Gamefam's Joe Ferencz On Roblox's Metaverse Potential

Gamefam's Joe Ferencz On Roblox's Metaverse Potential

Blogs

•

February 4, 2026

•

Lewis Ward

Gamefam's Joe Ferencz On Roblox's Metaverse Potential

Blogs

•

February 4, 2026

I was the consulting executive producer for Hot Wheels video games from 2015 to 2020. It was a two day a week, give or take, gig. We were putting Hot Wheels into so many different gaming franchises…I was getting these different trend reports on my desk and one of them was mentioning Roblox consistently…I looked it up and I said, “What the heck is this?” Roblox at that time, back in 2016, I believe, had about 30 million MAU [monthly active users]. Right now it’s got 150 million DAUs [daily active users]…In 2018, I could see it really starting to hockey stick up in terms of both users and revenue…I started bootstrapping some games. And I said, “I think this could be a real business that could make a real impact on the gaming industry.” So I started Gamefam.—Joe Ferencz

Late last year, Gamefam CEO Joe Ferencz and Newzoo Gaming Analyst Tianyi Gu joined Player Driven host Greg Posner to talk Roblox, especially in regard to the platform’s creator/developer and player community dynamics. The full episode is here (and it’s probably on your preferred podcast platform as well); what follows is a partial summary of, and a partial expansion upon the ground covered in that episode.

Two housekeeping notes before we dig into the meat and veggies of the discussion.

First, Ferencz and Gu were on a joint press tour at the time, touting Newzoo’s recently released Free Global Games Market Report 2025. Among other topics, the report included several Roblox-related insights that, in turn, were partly based on data that Gamefam collected. More specifically, Gamefam runs a service called RoMonitor that pulls data from Roblox’s APIs and nests that data in a slick tool that’s used to assess the performance of Roblox experiences and the creators/developers behind them. (If you’re unfamiliar with Roblox, it’s a social video game-oriented platform that offers a suite of tools that are used by a large community of external creators/studios to build the experiences that Roblox’s huge, young-skewing player/user base enjoys, and these creators collect a share of related player/user spending.)

Second, Gamefam has a vested interest in putting a positive spin on what’s happening on Roblox because (1) the company makes and supports first-party games and experiences on the platform and so, broadly speaking, the company does better if Roblox does better, and (2) Gamefam is in the business of helping video game studios and nongaming brands that aren’t on Roblox get onto the platform and, hopefully, achieve their business objectives. Gamefam’s home page currently states that the company aims to unleash “the potential of metaverse gaming for brands,” and touts the fact that the company has run 115+ campaigns for a range of brands.

With that context out of the way, let’s get to it.

Two topics Ferencz and Gu agreed upon right off the bat were that the typical Roblox player skews quite young and that mobile phones and tablets remain their preferred access channel. The aforementioned Newzoo report, for example, found that 29% of Roblox users were 10-15 years old (although Gu added Newzoo didn’t survey players <10 and said self-reporting in this age group can make the results sketchy; Roblox Corp. itself reported that 40% of its players/users worldwide were <13 in 2024).

However, “the 13+ group is growing faster,” Gu explained to Posner during their late 2025 exchange. Ge added added that most players “access the Roblox platform, or content on Roblox, through a mobile. And for Roblox players, they actually also engage with other gaming content through PC and console.”

Roblox Corp. reported that 80% of the platform’s DAUs accessed it through a mobile device in 2024, 17% were on PCs, and 3% used game consoles.

“Roblox released recently on PlayStation,” Gu continued. The company recently “reported out that it already captured about 3% of total playtime on PlayStation.”

In addition to touting RoMonitor, Ferencz was quick to honk Gamefam’s horn early in the discussion.

“We were the first ever professional Roblox studio,” Ferencz said. “We built the company by both making games and acquiring games. And so, you know, some of our biggest franchises right now are War Tycoon, the number one military game on Roblox, and Sonic Speed Simulator, the number one all-time IP game on Roblox, and Super League Soccer, which is a huge soccer game” that was recently rebranded FIFA Super Soccer!

