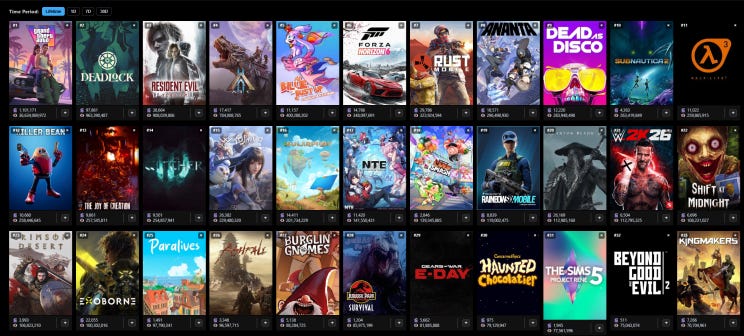

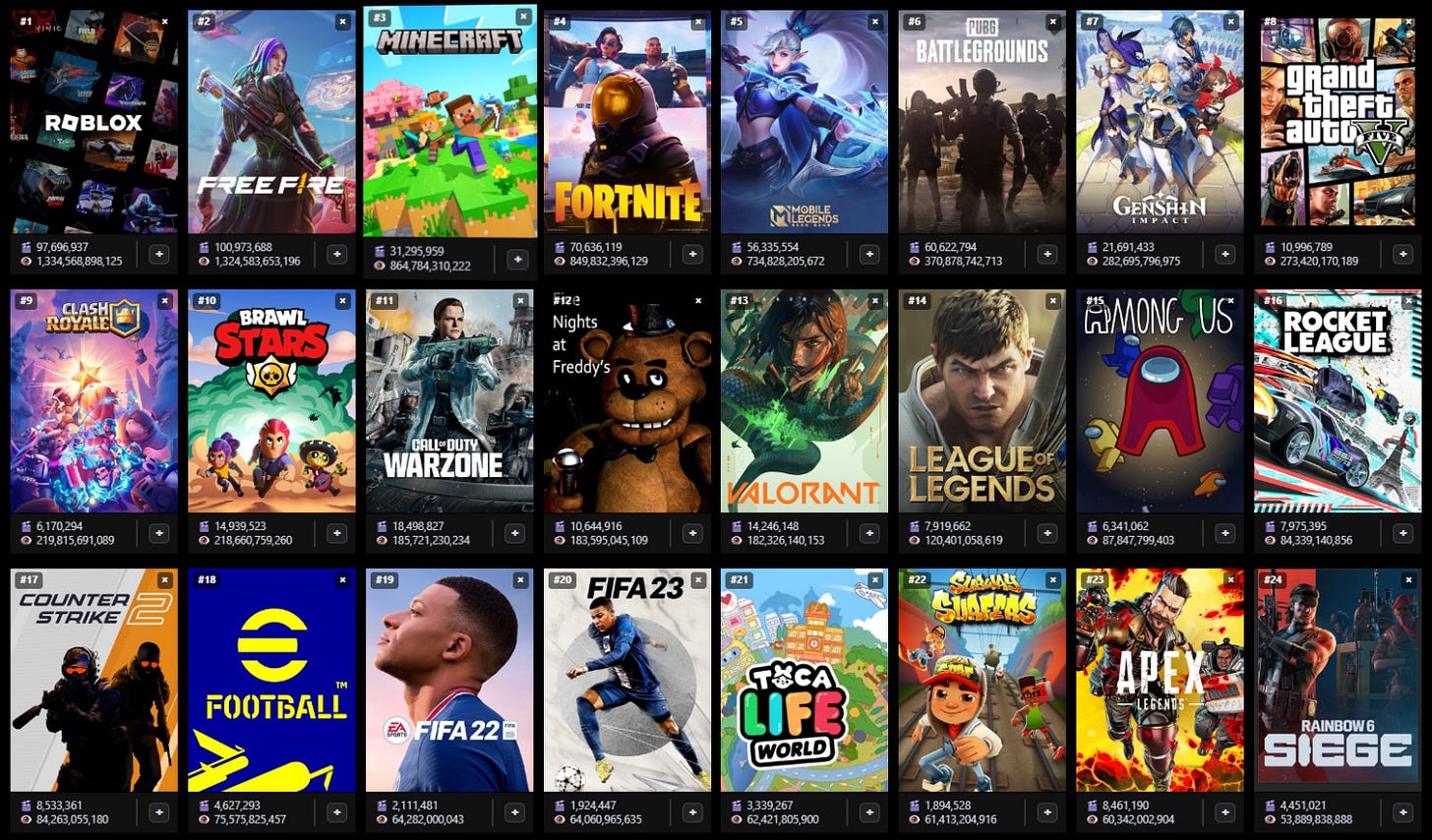

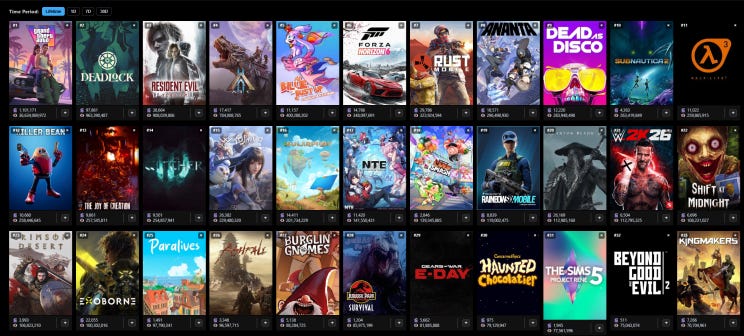

mindGAME Data - Top 24 games, sorted by video views, across the history of TikTok

The games that figured this out aren’t treating content platforms as competitors. They’re treating them as the product.

There are different ways to win that war. Short form video. Transmedia. And then there’s a third category that doesn’t get talked about enough... games that haven’t even launched yet, winning the attention economy on pure cultural gravity, beating fully released and actively marketed titles while people are still waiting to play them.

Fallout - clear winner of the transmedia era

At the macro level, yes... most games are losing. This is a winner-take-most environment, and the volume of releases every year means the vast majority are invisible from day one. Ball’s data captures that accurately. But the reason most games are losing isn’t because TikTok and sports betting are inherently unbeatable. It’s because most studios don’t understand the war they’re in. They’re marketing like it’s 2015. They’re assuming that if they build something good, the audience will find it. They’re playing by rules that stopped working years ago.

The games winning right now figured out something different. Let’s look at a few of them.

Short Form Video: Garena Free Fire And The Flood The Zone Playbook

Free Fire - the biggest game that is unknown in the west

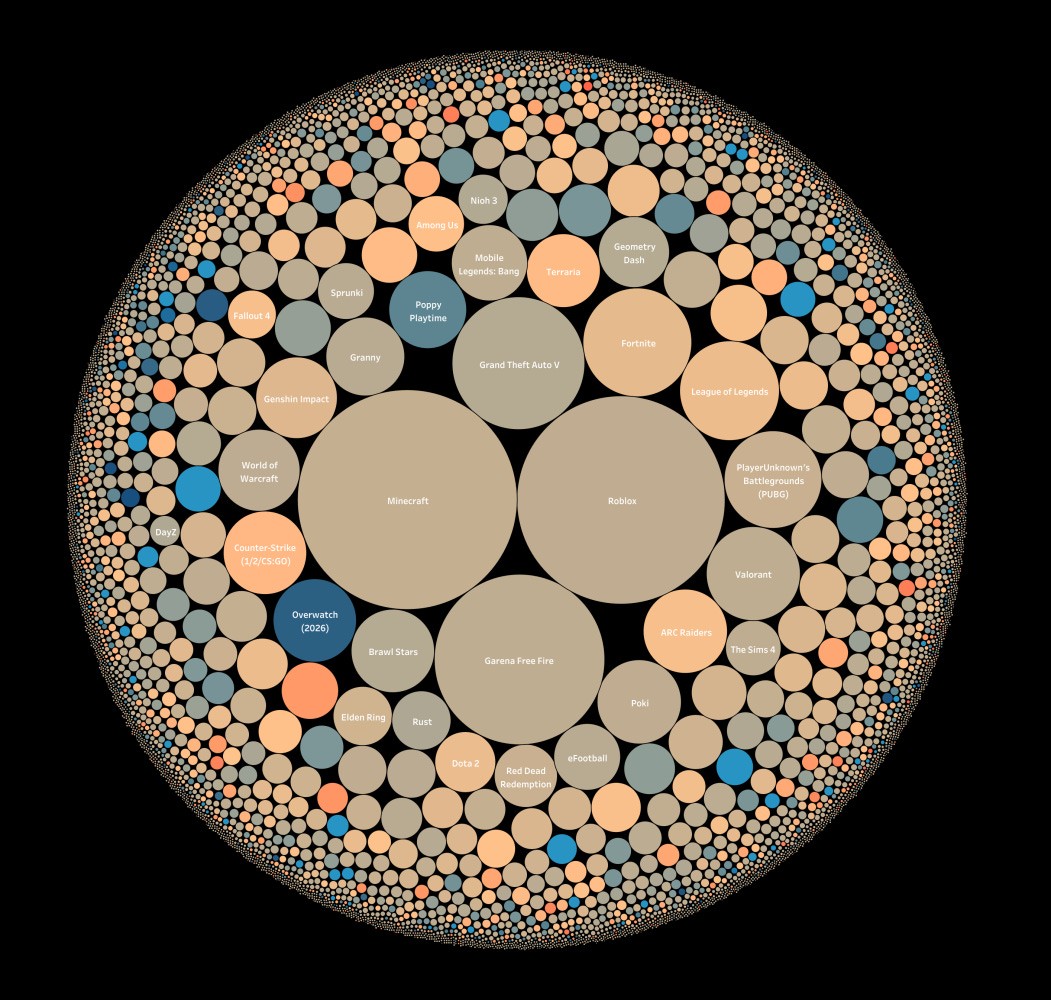

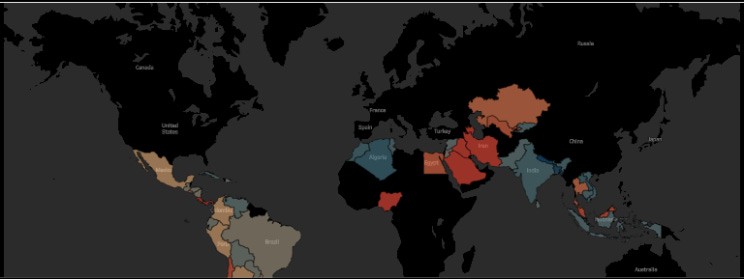

If you’re a Western gaming industry reader, Free Fire might not be on your radar. It doesn’t dominate U.S. charts. It doesn’t get talked about at GDC. It’s not in the conversation at most Western publisher strategy meetings.

And yet, by every meaningful attention metric we track at mindGAME Data, Garena Free Fire is the third largest game in the world.

Not third among mobile games. Third among everything... console, PC, mobile, browser. Consistently, week over week, sitting at roughly 4% global cumulative mindSHARE, behind only Roblox and Minecraft. Its peers aren’t Valorant or Call of Duty. Its peers are the two games that basically invented the concept of a platform-scale game ecosystem.

mindSHARE - Free Fire is #3 world wide

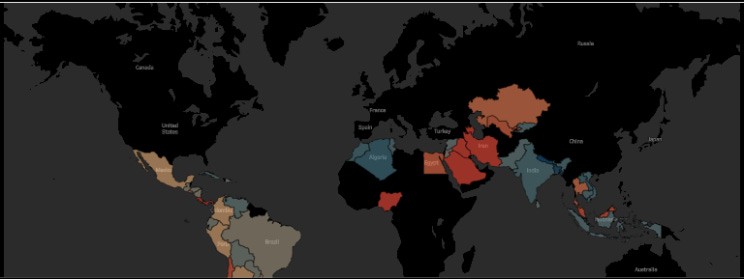

A quick background for context. Free Fire launched in 2017, built by Vietnam’s 111 Dots Studio and published by Garena out of Singapore. It’s a mobile battle royale, optimized from day one for the phones people in emerging markets actually owned... short 10-minute matches, lightweight client, runs on almost anything. It spread fast through Southeast Asia and Latin America, then South Asia, then MENA and Africa. It never needed the West to become what it is.

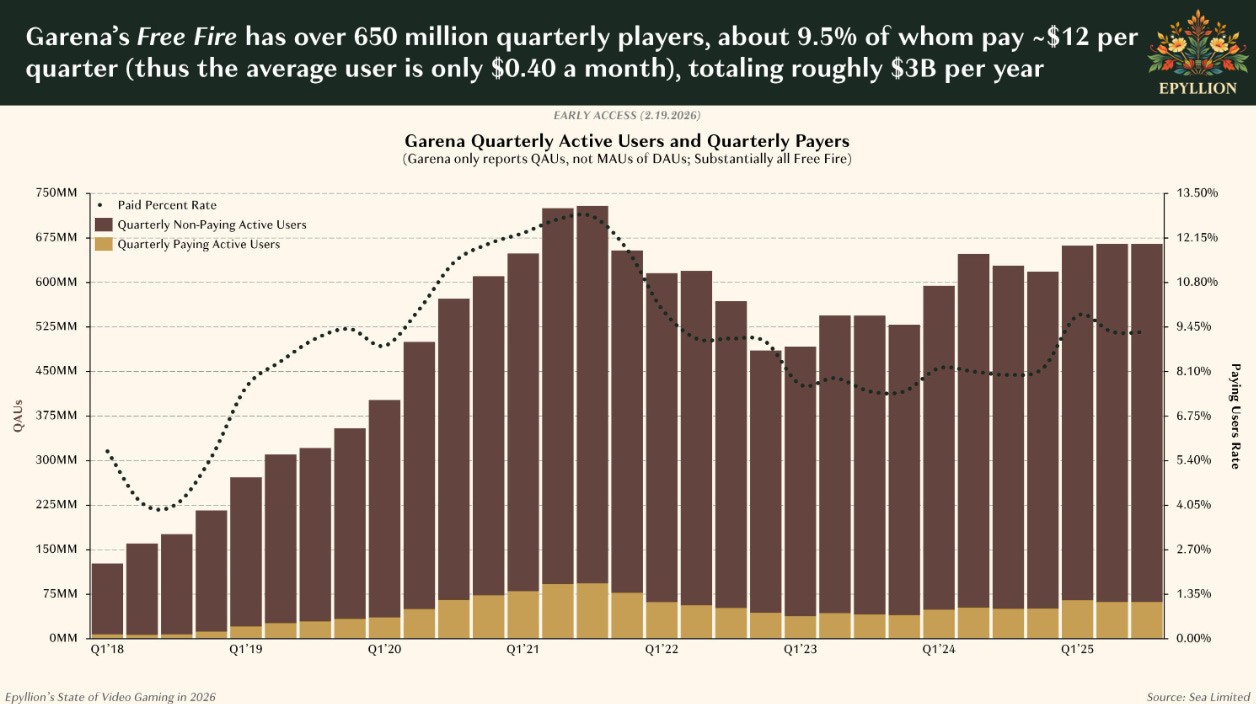

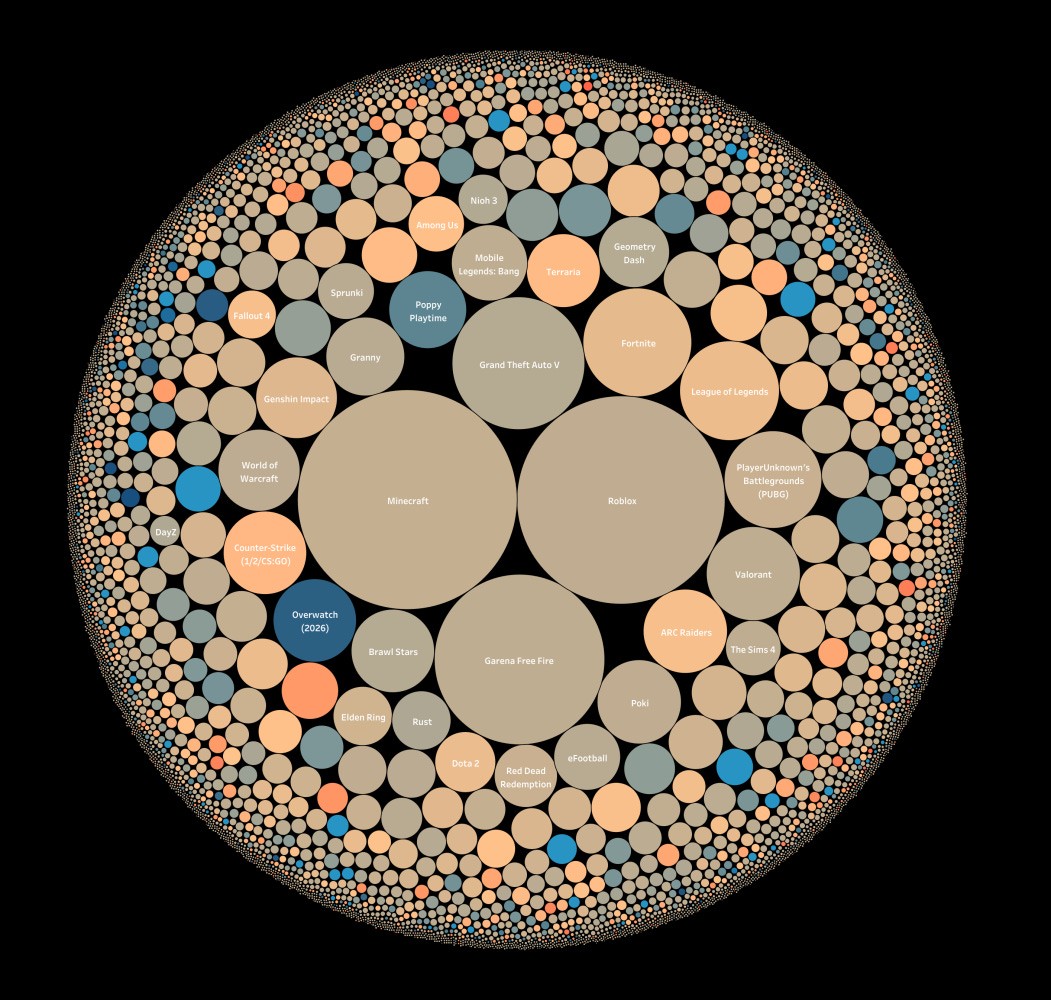

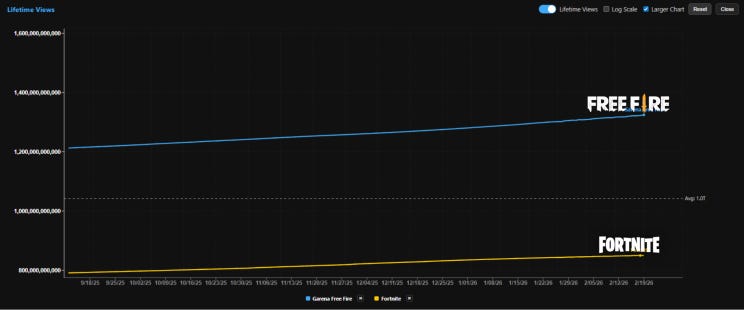

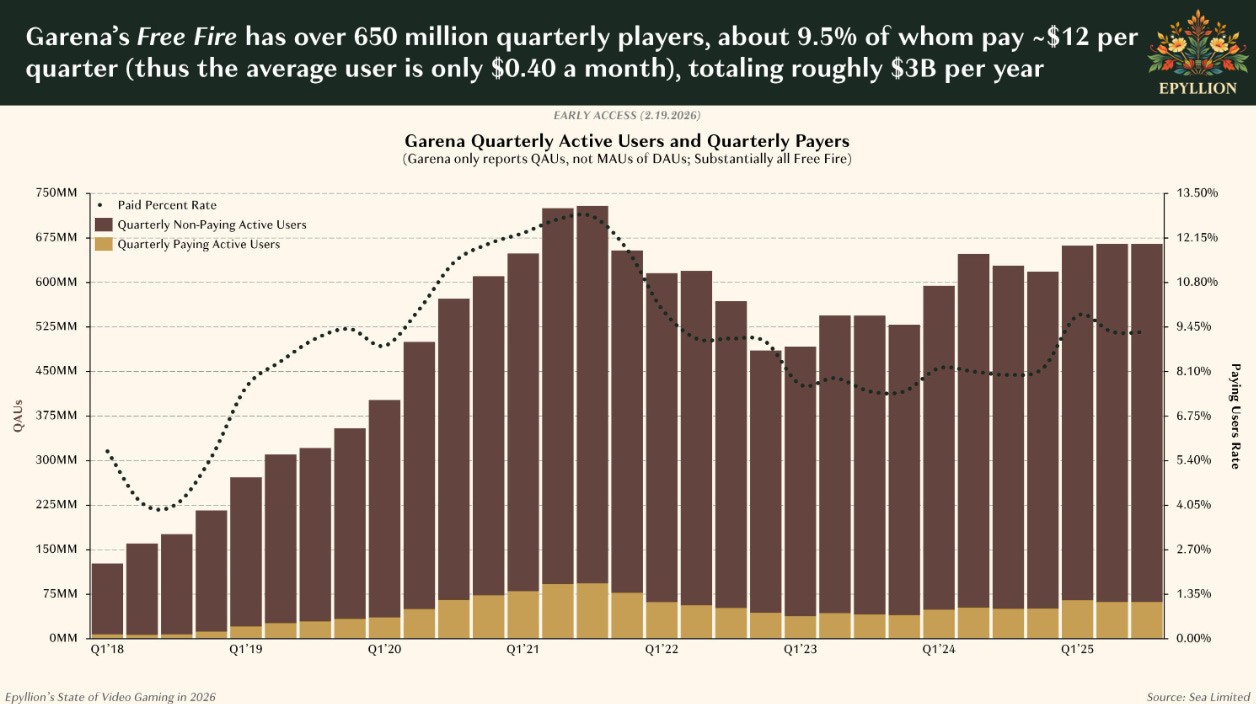

Ball actually cites Free Fire in his report, which is worth noting. He acknowledges the scale... roughly 650 million quarterly players generating around $3 billion annually... but contextualizes the audience as “less viable.” Lower ARPU, non-Western, outside the demographic Western publishers prioritize. The average user pays roughly 40 cents a month. And if you’re only looking at the revenue line, that framing makes some sense.

650 million quarterly players... not bad

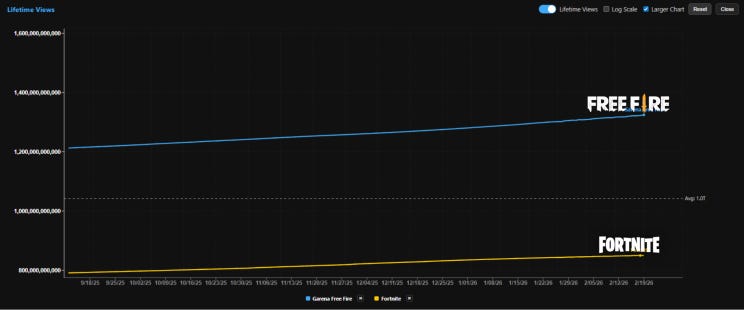

But here’s what 650 million quarterly players and 40 cents a month actually produces on TikTok.

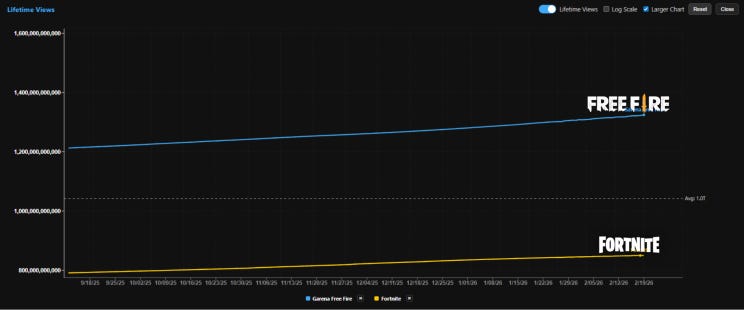

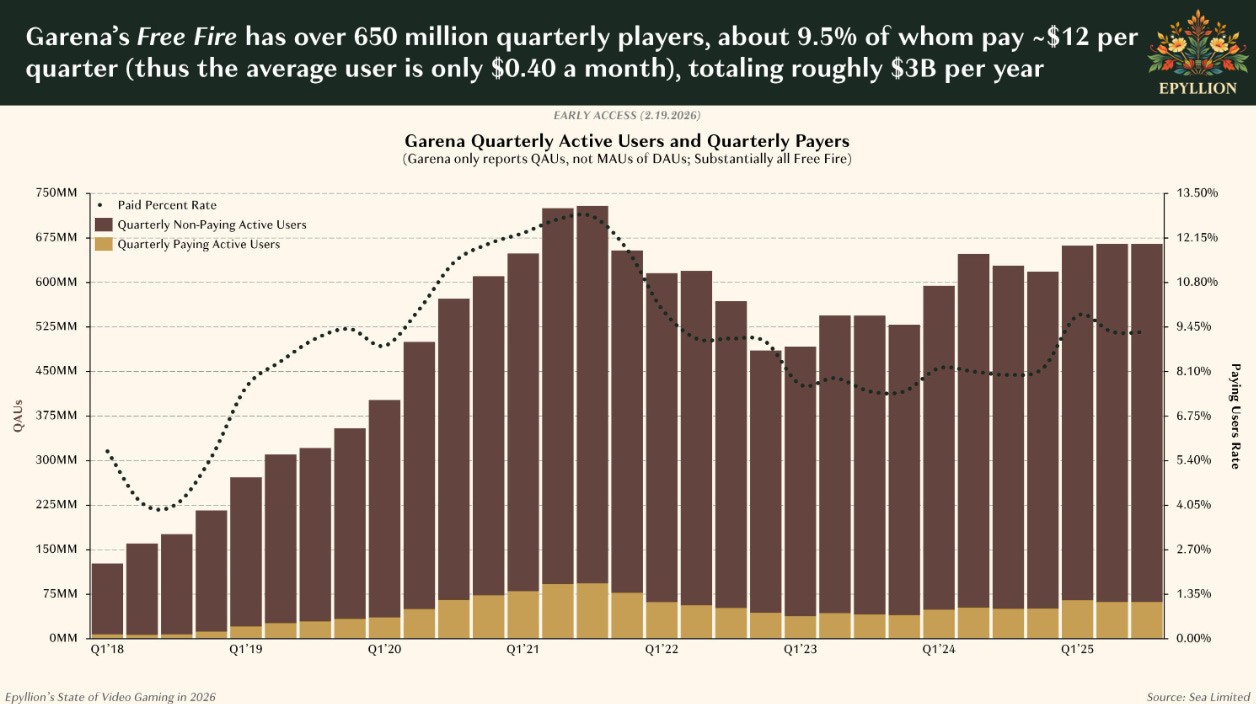

Free Fire currently has 1.324 trillion lifetime views on TikTok. That’s not a typo. One point three two four trillion. It is the number two game in the history of the platform, just behind Roblox, and it got there with over 100 million videos of Free Fire content... the most of any game ever created on TikTok. For reference, Fortnite sits at roughly 850 billion lifetime TikTok views across 70 million videos. Minecraft is in the same ballpark with 30 million videos of its own. Free Fire has 1.3 trillion views and over 100 million videos. It's not close.

Ball calls TikTok one of the primary platforms stealing attention from games. Free Fire turned TikTok into its single biggest customer acquisition channel.

mindGAME - Free Fire vs Fortnite = TikTok total views

The way they did it is worth understanding because it’s deliberate and replicable. Free Fire doesn’t run a single global TikTok channel. It runs hyper-localized regional channels... Brazil, MENA, Vietnam, India, and more... each producing content that is in-language, in-culture, and tuned to the specific meme vocabulary of that market. They’re not translating content. They’re building local content machines that generate a constant, high-volume stream of material for each regional audience to consume and share. Gameplay clips, yes. But also memes, trends, challenges, cultural moments. Content that lives and spreads whether or not the person watching has ever downloaded the game.

They’re flooding the zone. And they’re not the only game doing it... Block Blast, a Tetris-like mobile game, runs the same playbook, producing everything from gameplay footage to pure meme content that uses the game as backdrop. The goal is volume and variety, training the algorithm to find them, and making sure that when any version of their content goes viral, the brand is on it. The result is a game that is culturally present far beyond its actual player count.

Ball frames TikTok as the bad guy... its not... its critical to discovery

That last part is the key insight that Ball’s framing misses. A Free Fire TikTok view from someone who will never install the game still has value. It keeps the brand present. It keeps the IP visible. From a pure monetization standpoint, yes, that value is flowing to TikTok more than to Garena. But from an IP valuation standpoint, from a fandom-building standpoint, from a next-generation player acquisition standpoint... they are winning. They are generating more interest, more awareness, more cultural presence than games spending orders of magnitude more on paid acquisition.

In our data, Free Fire ranks #4 globally in search with around 9.3 million weekly queries, and consistently holds the top one to three spots on YouTube week over week. Its Twitch presence is essentially zero, which would be a red flag for almost any other shooter. For Free Fire it’s irrelevant, because Twitch doesn’t exist at meaningful scale in the markets where Free Fire lives. The platforms that matter for their audience, they dominate. Not by accident. By design.

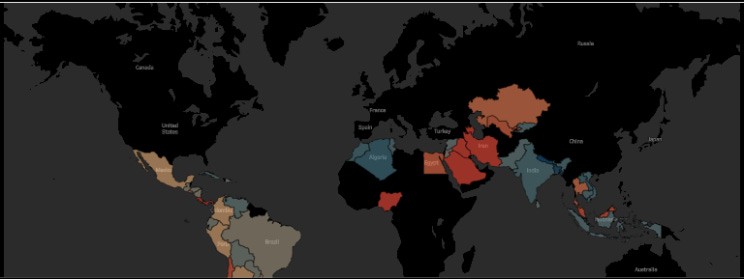

Free Fire - dominate across all non-major markets

I wrote about this in detail in the Free Fire TikTok Flywheel piece from last August. The short version is that Free Fire is proof that the content-as-discovery model works at the highest possible scale. You don’t need to outspend your competitors on paid acquisition if your community and your owned channels are generating an inexhaustible supply of organic inventory. You just need to build the machine. And then run it everywhere.