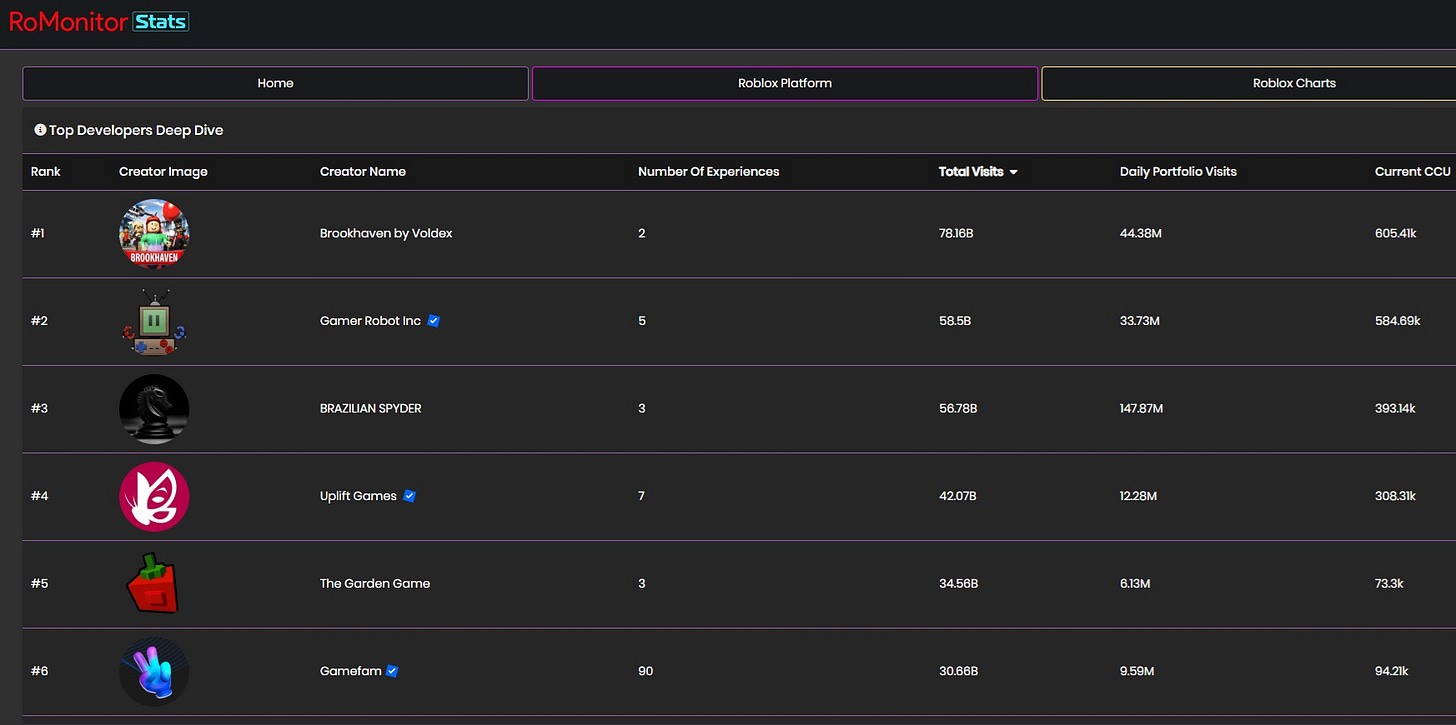

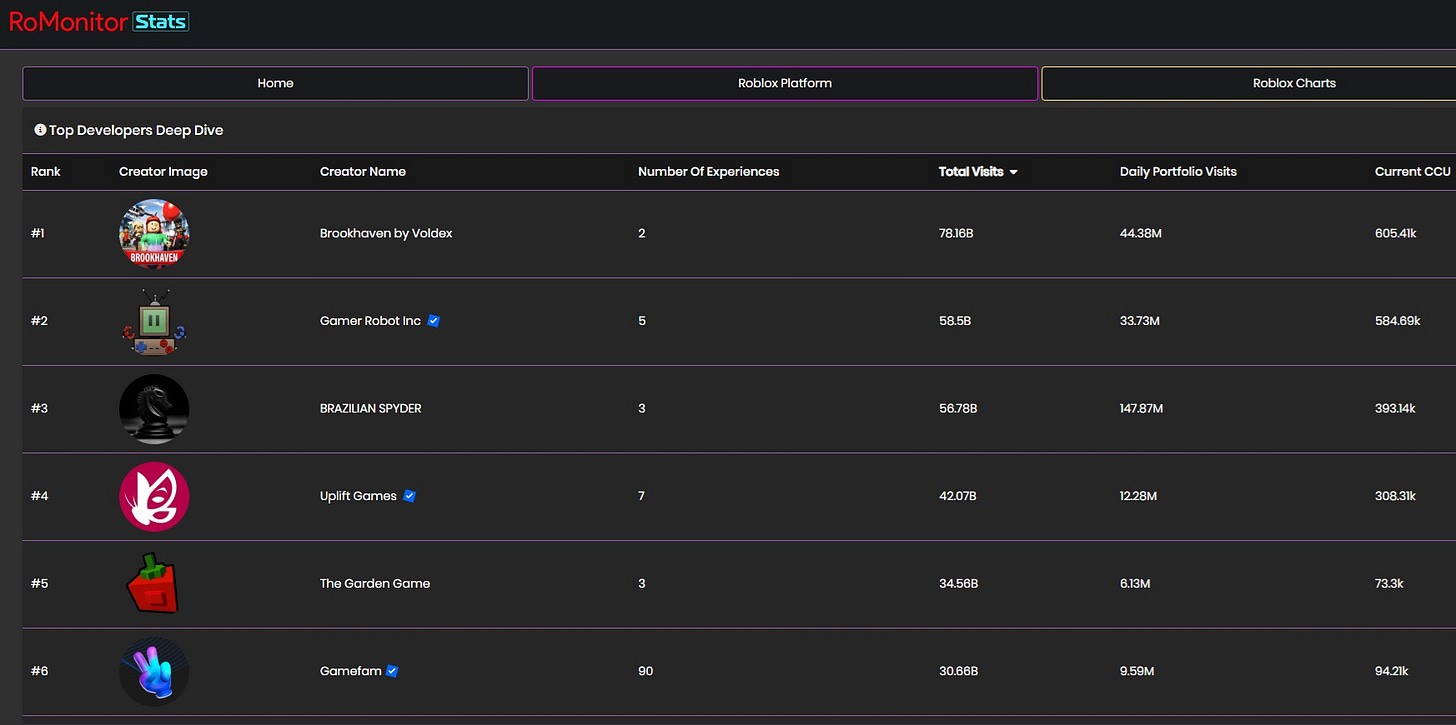