Transmedia: Nintendo And The Flywheel That Keeps Compounding

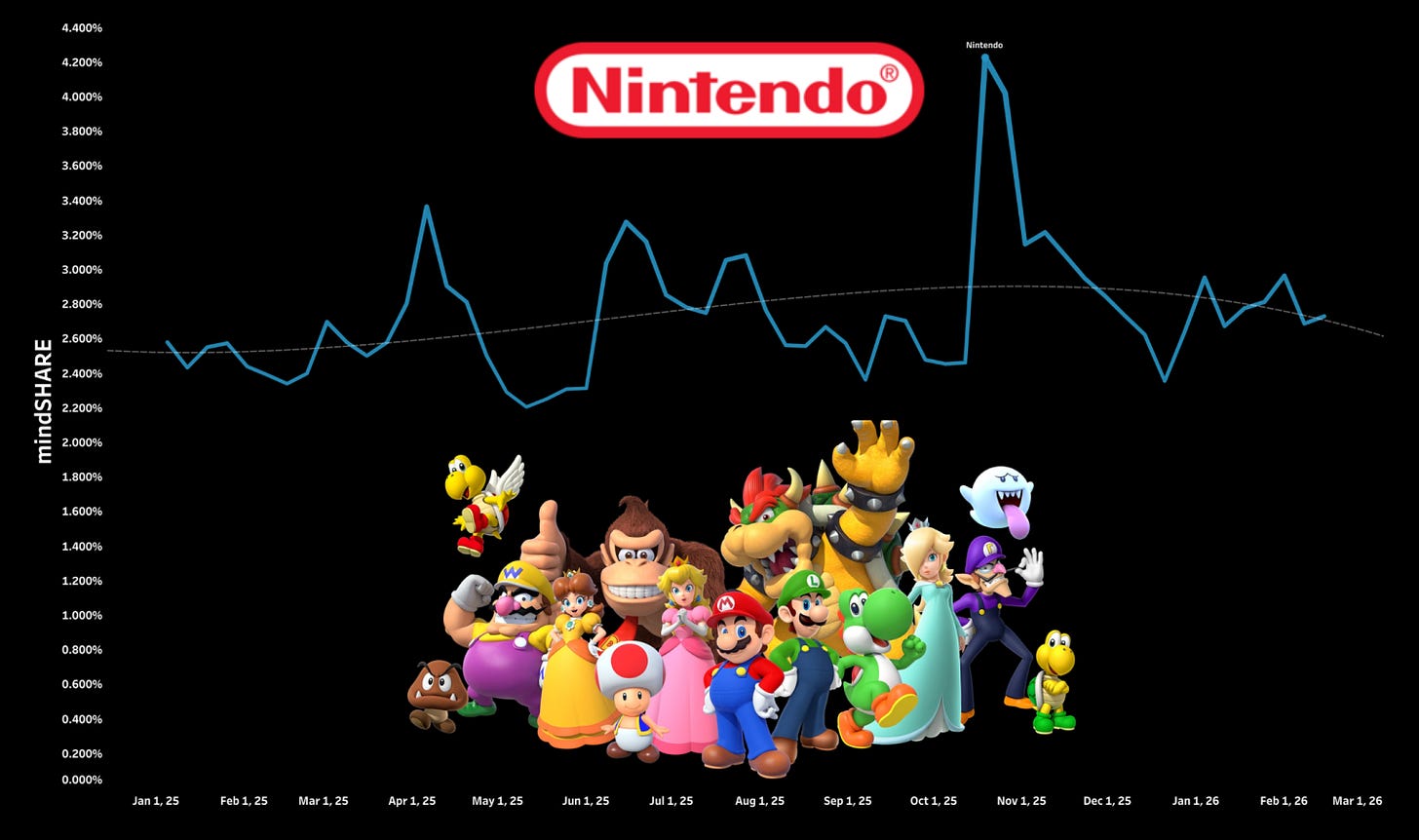

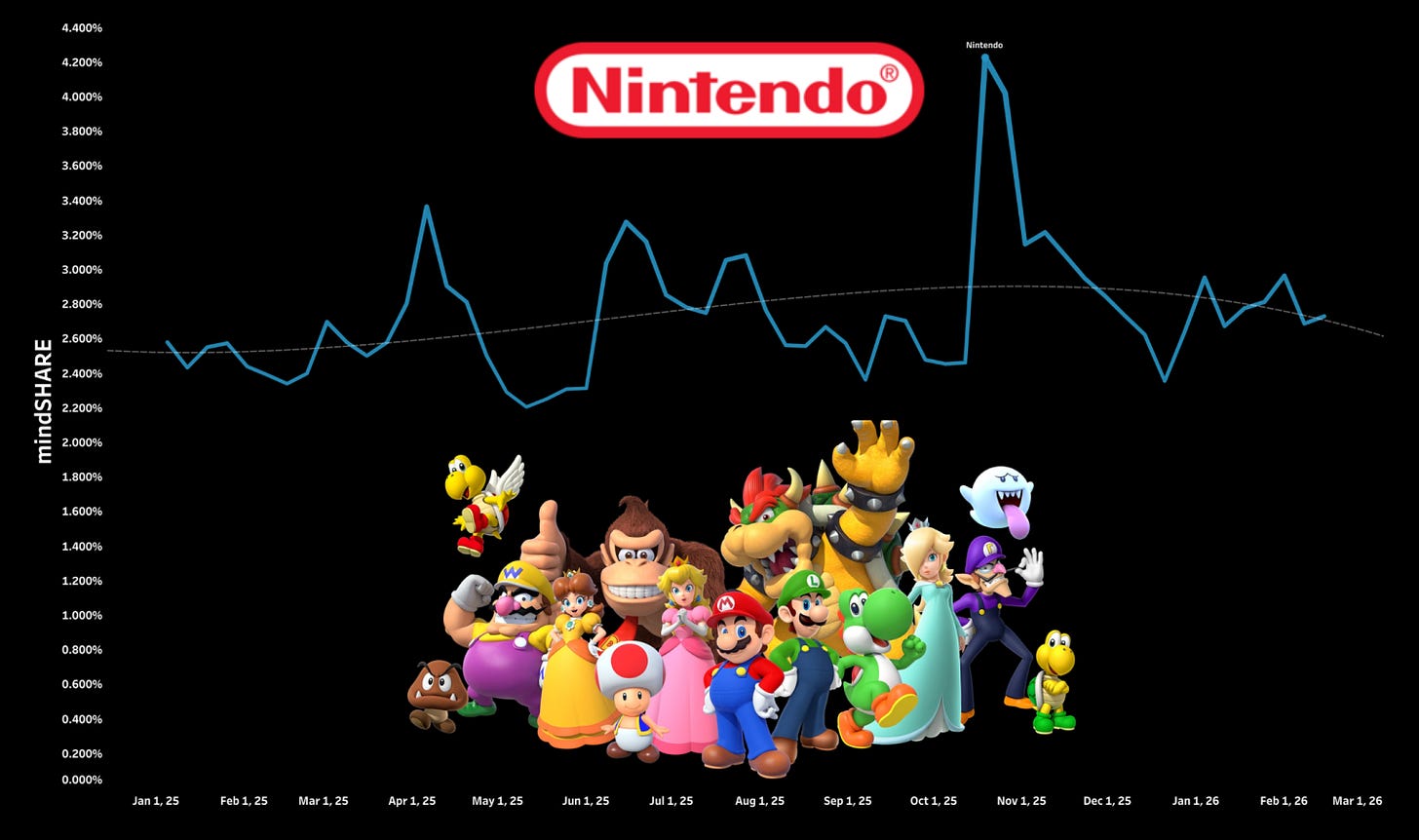

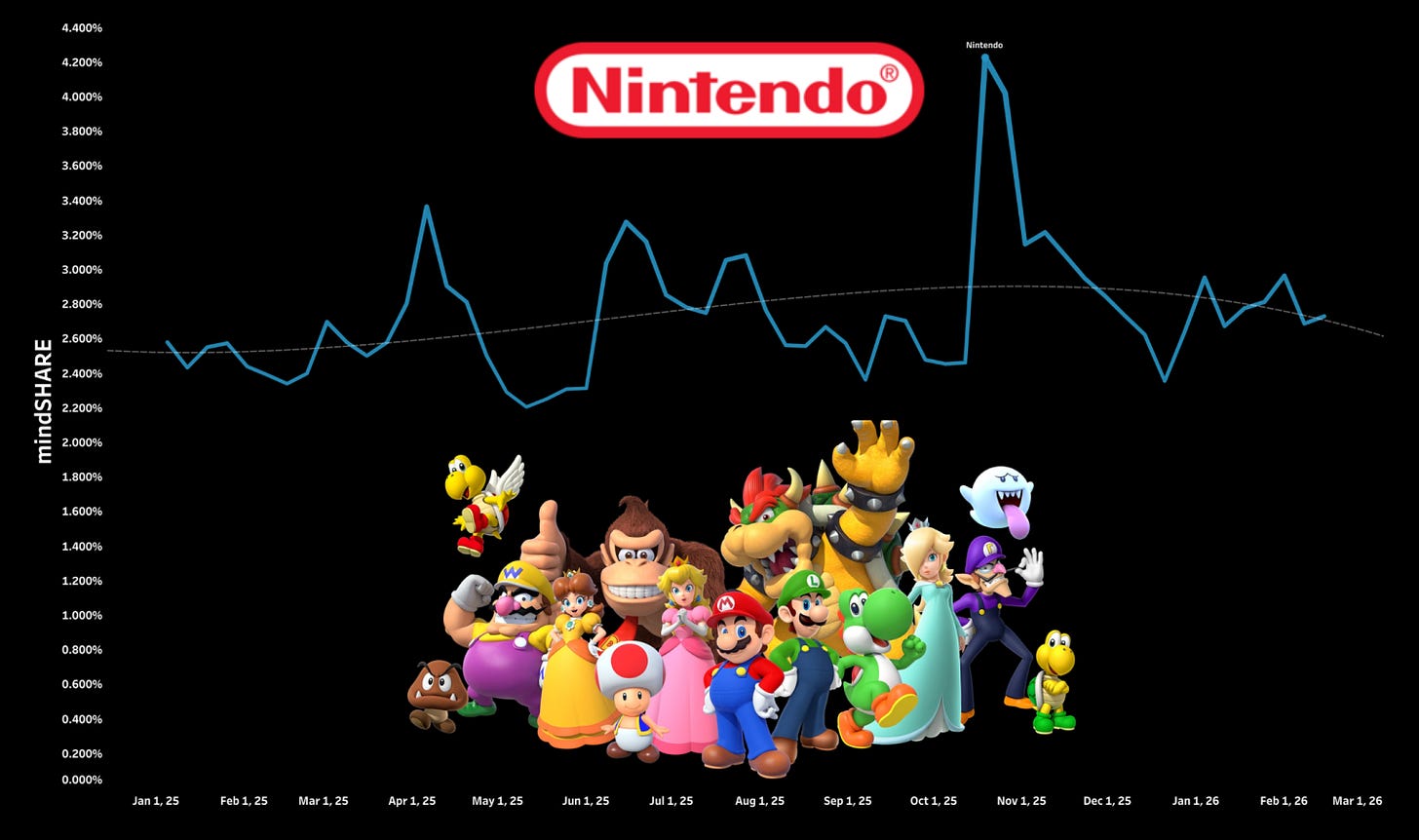

mindSHARE - Nintendo trending since 2025

I know, I know. I’ve written about Nintendo a lot. But Ball gave me an opening and I’m taking it, because what Nintendo is doing right now is the clearest possible counter to his thesis... and it keeps getting cleaner every quarter.

Free Fire wins the attention economy by being everywhere on one platform. Nintendo wins it by being everywhere in your life. Theme parks. Movies. Trading cards. Merchandise. Toys. The anime your kid has been watching since before they could hold a controller. These aren’t marketing tactics. They’re touch points. And every touch point pulls people back toward the games without Nintendo having to buy that attention outright.

That’s a fundamentally different strategy than anything else in this industry. And it’s why Nintendo keeps showing up in these conversations no matter how many times I promise myself I’ll move on.

I called Nintendo the winner of 2025 in my Game Awards piece, and the scoreboard case is pretty clean. Switch 2 was the most successful platform launch of the year. Mario Kart World, Donkey Kong: Bananza, Pokémon Legends: Z-A, Kirby Air Riders... the slate landed. When your floor is a B-tier franchise that still sells millions, you’re playing a different game than everyone else.

But the more interesting part of the story isn’t the hardware or the software. It’s the flywheel underneath all of it.

Nintendo x LEGO

The LEGO partnership is a good place to start because it’s been hiding in plain sight since 2020. Nintendo and LEGO announced their collaboration in March of that year, launching the interactive Super Mario play line alongside the NES collector set that August. What began as a COVID-era partnership has quietly become one of the most consistent, commercially durable brand relationships in gaming. Think about the breadth of what they’ve built together over five years... the interactive Mario play line where kids build levels and interact with QR-coded figures in real time, and on the adult collector side: the NES set where you “play” a Mario level inside the brick build, Bowser, Piranha Plant, the Mario 64 callback block, Mario Kart sets, and most recently the Game Boy, released October 2025.

These aren’t one-off licensing deals. This is a sustained, multi-year program that works because it serves two very different audiences simultaneously... kids who want to build and play, and adults who want a piece of nostalgia on their shelf. The LEGO x Nintendo adult line has been cracking that audience consistently and expanding it year over year. That’s not a happy accident.

And Nintendo isn’t doing this out of goodwill. LEGO pays licensing fees for every set that carries Nintendo IP. Nintendo collects that revenue while LEGO handles the manufacturing, the retail, and the distribution. The arrangement keeps renewing because both sides win... LEGO gets one of the most beloved game IPs on the planet, and Nintendo gets a physical touch point in toy aisles, living rooms, and Christmas wish lists around the world. That is a deliberate strategy to make the Nintendo brand present in spaces where a video game simply cannot go.

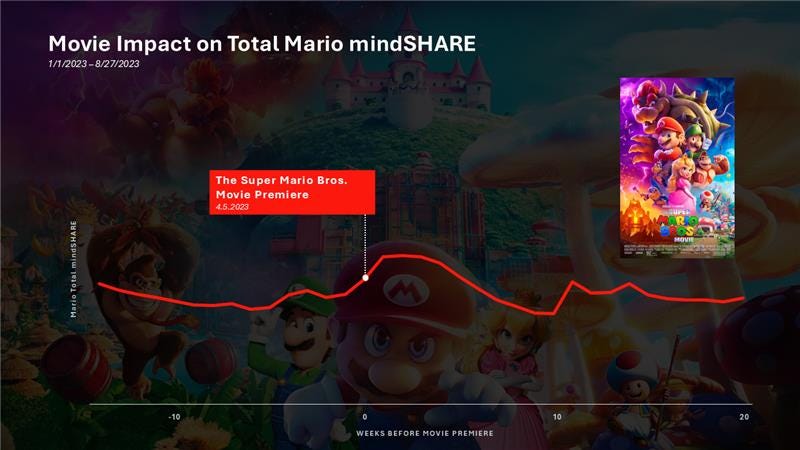

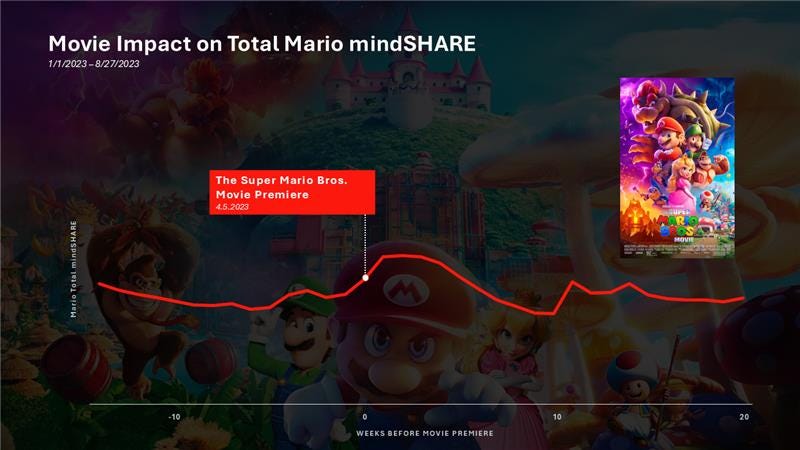

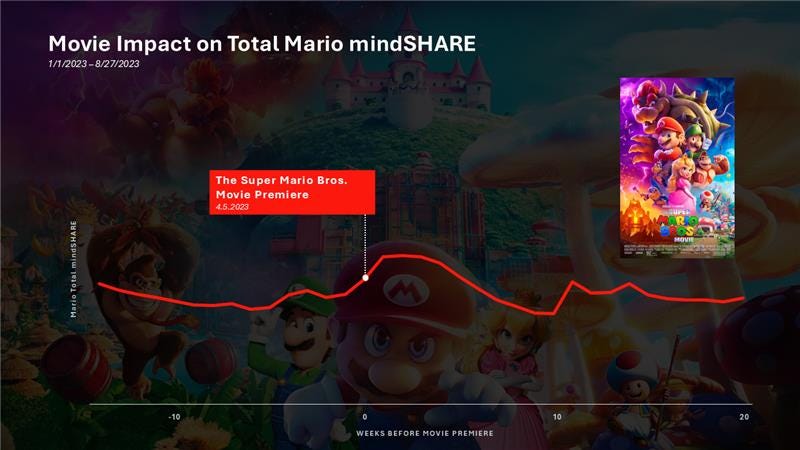

mindSHARE - The Super Mario Bros. Movie bump

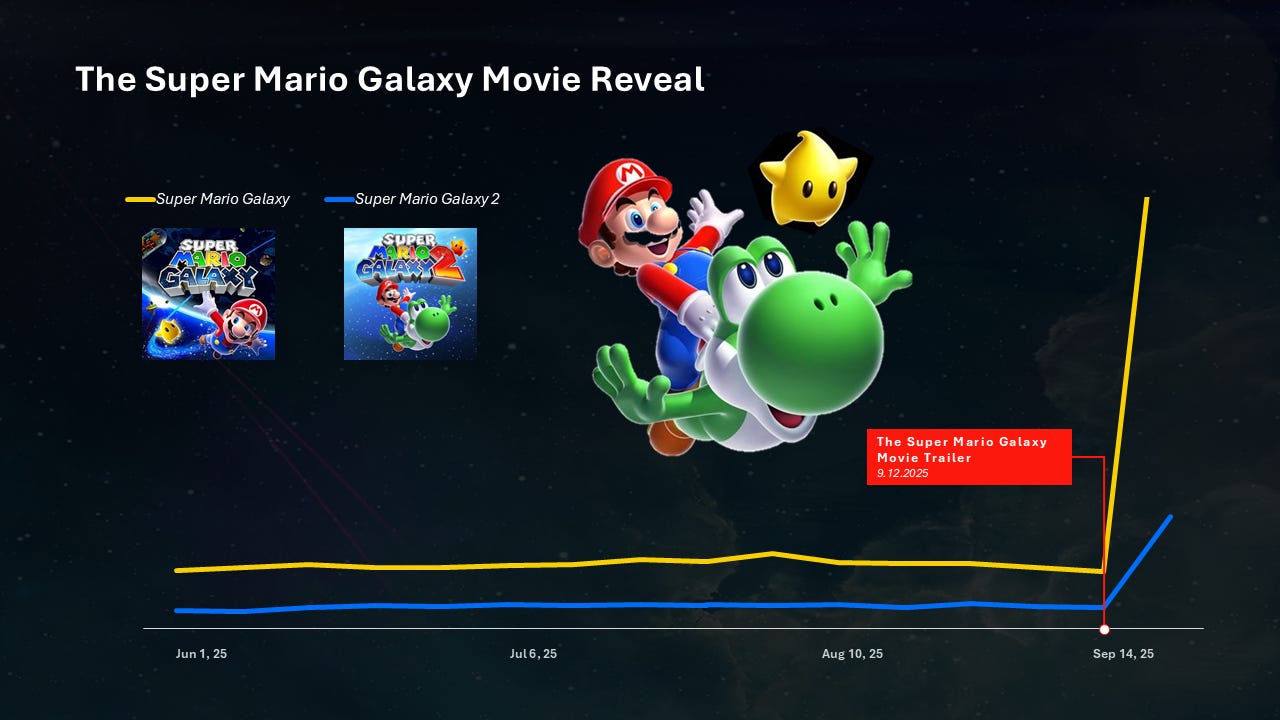

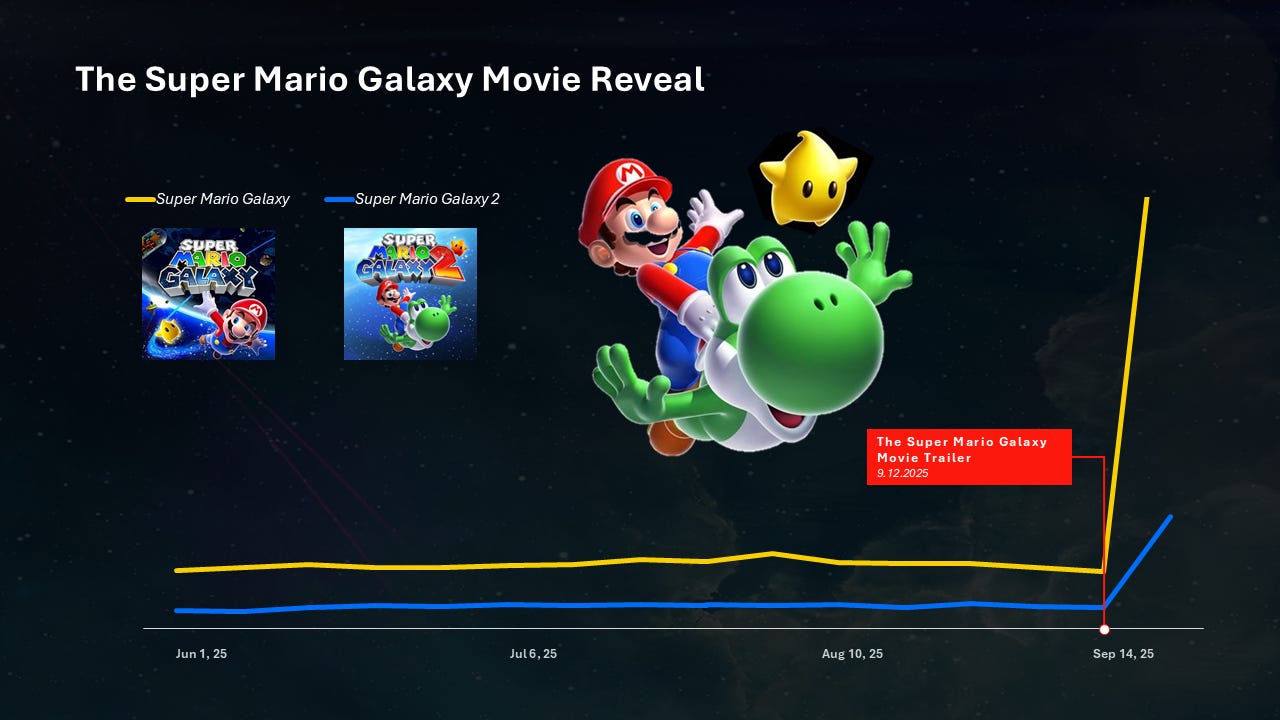

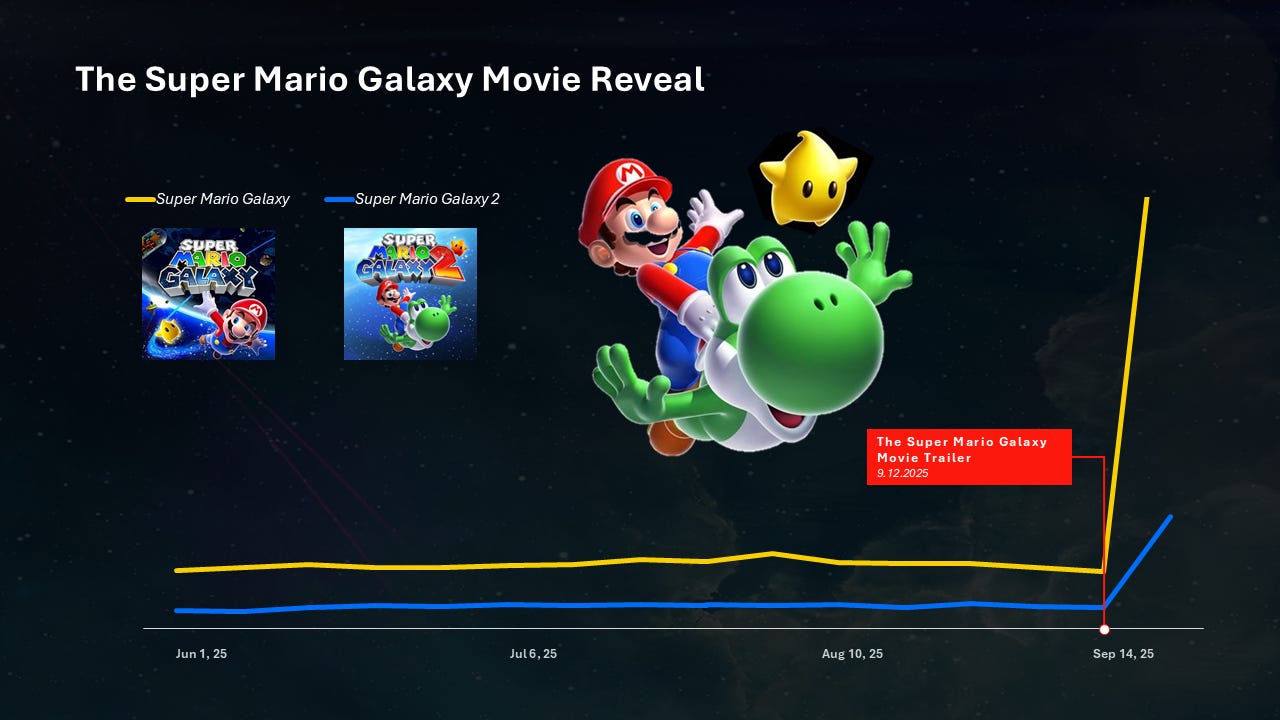

The Mario movie is the clearest proof of what the flywheel can do at full scale. The Super Mario Bros. Movie grossed over $1.36 billion worldwide in 2023, and the downstream lift to the game catalog was measurable... roughly 70% of the Mario catalog saw meaningful cumulative mindSHARE growth in the window after the film. That’s not marketing spend. That’s a content event creating organic demand across an entire portfolio. And now there’s a Super Mario Galaxy film coming, and the announcement alone generated extraordinary spikes... Galaxy mindSHARE up 927%, Galaxy 2 up 405%, search volume up over 1,200% in a single week. The flywheel catches every time.

Super Mario Galaxy movie reveal mindSHARE bump

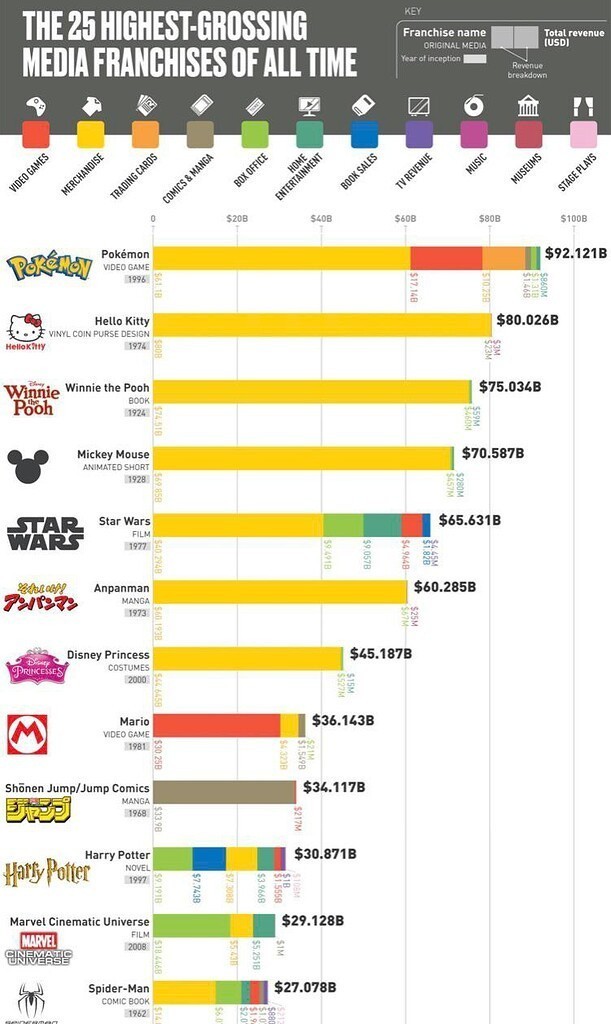

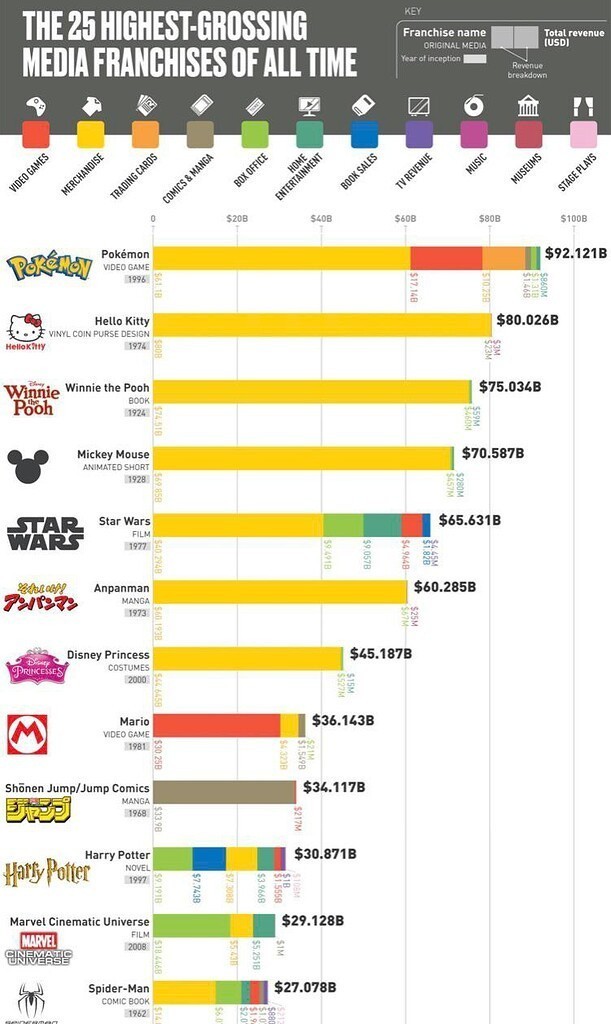

Then there’s Pokémon, which we wrote about extensively in the Adult Money piece... the five-headed machine of games, mobile, trading cards, film and TV, and merchandise, where each head feeds the others continuously. I won’t rehash all of it here. The short version is that Pokémon is the most extreme expression of everything Nintendo is doing with Mario, running across every medium simultaneously with no off switch. Pokémon GO has logged north of 22 billion lifetime TikTok views. The anime has never stopped airing since the late 90s. And in January 2026, Universal Studios and The Pokémon Company announced a global theme park expansion... starting at Universal Studios Japan for the franchise’s 30th anniversary, with explicit plans to scale across Universal’s international properties. This is not a limited-time overlay. This is Pokémon becoming a permanent pillar of one of the largest theme park ecosystems in the world.

Now here’s where I want to circle back to Ball’s thesis directly.

Ball’s argument is that gaming is losing time to ambient, multitaskable platforms. That the 18-to-34 demographic is drifting toward sports betting and TikTok and OnlyFans because those things don’t demand full presence. And he’s right that a lot of games are losing that fight.

Nintendo as a media franchise

But his framework measures the wrong thing when it comes to Nintendo. You can’t capture what Nintendo is doing by counting hours logged in Mario Kart. The value Nintendo is generating doesn’t live only inside the game client. It lives on the backpack your kid is carrying to school with Mario on it. It lives in the LEGO set on the shelf. It lives in the movie your family saw together last spring. It lives in the trading cards getting negotiated at the lunch table. It lives in the theme park ride you’re still talking about two years later.

Are those kids also playing Roblox when they get home? Sure. But they’re also deeply embedded in Nintendo IP across a dozen different touch points that have nothing to do with screen time. And that brand equity compounds. The kid with the Mario backpack today is more likely to want the Switch when they’re older. The parent who took their family to Super Nintendo World is more likely to buy the next Mario game. The adult who built the NES LEGO set is going to feel something when the next Nintendo Direct drops.

That’s the attention economy too. Ball is measuring one front of the war. Nintendo is fighting it everywhere.

The Black Hole: Winning The Attention War Without Playing

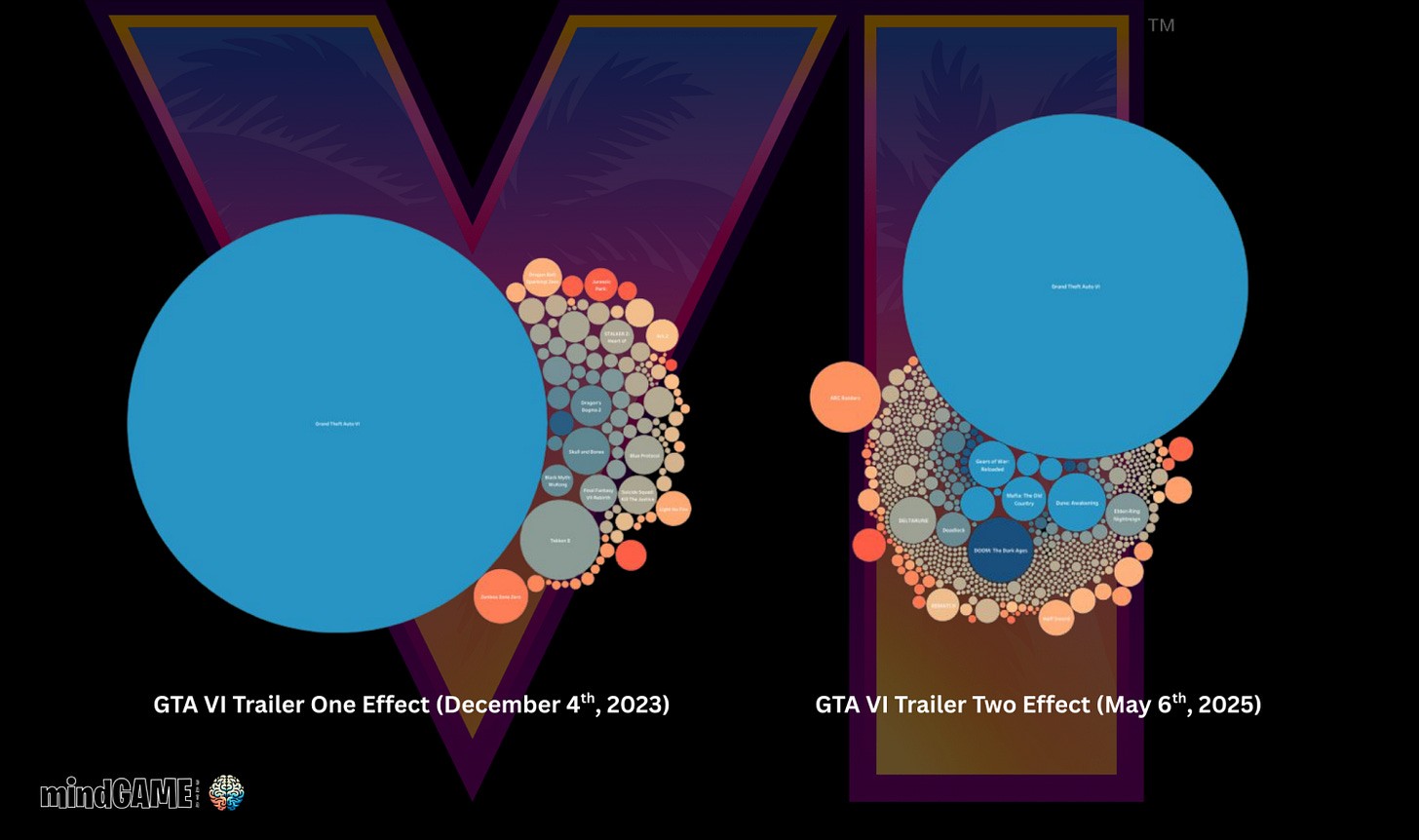

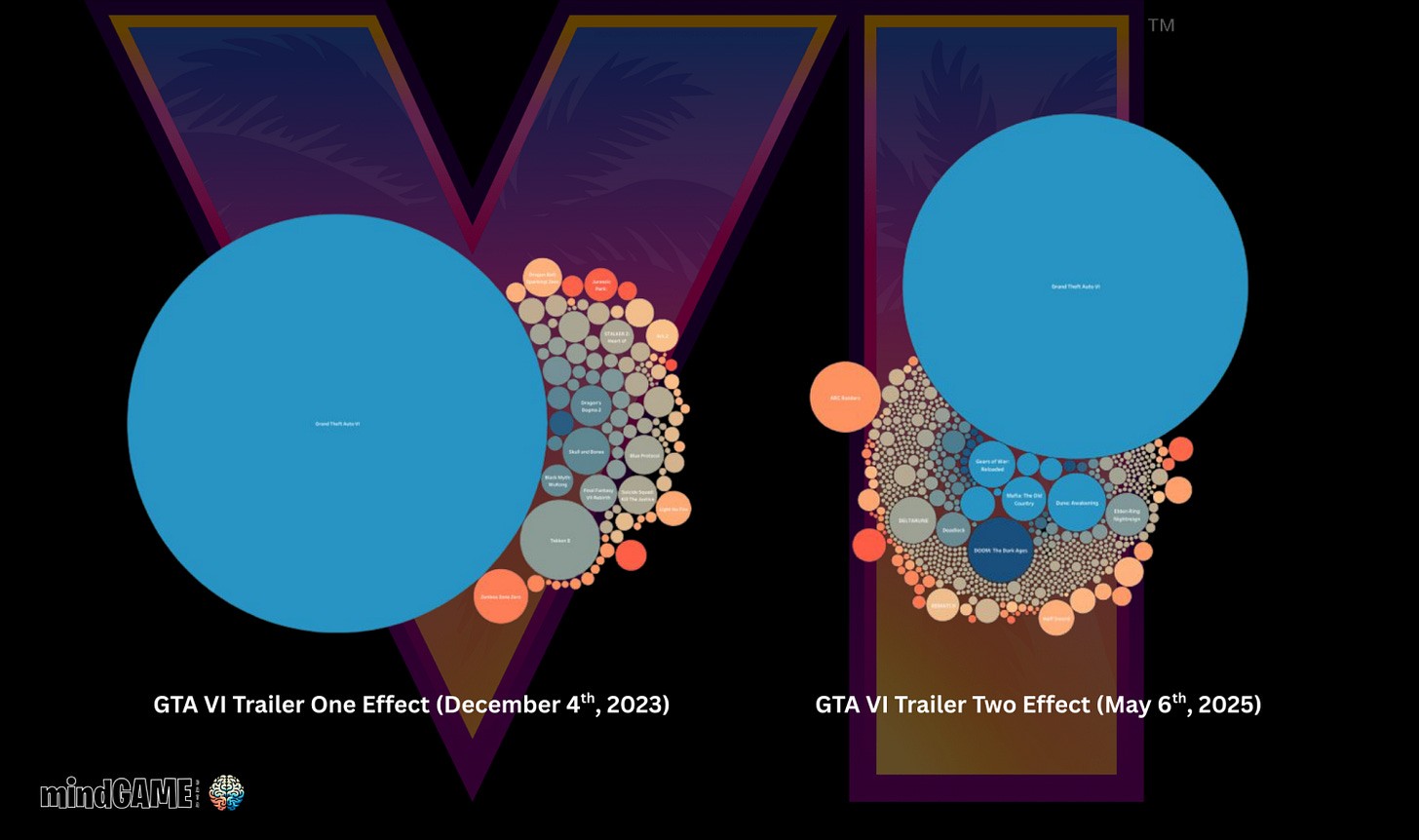

GTA IV Trailers = undefeated in sucking up all the market attention

Let me end with the most obvious example, and the one I think Ball would probably agree with too.

GTA VI.

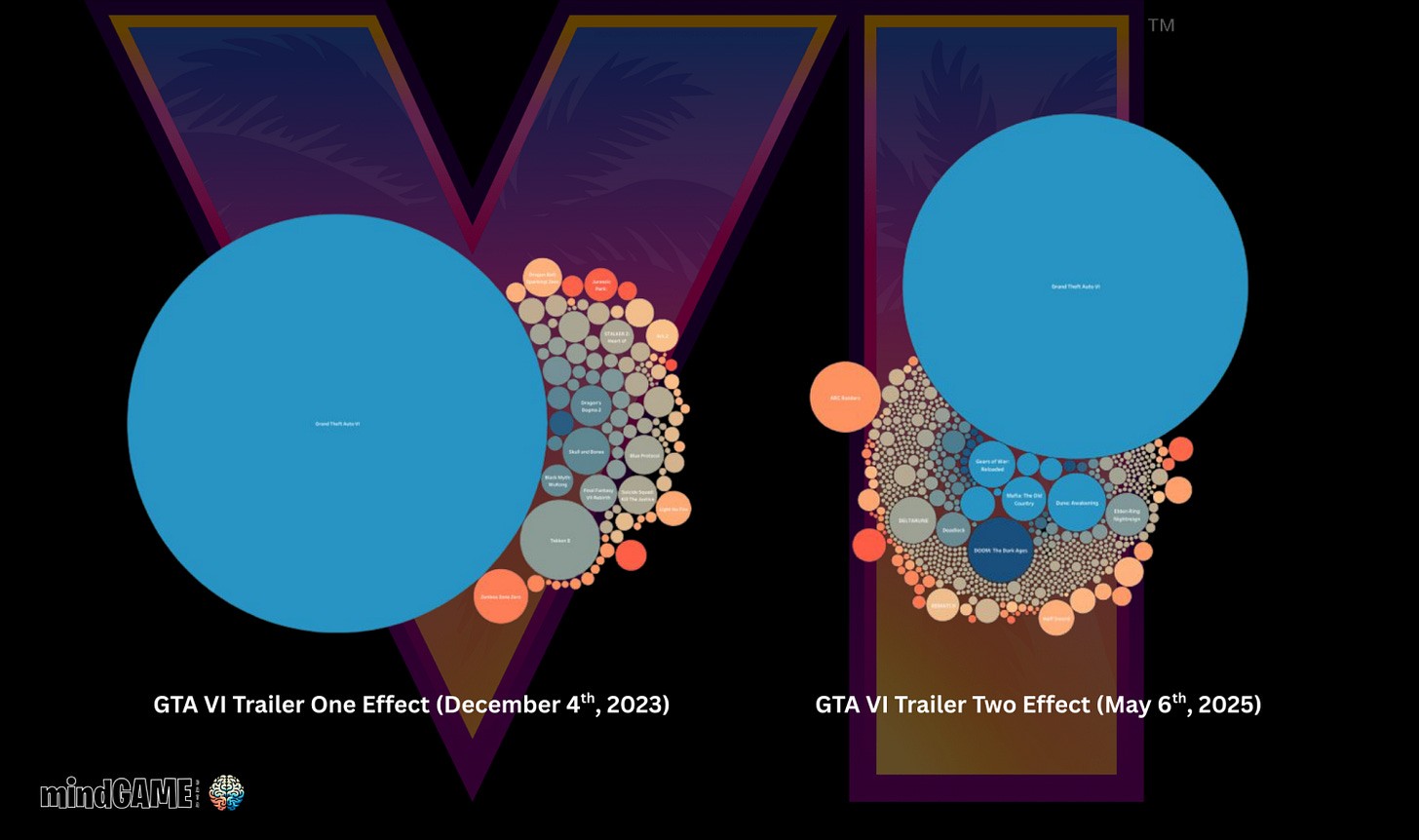

I’m not going to make the case for how big this game is going to be commercially. That argument makes itself. My point is different... it’s about what GTA VI is doing right now, before a single person has played it, with nothing in market beyond two trailers.

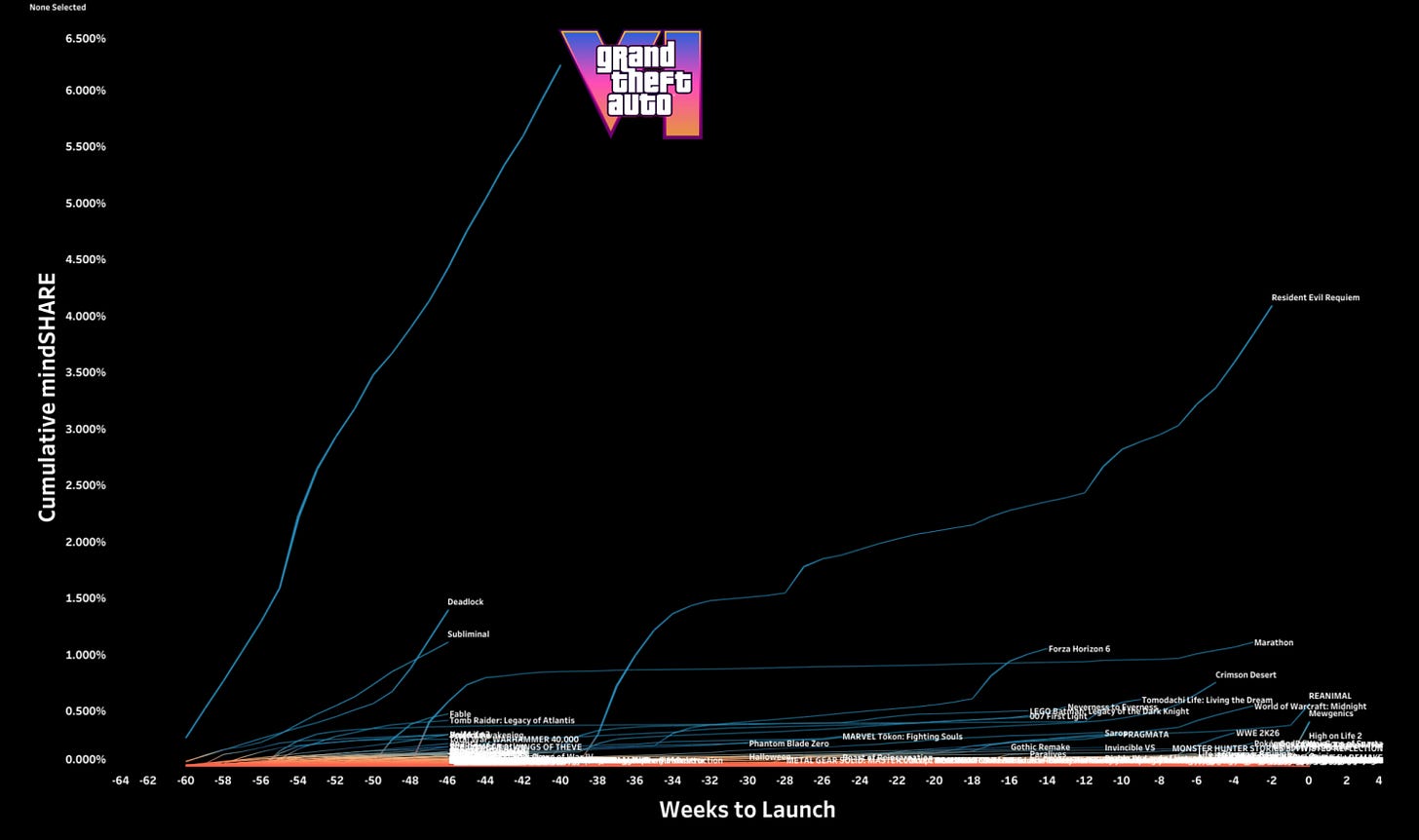

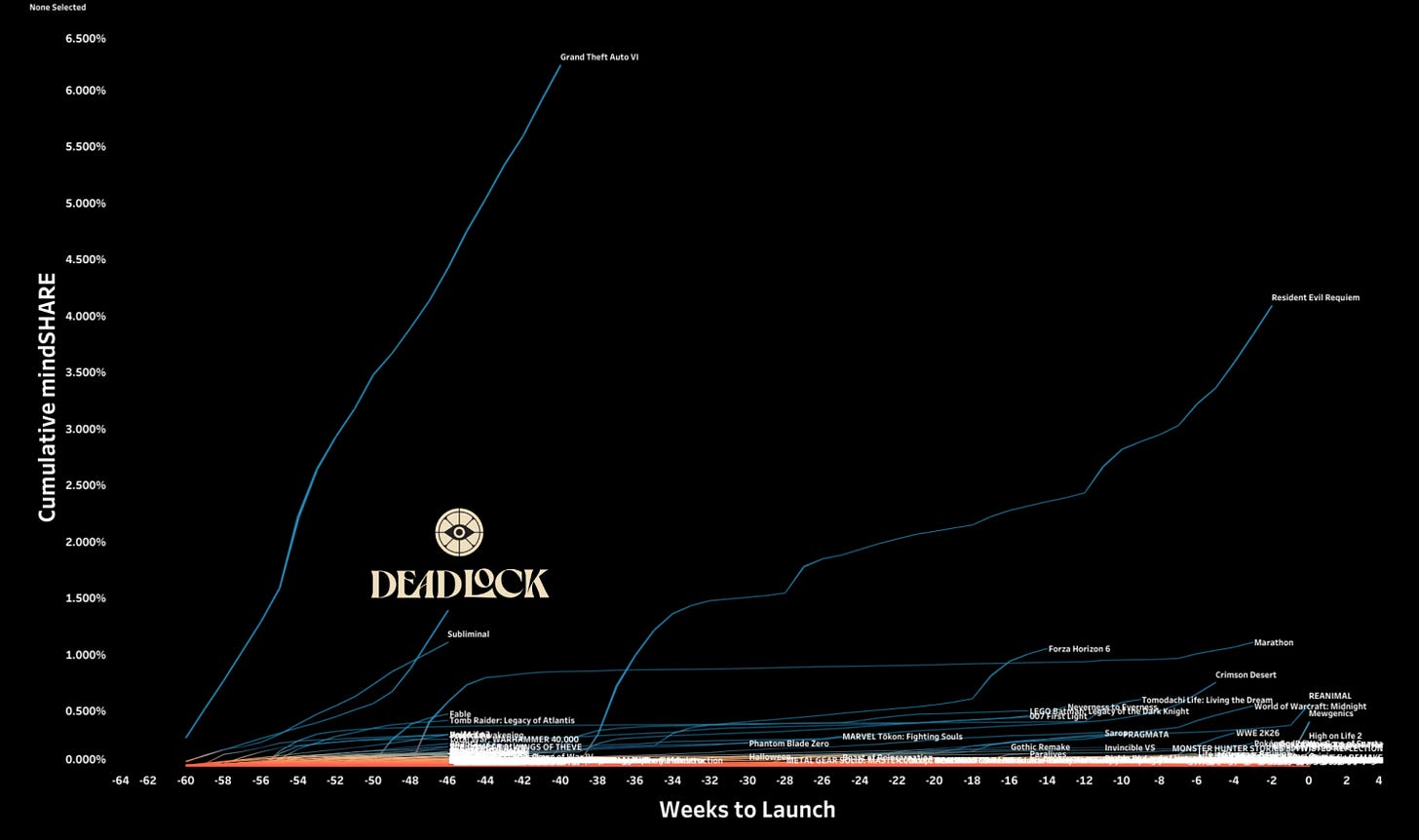

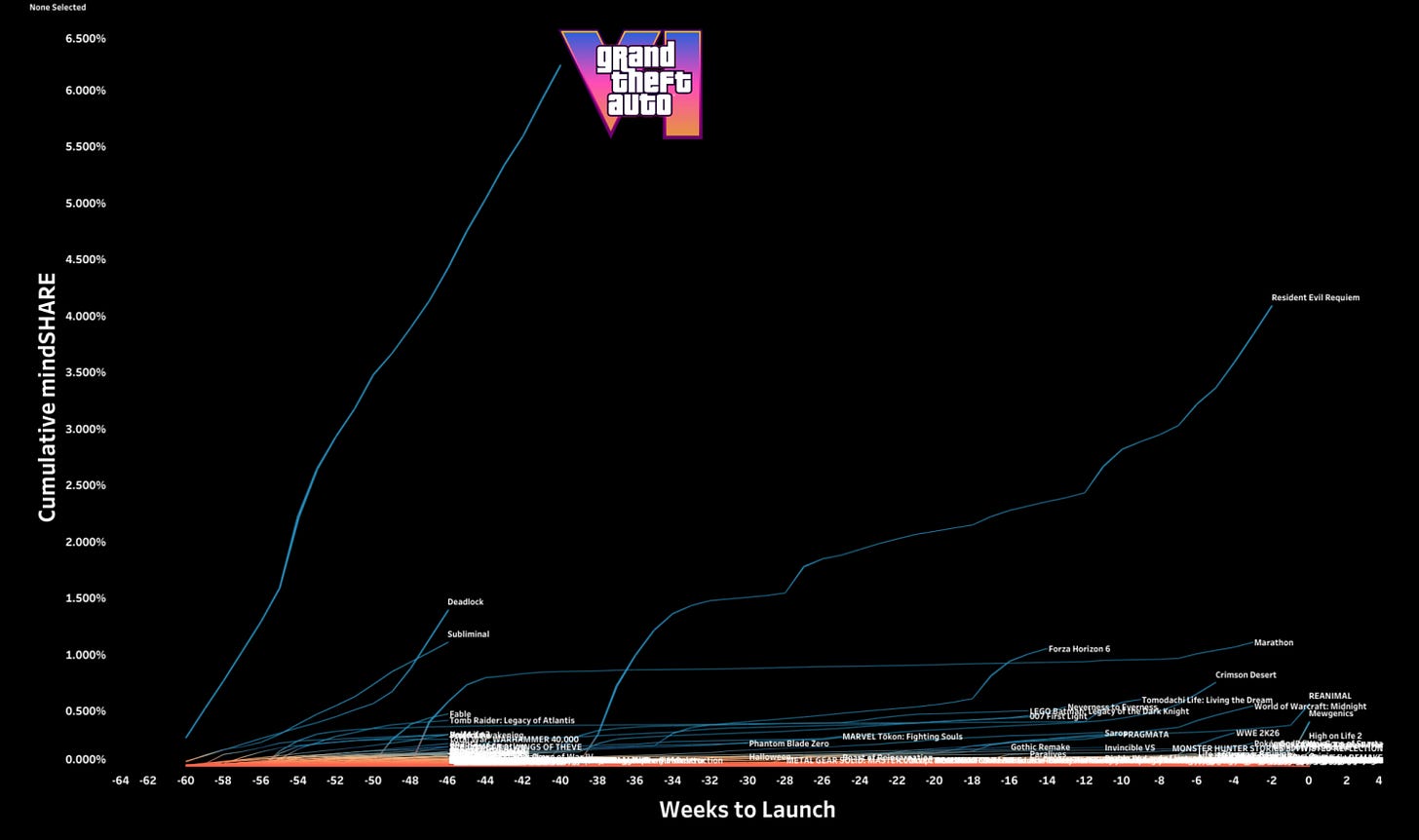

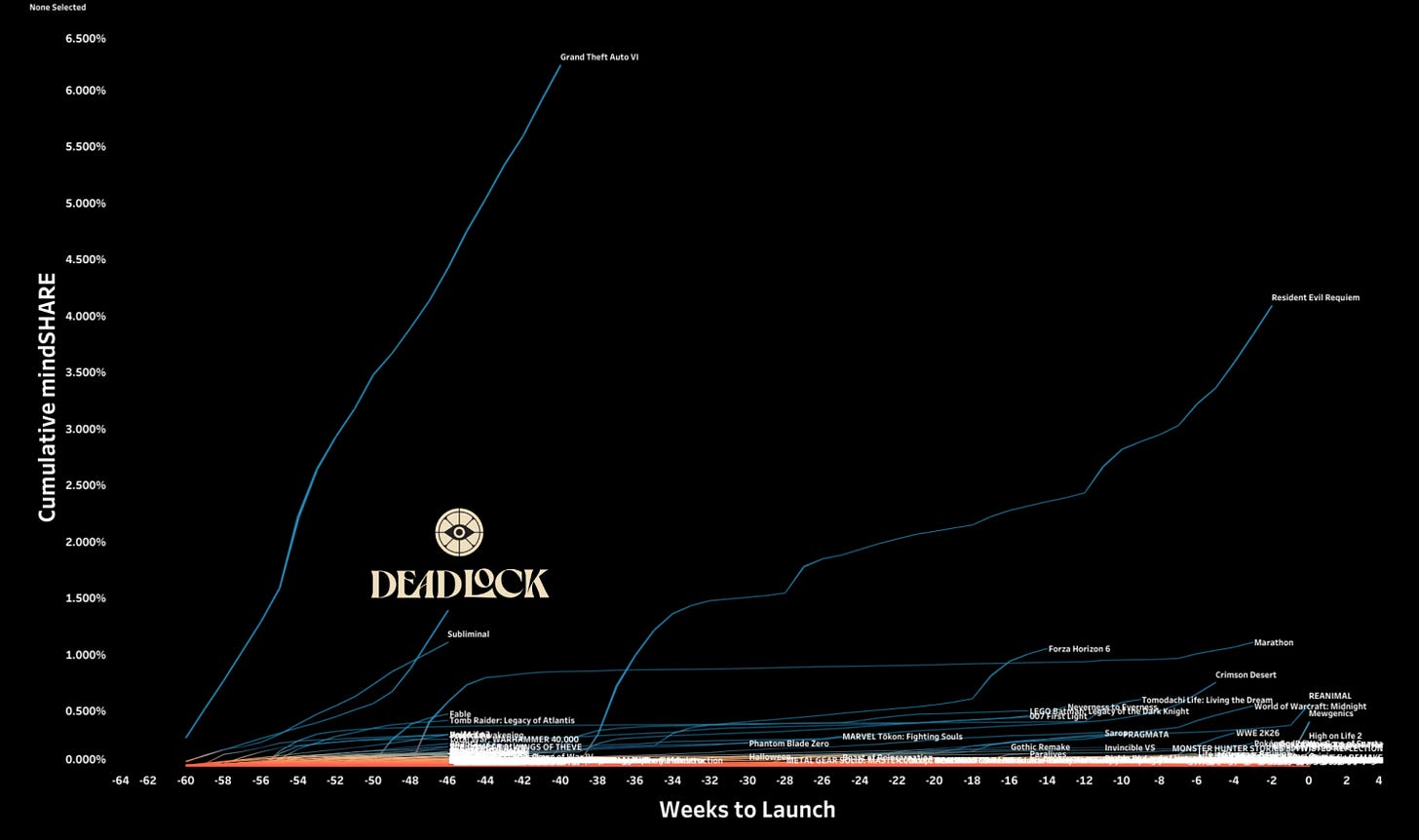

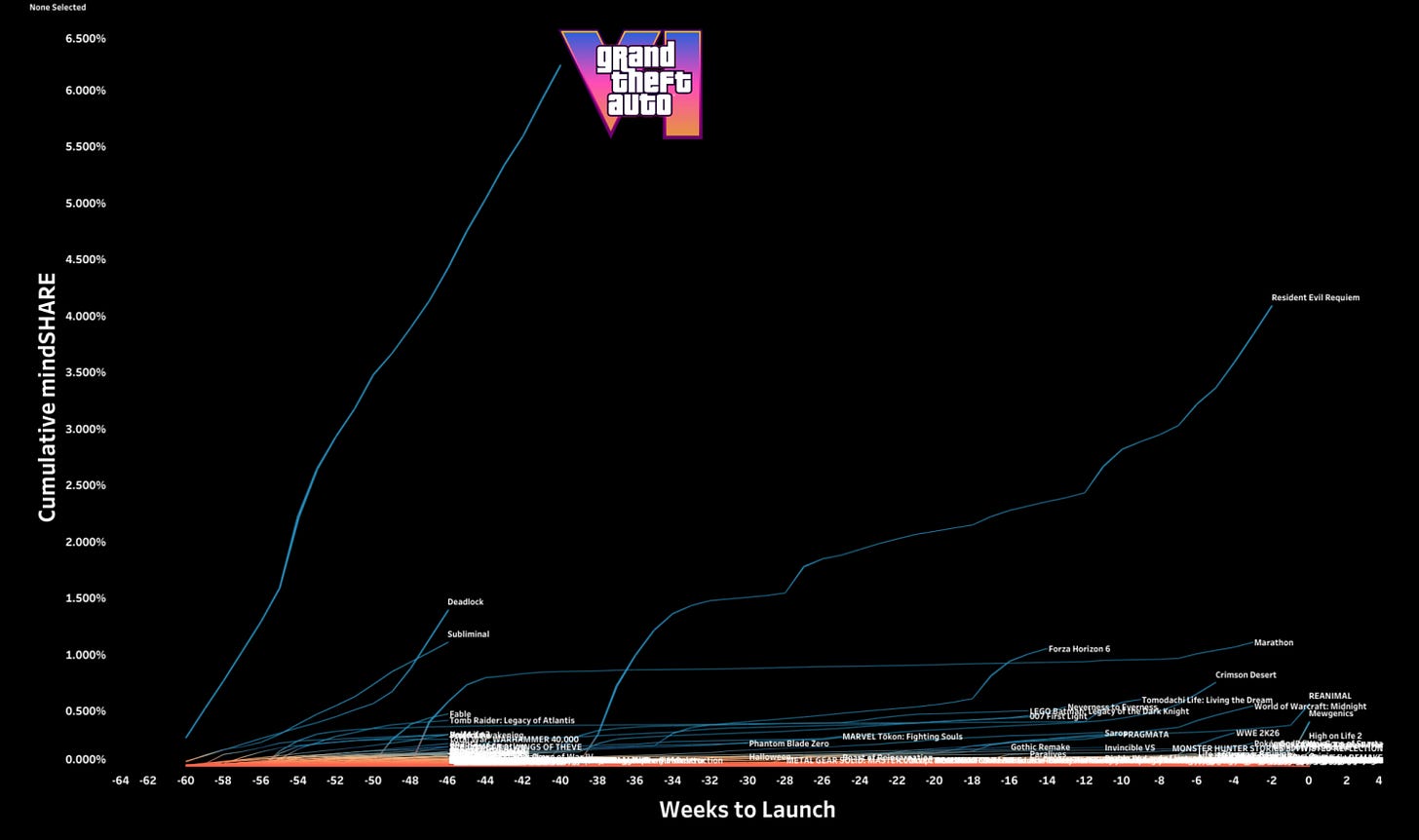

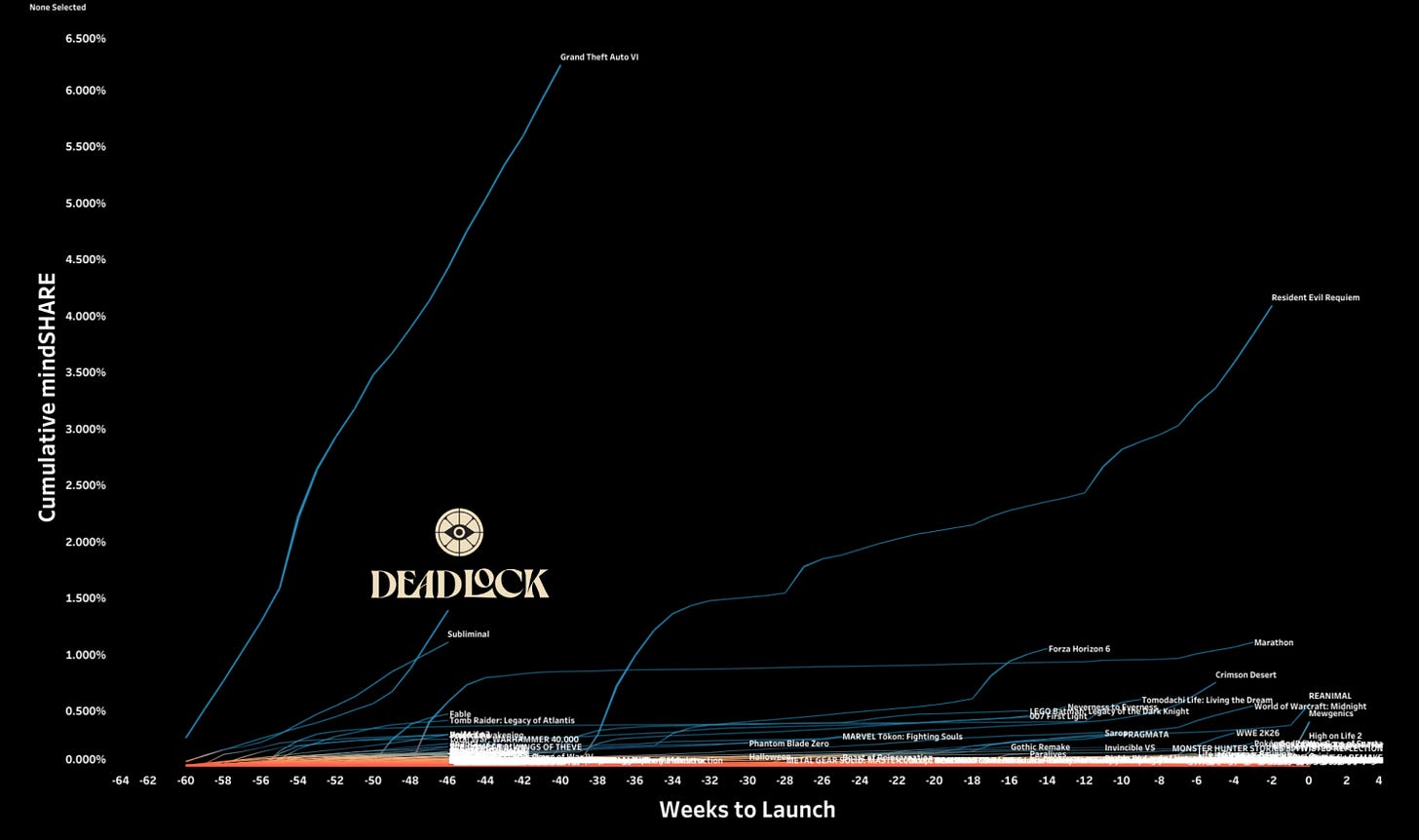

In our data, Rockstar Games‘ GTA VI carries a cumulative mindSHARE score of 6.2%. To put that in context... a successful game launch typically scores somewhere between 2% and 3%. Resident Evil Requiem, which is the biggest upcoming release of the first half of this year by a significant margin, and which has been in active, aggressive marketing since the Game Awards, sits at 4.085%. And Resident Evil is actively working for that number every week. GTA VI is doing nothing. Two trailers. That’s it. And it’s still winning.

GTA VI vs all other unreleased games FY 26

The search numbers illustrate the gap pretty clearly. GTA VI ranks #52 across all games in search with 1.7 million weekly search queries. It ranks #41 on YouTube despite the fact that Rockstar has produced essentially no active content for the game in months. It has no Twitch audience because there’s nothing to stream. And yet, across every signal we track, it just crushes everything else in market.

For contrast... Bungie‘s Marathon is trying to rebuild community attention right now, running activations, getting creators involved, had a notable streaming moment with TheBurntPeanut last week. Their community cumulative mindSHARE score sits at 1.1. Last week they ranked #308 in search, #313 in video, #206 in streaming. That’s not a knock on Marathon. That just illustrates what kind of gravitational force GTA VI is generating.

And then there’s TikTok, which is where the number gets genuinely absurd.

mindGAME - Top unreleased games by TikTok views

GTA VI has over 1.1 million videos on TikTok with over 36 billion lifetime views. Thirty-six billion. On a game that doesn’t exist yet. Based on two trailers.

The next closest unreleased game on TikTok is Deadlock from Valve, with roughly 97,000 videos and around 936 million views. That’s a real number for an unreleased game. It’s also not in the same timezone as GTA VI.

GTA VI got delayed on its own timeline, and Mandalorian and Grogu ended up being the beneficiary... they got a gift. A window they wouldn’t have had if Rockstar had shipped on the original schedule. That’s how much gravitational pull this game has. It warped the release calendar of a major Star Wars film just by moving. When GTA VI actually drops, I think it’s going to be a legitimate monocultural moment. Not just a big game launch. A gravitational event that pulls attention from everything around it.

GTA VI is the most extreme version of this, but it’s not the only one. There’s a broader pattern worth calling out: unreleased games winning the attention economy right now against titles that are actually in market.

Deadlock - Do not sleep on this game

Deadlock from Valve corporation is in early access... not even a full release... and it ranks #63 in overall search with around 1.3 million weekly queries. It sits at #86 on YouTube in a given week, fluctuating around that range. And it holds a top 20 to 25 position on Twitch consistently. That’s not a game that’s out. That’s a game winning the attention war via velvet rope... controlled access, word of mouth, the gravitational pull of people watching streams of something they can’t fully have yet. Different playbook than GTA VI’s silence, same outcome.

Playground Games‘ Forza Horizon 6 is another one worth noting. Cumulative mindSHARE of 1.05, which sounds modest until you remember it’s not out until May. It ranks #284 in search with close to 300,000 weekly queries, #254 on YouTube, and has 348 million lifetime TikTok views... #6 among all unreleased games on the platform. It’s also making a deliberate bet that matters in the context of Ball’s broader thesis: Forza is historically a western-dominant franchise, and this installment is leaning into an APAC setting centered on Japan. That’s not an accident. That’s a franchise actively pursuing the international audiences Ball identifies as the only growth story in this industry right now.

The throughline across all three... GTA VI, Deadlock, Forza Horizon 6... is that you do not have to be a fully playable, fully released game to win the attention economy. You can win it on hype. On access. On anticipation. On being the thing people are excited to play, or watching others play, or just talking about because the cultural momentum is already there. These games are beating titles that are in market right now. Active, released, marketed games. And they’re doing it while people are still waiting.

That’s the attention war too. And they’re winning it.

So Where Does That Leave Us?

Forza... I just wanted to share a image of good looking cars

Am I cherry-picking here? One could argue that. I’m not going to pretend I went looking for the failures.

But that’s sort of the point. I went looking for games that are defying the narrative... and I found them. Not obscure edge cases, not niche exceptions. The third largest game in the world. The most valuable entertainment IP on the planet. The most anticipated unreleased title in recent memory. Games not even fully out yet that are beating things that are. These are not accidents. These are teams that understood what war they were actually in and fought it accordingly.

Ball is one of the sharpest thinkers writing about this industry and this report genuinely got under my skin in the best way. I’ve read the deck four times. His core observation is real... a lot of games are losing the attention war, including big ones from publishers with the resources and data to know better. The structural forces he’s describing are not going away.

But the conclusion I’d push back on is that this means the industry is faltering. It doesn’t. It means there’s a learning curve. A significant one. And the gap between the studios that have figured it out and the ones still running 2015 playbooks is only getting wider.

The Attention Funnel

Here’s the framing I keep coming back to when I talk to gaming companies... attention earns time. Time earns money. That’s the funnel. If your IP can’t hold attention, you don’t get the hours, and if you don’t get the hours, you don’t get the revenue. Everything downstream flows from that first beat. And the studios that have internalized that aren’t treating TikTok or YouTube or any of these platforms as threats to survive. They’re treating them as distribution channels to exploit. Because that’s what they are.

Free Fire didn’t survive TikTok. It weaponized TikTok. Nintendo isn’t competing with ambient entertainment. It is ambient entertainment. GTA VI isn’t fighting for attention in a crowded market. It has so thoroughly colonized the cultural imagination that other games and major film releases are planning their windows around it. The takeaway isn’t that hype is magic. It’s that when you’ve actually earned it... through years of community building, through transmedia investment, through understanding where your audience lives and speaking to them there... hype is the most powerful distribution tool in existence.

Ball’s data captures the studios that haven’t figured any of this out yet. And there are a lot of them.

But there are also studios that have. And they’re not losing anything.

A few quick things before we get into it.

First, for those of you finding this via Substack... welcome. I also do a lot of content on LinkedIn.. follow me here

Second, GDC is coming up fast and honestly my calendar is already a bit of a disaster. If you’re going to be in San Francisco and want to grab coffee, lunch, a drink, or just talk shop... attention economy, mindGAME Data, what we have cooking for the rest of the year... hit me up. Wednesday and Thursday are my most open days right now. DM me and we’ll make something work.

GDC Calendly: https://calendly.com/colan_screenengine/in-person-coffee

Arknights: Endfield - Launch

Third, quick shoutout to my team. We just wrapped a case study on the Arknights Endfield launch... specifically how their marketing strategy actually managed to break through the attention economy and turn into a real hit, all things considered. If you want a copy, it’s free.

Password: X0YJg170jPrM

Okay. On to the thing I literally could not stop thinking about this week.

I was originally going to go deep on the Sony PlayStation catalog this week. Had my notes, had my angle, had the data queued up. And then Matthew Ball dropped his 164-slide State of Video Gaming report and... yeah, that went out the window pretty fast.

I always find Ball’s work genuinely interesting, even when I don’t fully agree with where he lands. And this year, there’s one specific thing he said that I haven’t been able to shake. His framing is that gaming is losing the attention economy. Not to a better game. Not to a better platform. To everything else. TikTok. Sports betting. Crypto. OnlyFans. Prediction markets. The argument is that all of these have quietly moved into the same psychological territory that games used to own, and they’re winning.

I both agree and disagree with that. And I want to be fair to his case before I get into my own thinking, because the data he’s working with is real, and the trend he’s identifying is real. Where I start to push back is on the conclusion.

Data is data.. but what this marco picture misses are clear winners and losers

Because when Ball says gaming is losing the attention war... I think the more precise thing to say is that some games are losing it. A lot of games, actually. Big ones. Publishers that genuinely should know better. But other games are not losing it at all. Other games are winning it decisively, and they’re doing it because they understand what war they’re actually in.

That’s the gap I keep running into in conversations, whether I’m talking to a big publisher or a small indie team. There’s still a widespread assumption that if you build something good, people will find it. Or that the marketing tactics from 2015 are going to generate the same ROI in 2026. They won’t. The war has changed, the economy has changed, the way you earn attention has completely changed. And the studios that haven’t internalized that yet are the ones showing up in Ball’s data as casualties.

I’ve written about this a few times now. In “Content Is Discovery” I made the case that the biggest games in the world aren’t just competing in the attention economy... they’re feeding it. And in the Highguard piece and Microsoft piece, you can see exactly what it looks like when teams either don’t understand the war they’re in or fundamentally misread the playbook.

So let’s do this in two parts. First, I want to lay out Ball’s case as cleanly as I can, pulling from his conversations with Ben Thompson at Stratechery and Christopher Dring at The Game Business. Then I’ll get into my perspective... which is that the games winning the attention economy right now aren’t winning despite the current environment. They’re winning because they figured out what game is actually being played.

Ball’s Case: Gaming Is Losing The Attention War

Ball making the case

Ball has been building toward this argument for a couple of years now, but this year he sharpened it. The headline, delivered pretty plainly in his interview with Christopher Dring at The Game Business:

“Video gaming has been a loser in the attention wars over the last half decade.”

Matthew Ball, The Game Business, February 2026

That’s a jarring thing to read in a year when the industry just hit an all-time revenue high. But Ball’s argument isn’t really about revenue, at least not at first. It’s about time. And specifically about where the time of the demographic that built this industry is actually going.

The core of his case is that the attention economy restructured pretty significantly after 2019, and gaming, particularly in the mature markets that built the industry, ended up on the wrong side of that. The competition didn’t show up with better games. It showed up with better hooks.

The “bad” guys to gaming.

TikTok. Sports betting. OnlyFans. Crypto. Prediction markets. On paper none of these look like they’re competing with a 60-hour RPG or a ranked shooter. But Ball’s point is that they’re all fishing from the same pool... 18-to-34-year-old men, the exact demographic that has driven PC and console spending for two decades. And these alternatives don’t just steal time. They steal it more efficiently, because they’re engineered for a world where attention is fractured and multitasking is the default.

He put the structural problem plainly in his conversation with Ben Thompson at Stratechery:

“One of the things that I hear a lot from the ecosystem now is that what we often believed was one of the unique strengths of the industry, massive attention, singular attention, is in many ways the Achilles heel, because when you take a look at the time of use, you say Americans engage with 30 hours of content per day, and that’s because we’re multitasking. The one challenge here is I can be on TikTok and Twitter and Polymarket while watching television, but I can’t actually have both hands on controller in a live multiplayer match while multitasking.”

Matthew Ball, Stratechery, February 2026

That’s the whole structural problem in one paragraph. Gaming almost uniquely demands full presence. Both hands on the controller. Active decision-making. Real-time response. And in a world where every other form of entertainment has figured out how to stack... that full-presence requirement has quietly become a liability.

A chart I never thought I would see or share.

The competing platforms aren’t subtle about it either. Ball’s data on the alternatives is pretty striking. Online sports betting generated roughly $17 billion in net losses across 35 states last year. iGaming hit $11 billion, and that’s only legal in seven states. OnlyFans has around 12 million American users spending $5 billion annually, roughly half of them in that 18-to-34 male bracket. These aren’t fringe behaviors anymore. They’re mainstream. And they’re all engineered around the same psychological triggers games used to own almost exclusively... progression, risk, social signaling, the feedback loop that tells you you’re winning.

The part that makes this uncomfortable to wave away is the multitasking angle. Sports betting gives you a live stake in something that just runs in the background. Crypto gives you a ticker you can check between meetings. Prediction markets give you the feeling of applying skill to real-world outcomes without ever having to clear your schedule. These things don’t ask you to commit. They’re ambient. They travel with you. And when they interrupt a game session... the interruption wins.

Ball put it bluntly to Thompson:

“It could just be you just lost 100 bucks, it could just mean you won 1,000 bucks, or it can be the OnlyFans star that you subscribe just told you a new pay-per-view video is available. Guess what? A lot of those people are gone, and they can multitask in other ways, but not that.”

That’s the threat in one sentence. It’s not that games got worse. It’s that the cost of demanding full presence in a fractured world keeps going up.

And Ball isn’t wrong about the underlying numbers. The Major Market 8... US, UK, Germany, Japan, Korea, France, Italy, Canada... have been flat for five years. The 18-to-34 core is measurably pulling back. The structural forces are real, and they’re not going away.

Scary... without context

Where I start to push back is on what all of that actually means for the games that are winning right now. Because Ball’s framing, taken literally, would suggest the industry is basically in a defensive crouch with limited options. And I just don’t think that’s what the data shows when you look at the right titles.

Some games aren’t losing the attention war at all. Some games winning the war and are dominating all forms of entertianment in the process.

And that’s where we’re going next.

Some Games Don’t Compete For Attention. They Generate It.

All this chart tells me is the death of Twitch / Livestreaming.. which I agree with.. but that is a Twitch problem.

Ball’s attention economy argument is directionally right. The war is real. The competition is real. The structural disadvantage of demanding full presence in a multitasking world is real.

But there’s a version of his argument that I keep tripping over, which is the implication that all games are fighting the same losing battle. Because when you actually look at the games sitting at the very top of the attention economy right now... some of them aren’t losing to TikTok at all. Some of them own TikTok. And some of them have built content universes so large they don’t compete with the platforms Ball cites as threats. They use them.

mindGAME Data - Top 24 games, sorted by video views, across the history of TikTok

The games that figured this out aren’t treating content platforms as competitors. They’re treating them as the product.

There are different ways to win that war. Short form video. Transmedia. And then there’s a third category that doesn’t get talked about enough... games that haven’t even launched yet, winning the attention economy on pure cultural gravity, beating fully released and actively marketed titles while people are still waiting to play them.

Fallout - clear winner of the transmedia era

At the macro level, yes... most games are losing. This is a winner-take-most environment, and the volume of releases every year means the vast majority are invisible from day one. Ball’s data captures that accurately. But the reason most games are losing isn’t because TikTok and sports betting are inherently unbeatable. It’s because most studios don’t understand the war they’re in. They’re marketing like it’s 2015. They’re assuming that if they build something good, the audience will find it. They’re playing by rules that stopped working years ago.

The games winning right now figured out something different. Let’s look at a few of them.

Short Form Video: Garena Free Fire And The Flood The Zone Playbook

Free Fire - the biggest game that is unknown in the west

If you’re a Western gaming industry reader, Free Fire might not be on your radar. It doesn’t dominate U.S. charts. It doesn’t get talked about at GDC. It’s not in the conversation at most Western publisher strategy meetings.

And yet, by every meaningful attention metric we track at mindGAME Data, Garena Free Fire is the third largest game in the world.

Not third among mobile games. Third among everything... console, PC, mobile, browser. Consistently, week over week, sitting at roughly 4% global cumulative mindSHARE, behind only Roblox and Minecraft. Its peers aren’t Valorant or Call of Duty. Its peers are the two games that basically invented the concept of a platform-scale game ecosystem.

mindSHARE - Free Fire is #3 world wide

A quick background for context. Free Fire launched in 2017, built by Vietnam’s 111 Dots Studio and published by Garena out of Singapore. It’s a mobile battle royale, optimized from day one for the phones people in emerging markets actually owned... short 10-minute matches, lightweight client, runs on almost anything. It spread fast through Southeast Asia and Latin America, then South Asia, then MENA and Africa. It never needed the West to become what it is.

Ball actually cites Free Fire in his report, which is worth noting. He acknowledges the scale... roughly 650 million quarterly players generating around $3 billion annually... but contextualizes the audience as “less viable.” Lower ARPU, non-Western, outside the demographic Western publishers prioritize. The average user pays roughly 40 cents a month. And if you’re only looking at the revenue line, that framing makes some sense.

650 million quarterly players... not bad

But here’s what 650 million quarterly players and 40 cents a month actually produces on TikTok.

Free Fire currently has 1.324 trillion lifetime views on TikTok. That’s not a typo. One point three two four trillion. It is the number two game in the history of the platform, just behind Roblox, and it got there with over 100 million videos of Free Fire content... the most of any game ever created on TikTok. For reference, Fortnite sits at roughly 850 billion lifetime TikTok views across 70 million videos. Minecraft is in the same ballpark with 30 million videos of its own. Free Fire has 1.3 trillion views and over 100 million videos. It's not close.

Ball calls TikTok one of the primary platforms stealing attention from games. Free Fire turned TikTok into its single biggest customer acquisition channel.

mindGAME - Free Fire vs Fortnite = TikTok total views

The way they did it is worth understanding because it’s deliberate and replicable. Free Fire doesn’t run a single global TikTok channel. It runs hyper-localized regional channels... Brazil, MENA, Vietnam, India, and more... each producing content that is in-language, in-culture, and tuned to the specific meme vocabulary of that market. They’re not translating content. They’re building local content machines that generate a constant, high-volume stream of material for each regional audience to consume and share. Gameplay clips, yes. But also memes, trends, challenges, cultural moments. Content that lives and spreads whether or not the person watching has ever downloaded the game.

They’re flooding the zone. And they’re not the only game doing it... Block Blast, a Tetris-like mobile game, runs the same playbook, producing everything from gameplay footage to pure meme content that uses the game as backdrop. The goal is volume and variety, training the algorithm to find them, and making sure that when any version of their content goes viral, the brand is on it. The result is a game that is culturally present far beyond its actual player count.

Ball frames TikTok as the bad guy... its not... its critical to discovery

That last part is the key insight that Ball’s framing misses. A Free Fire TikTok view from someone who will never install the game still has value. It keeps the brand present. It keeps the IP visible. From a pure monetization standpoint, yes, that value is flowing to TikTok more than to Garena. But from an IP valuation standpoint, from a fandom-building standpoint, from a next-generation player acquisition standpoint... they are winning. They are generating more interest, more awareness, more cultural presence than games spending orders of magnitude more on paid acquisition.

In our data, Free Fire ranks #4 globally in search with around 9.3 million weekly queries, and consistently holds the top one to three spots on YouTube week over week. Its Twitch presence is essentially zero, which would be a red flag for almost any other shooter. For Free Fire it’s irrelevant, because Twitch doesn’t exist at meaningful scale in the markets where Free Fire lives. The platforms that matter for their audience, they dominate. Not by accident. By design.

Free Fire - dominate across all non-major markets

I wrote about this in detail in the Free Fire TikTok Flywheel piece from last August. The short version is that Free Fire is proof that the content-as-discovery model works at the highest possible scale. You don’t need to outspend your competitors on paid acquisition if your community and your owned channels are generating an inexhaustible supply of organic inventory. You just need to build the machine. And then run it everywhere.

Transmedia: Nintendo And The Flywheel That Keeps Compounding

mindSHARE - Nintendo trending since 2025

I know, I know. I’ve written about Nintendo a lot. But Ball gave me an opening and I’m taking it, because what Nintendo is doing right now is the clearest possible counter to his thesis... and it keeps getting cleaner every quarter.

Free Fire wins the attention economy by being everywhere on one platform. Nintendo wins it by being everywhere in your life. Theme parks. Movies. Trading cards. Merchandise. Toys. The anime your kid has been watching since before they could hold a controller. These aren’t marketing tactics. They’re touch points. And every touch point pulls people back toward the games without Nintendo having to buy that attention outright.

That’s a fundamentally different strategy than anything else in this industry. And it’s why Nintendo keeps showing up in these conversations no matter how many times I promise myself I’ll move on.

I called Nintendo the winner of 2025 in my Game Awards piece, and the scoreboard case is pretty clean. Switch 2 was the most successful platform launch of the year. Mario Kart World, Donkey Kong: Bananza, Pokémon Legends: Z-A, Kirby Air Riders... the slate landed. When your floor is a B-tier franchise that still sells millions, you’re playing a different game than everyone else.

But the more interesting part of the story isn’t the hardware or the software. It’s the flywheel underneath all of it.

Nintendo x LEGO

The LEGO partnership is a good place to start because it’s been hiding in plain sight since 2020. Nintendo and LEGO announced their collaboration in March of that year, launching the interactive Super Mario play line alongside the NES collector set that August. What began as a COVID-era partnership has quietly become one of the most consistent, commercially durable brand relationships in gaming. Think about the breadth of what they’ve built together over five years... the interactive Mario play line where kids build levels and interact with QR-coded figures in real time, and on the adult collector side: the NES set where you “play” a Mario level inside the brick build, Bowser, Piranha Plant, the Mario 64 callback block, Mario Kart sets, and most recently the Game Boy, released October 2025.

These aren’t one-off licensing deals. This is a sustained, multi-year program that works because it serves two very different audiences simultaneously... kids who want to build and play, and adults who want a piece of nostalgia on their shelf. The LEGO x Nintendo adult line has been cracking that audience consistently and expanding it year over year. That’s not a happy accident.

And Nintendo isn’t doing this out of goodwill. LEGO pays licensing fees for every set that carries Nintendo IP. Nintendo collects that revenue while LEGO handles the manufacturing, the retail, and the distribution. The arrangement keeps renewing because both sides win... LEGO gets one of the most beloved game IPs on the planet, and Nintendo gets a physical touch point in toy aisles, living rooms, and Christmas wish lists around the world. That is a deliberate strategy to make the Nintendo brand present in spaces where a video game simply cannot go.

mindSHARE - The Super Mario Bros. Movie bump

The Mario movie is the clearest proof of what the flywheel can do at full scale. The Super Mario Bros. Movie grossed over $1.36 billion worldwide in 2023, and the downstream lift to the game catalog was measurable... roughly 70% of the Mario catalog saw meaningful cumulative mindSHARE growth in the window after the film. That’s not marketing spend. That’s a content event creating organic demand across an entire portfolio. And now there’s a Super Mario Galaxy film coming, and the announcement alone generated extraordinary spikes... Galaxy mindSHARE up 927%, Galaxy 2 up 405%, search volume up over 1,200% in a single week. The flywheel catches every time.

Super Mario Galaxy movie reveal mindSHARE bump

Then there’s Pokémon, which we wrote about extensively in the Adult Money piece... the five-headed machine of games, mobile, trading cards, film and TV, and merchandise, where each head feeds the others continuously. I won’t rehash all of it here. The short version is that Pokémon is the most extreme expression of everything Nintendo is doing with Mario, running across every medium simultaneously with no off switch. Pokémon GO has logged north of 22 billion lifetime TikTok views. The anime has never stopped airing since the late 90s. And in January 2026, Universal Studios and The Pokémon Company announced a global theme park expansion... starting at Universal Studios Japan for the franchise’s 30th anniversary, with explicit plans to scale across Universal’s international properties. This is not a limited-time overlay. This is Pokémon becoming a permanent pillar of one of the largest theme park ecosystems in the world.

Now here’s where I want to circle back to Ball’s thesis directly.

Ball’s argument is that gaming is losing time to ambient, multitaskable platforms. That the 18-to-34 demographic is drifting toward sports betting and TikTok and OnlyFans because those things don’t demand full presence. And he’s right that a lot of games are losing that fight.

Nintendo as a media franchise

But his framework measures the wrong thing when it comes to Nintendo. You can’t capture what Nintendo is doing by counting hours logged in Mario Kart. The value Nintendo is generating doesn’t live only inside the game client. It lives on the backpack your kid is carrying to school with Mario on it. It lives in the LEGO set on the shelf. It lives in the movie your family saw together last spring. It lives in the trading cards getting negotiated at the lunch table. It lives in the theme park ride you’re still talking about two years later.

Are those kids also playing Roblox when they get home? Sure. But they’re also deeply embedded in Nintendo IP across a dozen different touch points that have nothing to do with screen time. And that brand equity compounds. The kid with the Mario backpack today is more likely to want the Switch when they’re older. The parent who took their family to Super Nintendo World is more likely to buy the next Mario game. The adult who built the NES LEGO set is going to feel something when the next Nintendo Direct drops.

That’s the attention economy too. Ball is measuring one front of the war. Nintendo is fighting it everywhere.

The Black Hole: Winning The Attention War Without Playing

GTA IV Trailers = undefeated in sucking up all the market attention

Let me end with the most obvious example, and the one I think Ball would probably agree with too.

GTA VI.

I’m not going to make the case for how big this game is going to be commercially. That argument makes itself. My point is different... it’s about what GTA VI is doing right now, before a single person has played it, with nothing in market beyond two trailers.

In our data, Rockstar Games‘ GTA VI carries a cumulative mindSHARE score of 6.2%. To put that in context... a successful game launch typically scores somewhere between 2% and 3%. Resident Evil Requiem, which is the biggest upcoming release of the first half of this year by a significant margin, and which has been in active, aggressive marketing since the Game Awards, sits at 4.085%. And Resident Evil is actively working for that number every week. GTA VI is doing nothing. Two trailers. That’s it. And it’s still winning.

GTA VI vs all other unreleased games FY 26

The search numbers illustrate the gap pretty clearly. GTA VI ranks #52 across all games in search with 1.7 million weekly search queries. It ranks #41 on YouTube despite the fact that Rockstar has produced essentially no active content for the game in months. It has no Twitch audience because there’s nothing to stream. And yet, across every signal we track, it just crushes everything else in market.

For contrast... Bungie‘s Marathon is trying to rebuild community attention right now, running activations, getting creators involved, had a notable streaming moment with TheBurntPeanut last week. Their community cumulative mindSHARE score sits at 1.1. Last week they ranked #308 in search, #313 in video, #206 in streaming. That’s not a knock on Marathon. That just illustrates what kind of gravitational force GTA VI is generating.

And then there’s TikTok, which is where the number gets genuinely absurd.

mindGAME - Top unreleased games by TikTok views

GTA VI has over 1.1 million videos on TikTok with over 36 billion lifetime views. Thirty-six billion. On a game that doesn’t exist yet. Based on two trailers.

The next closest unreleased game on TikTok is Deadlock from Valve, with roughly 97,000 videos and around 936 million views. That’s a real number for an unreleased game. It’s also not in the same timezone as GTA VI.

GTA VI got delayed on its own timeline, and Mandalorian and Grogu ended up being the beneficiary... they got a gift. A window they wouldn’t have had if Rockstar had shipped on the original schedule. That’s how much gravitational pull this game has. It warped the release calendar of a major Star Wars film just by moving. When GTA VI actually drops, I think it’s going to be a legitimate monocultural moment. Not just a big game launch. A gravitational event that pulls attention from everything around it.

GTA VI is the most extreme version of this, but it’s not the only one. There’s a broader pattern worth calling out: unreleased games winning the attention economy right now against titles that are actually in market.

Deadlock - Do not sleep on this game

Deadlock from Valve corporation is in early access... not even a full release... and it ranks #63 in overall search with around 1.3 million weekly queries. It sits at #86 on YouTube in a given week, fluctuating around that range. And it holds a top 20 to 25 position on Twitch consistently. That’s not a game that’s out. That’s a game winning the attention war via velvet rope... controlled access, word of mouth, the gravitational pull of people watching streams of something they can’t fully have yet. Different playbook than GTA VI’s silence, same outcome.

Playground Games‘ Forza Horizon 6 is another one worth noting. Cumulative mindSHARE of 1.05, which sounds modest until you remember it’s not out until May. It ranks #284 in search with close to 300,000 weekly queries, #254 on YouTube, and has 348 million lifetime TikTok views... #6 among all unreleased games on the platform. It’s also making a deliberate bet that matters in the context of Ball’s broader thesis: Forza is historically a western-dominant franchise, and this installment is leaning into an APAC setting centered on Japan. That’s not an accident. That’s a franchise actively pursuing the international audiences Ball identifies as the only growth story in this industry right now.

The throughline across all three... GTA VI, Deadlock, Forza Horizon 6... is that you do not have to be a fully playable, fully released game to win the attention economy. You can win it on hype. On access. On anticipation. On being the thing people are excited to play, or watching others play, or just talking about because the cultural momentum is already there. These games are beating titles that are in market right now. Active, released, marketed games. And they’re doing it while people are still waiting.

That’s the attention war too. And they’re winning it.

So Where Does That Leave Us?

Forza... I just wanted to share a image of good looking cars

Am I cherry-picking here? One could argue that. I’m not going to pretend I went looking for the failures.

But that’s sort of the point. I went looking for games that are defying the narrative... and I found them. Not obscure edge cases, not niche exceptions. The third largest game in the world. The most valuable entertainment IP on the planet. The most anticipated unreleased title in recent memory. Games not even fully out yet that are beating things that are. These are not accidents. These are teams that understood what war they were actually in and fought it accordingly.

Ball is one of the sharpest thinkers writing about this industry and this report genuinely got under my skin in the best way. I’ve read the deck four times. His core observation is real... a lot of games are losing the attention war, including big ones from publishers with the resources and data to know better. The structural forces he’s describing are not going away.

But the conclusion I’d push back on is that this means the industry is faltering. It doesn’t. It means there’s a learning curve. A significant one. And the gap between the studios that have figured it out and the ones still running 2015 playbooks is only getting wider.

The Attention Funnel

Here’s the framing I keep coming back to when I talk to gaming companies... attention earns time. Time earns money. That’s the funnel. If your IP can’t hold attention, you don’t get the hours, and if you don’t get the hours, you don’t get the revenue. Everything downstream flows from that first beat. And the studios that have internalized that aren’t treating TikTok or YouTube or any of these platforms as threats to survive. They’re treating them as distribution channels to exploit. Because that’s what they are.

Free Fire didn’t survive TikTok. It weaponized TikTok. Nintendo isn’t competing with ambient entertainment. It is ambient entertainment. GTA VI isn’t fighting for attention in a crowded market. It has so thoroughly colonized the cultural imagination that other games and major film releases are planning their windows around it. The takeaway isn’t that hype is magic. It’s that when you’ve actually earned it... through years of community building, through transmedia investment, through understanding where your audience lives and speaking to them there... hype is the most powerful distribution tool in existence.

Ball’s data captures the studios that haven’t figured any of this out yet. And there are a lot of them.

But there are also studios that have. And they’re not losing anything.

A few quick things before we get into it.

First, for those of you finding this via Substack... welcome. I also do a lot of content on LinkedIn.. follow me here

Second, GDC is coming up fast and honestly my calendar is already a bit of a disaster. If you’re going to be in San Francisco and want to grab coffee, lunch, a drink, or just talk shop... attention economy, mindGAME Data, what we have cooking for the rest of the year... hit me up. Wednesday and Thursday are my most open days right now. DM me and we’ll make something work.

GDC Calendly: https://calendly.com/colan_screenengine/in-person-coffee

Arknights: Endfield - Launch

Third, quick shoutout to my team. We just wrapped a case study on the Arknights Endfield launch... specifically how their marketing strategy actually managed to break through the attention economy and turn into a real hit, all things considered. If you want a copy, it’s free.

Password: X0YJg170jPrM

Okay. On to the thing I literally could not stop thinking about this week.

I was originally going to go deep on the Sony PlayStation catalog this week. Had my notes, had my angle, had the data queued up. And then Matthew Ball dropped his 164-slide State of Video Gaming report and... yeah, that went out the window pretty fast.

I always find Ball’s work genuinely interesting, even when I don’t fully agree with where he lands. And this year, there’s one specific thing he said that I haven’t been able to shake. His framing is that gaming is losing the attention economy. Not to a better game. Not to a better platform. To everything else. TikTok. Sports betting. Crypto. OnlyFans. Prediction markets. The argument is that all of these have quietly moved into the same psychological territory that games used to own, and they’re winning.

I both agree and disagree with that. And I want to be fair to his case before I get into my own thinking, because the data he’s working with is real, and the trend he’s identifying is real. Where I start to push back is on the conclusion.

Data is data.. but what this marco picture misses are clear winners and losers

Because when Ball says gaming is losing the attention war... I think the more precise thing to say is that some games are losing it. A lot of games, actually. Big ones. Publishers that genuinely should know better. But other games are not losing it at all. Other games are winning it decisively, and they’re doing it because they understand what war they’re actually in.

That’s the gap I keep running into in conversations, whether I’m talking to a big publisher or a small indie team. There’s still a widespread assumption that if you build something good, people will find it. Or that the marketing tactics from 2015 are going to generate the same ROI in 2026. They won’t. The war has changed, the economy has changed, the way you earn attention has completely changed. And the studios that haven’t internalized that yet are the ones showing up in Ball’s data as casualties.

I’ve written about this a few times now. In “Content Is Discovery” I made the case that the biggest games in the world aren’t just competing in the attention economy... they’re feeding it. And in the Highguard piece and Microsoft piece, you can see exactly what it looks like when teams either don’t understand the war they’re in or fundamentally misread the playbook.

So let’s do this in two parts. First, I want to lay out Ball’s case as cleanly as I can, pulling from his conversations with Ben Thompson at Stratechery and Christopher Dring at The Game Business. Then I’ll get into my perspective... which is that the games winning the attention economy right now aren’t winning despite the current environment. They’re winning because they figured out what game is actually being played.

Ball’s Case: Gaming Is Losing The Attention War

Ball making the case

Ball has been building toward this argument for a couple of years now, but this year he sharpened it. The headline, delivered pretty plainly in his interview with Christopher Dring at The Game Business:

“Video gaming has been a loser in the attention wars over the last half decade.”

Matthew Ball, The Game Business, February 2026

That’s a jarring thing to read in a year when the industry just hit an all-time revenue high. But Ball’s argument isn’t really about revenue, at least not at first. It’s about time. And specifically about where the time of the demographic that built this industry is actually going.

The core of his case is that the attention economy restructured pretty significantly after 2019, and gaming, particularly in the mature markets that built the industry, ended up on the wrong side of that. The competition didn’t show up with better games. It showed up with better hooks.

The “bad” guys to gaming.

TikTok. Sports betting. OnlyFans. Crypto. Prediction markets. On paper none of these look like they’re competing with a 60-hour RPG or a ranked shooter. But Ball’s point is that they’re all fishing from the same pool... 18-to-34-year-old men, the exact demographic that has driven PC and console spending for two decades. And these alternatives don’t just steal time. They steal it more efficiently, because they’re engineered for a world where attention is fractured and multitasking is the default.

He put the structural problem plainly in his conversation with Ben Thompson at Stratechery:

“One of the things that I hear a lot from the ecosystem now is that what we often believed was one of the unique strengths of the industry, massive attention, singular attention, is in many ways the Achilles heel, because when you take a look at the time of use, you say Americans engage with 30 hours of content per day, and that’s because we’re multitasking. The one challenge here is I can be on TikTok and Twitter and Polymarket while watching television, but I can’t actually have both hands on controller in a live multiplayer match while multitasking.”

Matthew Ball, Stratechery, February 2026

That’s the whole structural problem in one paragraph. Gaming almost uniquely demands full presence. Both hands on the controller. Active decision-making. Real-time response. And in a world where every other form of entertainment has figured out how to stack... that full-presence requirement has quietly become a liability.

A chart I never thought I would see or share.

The competing platforms aren’t subtle about it either. Ball’s data on the alternatives is pretty striking. Online sports betting generated roughly $17 billion in net losses across 35 states last year. iGaming hit $11 billion, and that’s only legal in seven states. OnlyFans has around 12 million American users spending $5 billion annually, roughly half of them in that 18-to-34 male bracket. These aren’t fringe behaviors anymore. They’re mainstream. And they’re all engineered around the same psychological triggers games used to own almost exclusively... progression, risk, social signaling, the feedback loop that tells you you’re winning.

The part that makes this uncomfortable to wave away is the multitasking angle. Sports betting gives you a live stake in something that just runs in the background. Crypto gives you a ticker you can check between meetings. Prediction markets give you the feeling of applying skill to real-world outcomes without ever having to clear your schedule. These things don’t ask you to commit. They’re ambient. They travel with you. And when they interrupt a game session... the interruption wins.

Ball put it bluntly to Thompson:

“It could just be you just lost 100 bucks, it could just mean you won 1,000 bucks, or it can be the OnlyFans star that you subscribe just told you a new pay-per-view video is available. Guess what? A lot of those people are gone, and they can multitask in other ways, but not that.”

That’s the threat in one sentence. It’s not that games got worse. It’s that the cost of demanding full presence in a fractured world keeps going up.

And Ball isn’t wrong about the underlying numbers. The Major Market 8... US, UK, Germany, Japan, Korea, France, Italy, Canada... have been flat for five years. The 18-to-34 core is measurably pulling back. The structural forces are real, and they’re not going away.

Scary... without context

Where I start to push back is on what all of that actually means for the games that are winning right now. Because Ball’s framing, taken literally, would suggest the industry is basically in a defensive crouch with limited options. And I just don’t think that’s what the data shows when you look at the right titles.

Some games aren’t losing the attention war at all. Some games winning the war and are dominating all forms of entertianment in the process.

And that’s where we’re going next.

Some Games Don’t Compete For Attention. They Generate It.

All this chart tells me is the death of Twitch / Livestreaming.. which I agree with.. but that is a Twitch problem.

Ball’s attention economy argument is directionally right. The war is real. The competition is real. The structural disadvantage of demanding full presence in a multitasking world is real.

But there’s a version of his argument that I keep tripping over, which is the implication that all games are fighting the same losing battle. Because when you actually look at the games sitting at the very top of the attention economy right now... some of them aren’t losing to TikTok at all. Some of them own TikTok. And some of them have built content universes so large they don’t compete with the platforms Ball cites as threats. They use them.

mindGAME Data - Top 24 games, sorted by video views, across the history of TikTok

The games that figured this out aren’t treating content platforms as competitors. They’re treating them as the product.

There are different ways to win that war. Short form video. Transmedia. And then there’s a third category that doesn’t get talked about enough... games that haven’t even launched yet, winning the attention economy on pure cultural gravity, beating fully released and actively marketed titles while people are still waiting to play them.

Fallout - clear winner of the transmedia era

At the macro level, yes... most games are losing. This is a winner-take-most environment, and the volume of releases every year means the vast majority are invisible from day one. Ball’s data captures that accurately. But the reason most games are losing isn’t because TikTok and sports betting are inherently unbeatable. It’s because most studios don’t understand the war they’re in. They’re marketing like it’s 2015. They’re assuming that if they build something good, the audience will find it. They’re playing by rules that stopped working years ago.

The games winning right now figured out something different. Let’s look at a few of them.

Short Form Video: Garena Free Fire And The Flood The Zone Playbook

Free Fire - the biggest game that is unknown in the west

If you’re a Western gaming industry reader, Free Fire might not be on your radar. It doesn’t dominate U.S. charts. It doesn’t get talked about at GDC. It’s not in the conversation at most Western publisher strategy meetings.

And yet, by every meaningful attention metric we track at mindGAME Data, Garena Free Fire is the third largest game in the world.

Not third among mobile games. Third among everything... console, PC, mobile, browser. Consistently, week over week, sitting at roughly 4% global cumulative mindSHARE, behind only Roblox and Minecraft. Its peers aren’t Valorant or Call of Duty. Its peers are the two games that basically invented the concept of a platform-scale game ecosystem.

mindSHARE - Free Fire is #3 world wide

A quick background for context. Free Fire launched in 2017, built by Vietnam’s 111 Dots Studio and published by Garena out of Singapore. It’s a mobile battle royale, optimized from day one for the phones people in emerging markets actually owned... short 10-minute matches, lightweight client, runs on almost anything. It spread fast through Southeast Asia and Latin America, then South Asia, then MENA and Africa. It never needed the West to become what it is.

Ball actually cites Free Fire in his report, which is worth noting. He acknowledges the scale... roughly 650 million quarterly players generating around $3 billion annually... but contextualizes the audience as “less viable.” Lower ARPU, non-Western, outside the demographic Western publishers prioritize. The average user pays roughly 40 cents a month. And if you’re only looking at the revenue line, that framing makes some sense.

650 million quarterly players... not bad

But here’s what 650 million quarterly players and 40 cents a month actually produces on TikTok.

Free Fire currently has 1.324 trillion lifetime views on TikTok. That’s not a typo. One point three two four trillion. It is the number two game in the history of the platform, just behind Roblox, and it got there with over 100 million videos of Free Fire content... the most of any game ever created on TikTok. For reference, Fortnite sits at roughly 850 billion lifetime TikTok views across 70 million videos. Minecraft is in the same ballpark with 30 million videos of its own. Free Fire has 1.3 trillion views and over 100 million videos. It's not close.

Ball calls TikTok one of the primary platforms stealing attention from games. Free Fire turned TikTok into its single biggest customer acquisition channel.

mindGAME - Free Fire vs Fortnite = TikTok total views

The way they did it is worth understanding because it’s deliberate and replicable. Free Fire doesn’t run a single global TikTok channel. It runs hyper-localized regional channels... Brazil, MENA, Vietnam, India, and more... each producing content that is in-language, in-culture, and tuned to the specific meme vocabulary of that market. They’re not translating content. They’re building local content machines that generate a constant, high-volume stream of material for each regional audience to consume and share. Gameplay clips, yes. But also memes, trends, challenges, cultural moments. Content that lives and spreads whether or not the person watching has ever downloaded the game.

They’re flooding the zone. And they’re not the only game doing it... Block Blast, a Tetris-like mobile game, runs the same playbook, producing everything from gameplay footage to pure meme content that uses the game as backdrop. The goal is volume and variety, training the algorithm to find them, and making sure that when any version of their content goes viral, the brand is on it. The result is a game that is culturally present far beyond its actual player count.

Ball frames TikTok as the bad guy... its not... its critical to discovery

That last part is the key insight that Ball’s framing misses. A Free Fire TikTok view from someone who will never install the game still has value. It keeps the brand present. It keeps the IP visible. From a pure monetization standpoint, yes, that value is flowing to TikTok more than to Garena. But from an IP valuation standpoint, from a fandom-building standpoint, from a next-generation player acquisition standpoint... they are winning. They are generating more interest, more awareness, more cultural presence than games spending orders of magnitude more on paid acquisition.

In our data, Free Fire ranks #4 globally in search with around 9.3 million weekly queries, and consistently holds the top one to three spots on YouTube week over week. Its Twitch presence is essentially zero, which would be a red flag for almost any other shooter. For Free Fire it’s irrelevant, because Twitch doesn’t exist at meaningful scale in the markets where Free Fire lives. The platforms that matter for their audience, they dominate. Not by accident. By design.

Free Fire - dominate across all non-major markets

I wrote about this in detail in the Free Fire TikTok Flywheel piece from last August. The short version is that Free Fire is proof that the content-as-discovery model works at the highest possible scale. You don’t need to outspend your competitors on paid acquisition if your community and your owned channels are generating an inexhaustible supply of organic inventory. You just need to build the machine. And then run it everywhere.

Transmedia: Nintendo And The Flywheel That Keeps Compounding

mindSHARE - Nintendo trending since 2025

I know, I know. I’ve written about Nintendo a lot. But Ball gave me an opening and I’m taking it, because what Nintendo is doing right now is the clearest possible counter to his thesis... and it keeps getting cleaner every quarter.

Free Fire wins the attention economy by being everywhere on one platform. Nintendo wins it by being everywhere in your life. Theme parks. Movies. Trading cards. Merchandise. Toys. The anime your kid has been watching since before they could hold a controller. These aren’t marketing tactics. They’re touch points. And every touch point pulls people back toward the games without Nintendo having to buy that attention outright.

That’s a fundamentally different strategy than anything else in this industry. And it’s why Nintendo keeps showing up in these conversations no matter how many times I promise myself I’ll move on.