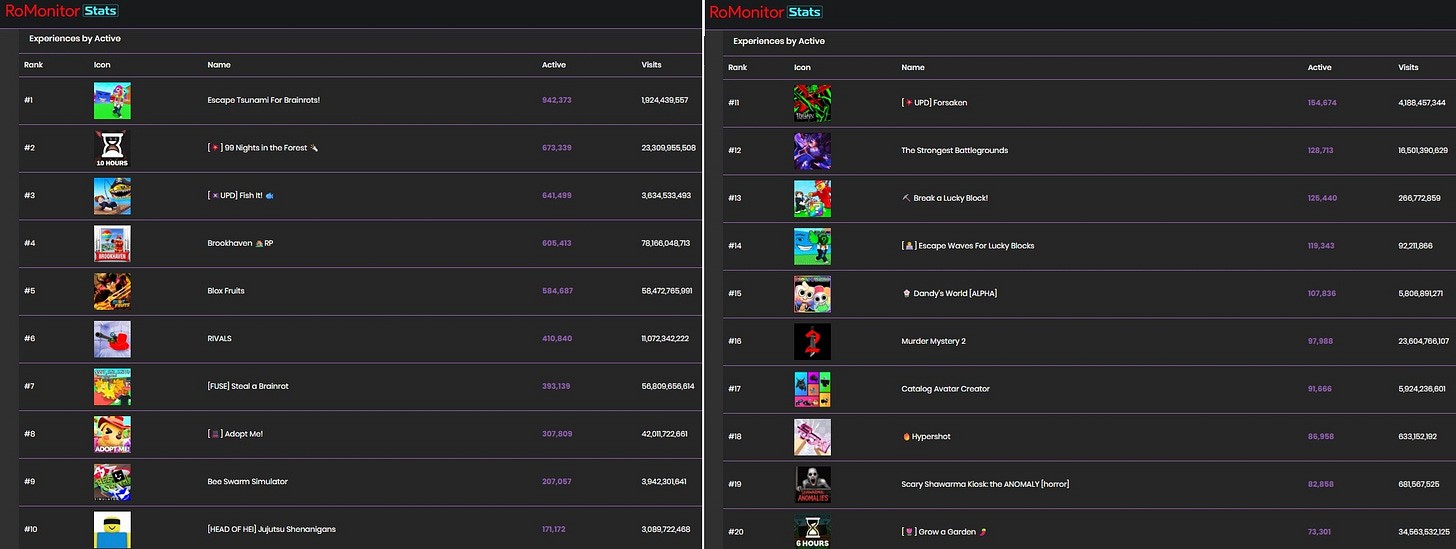

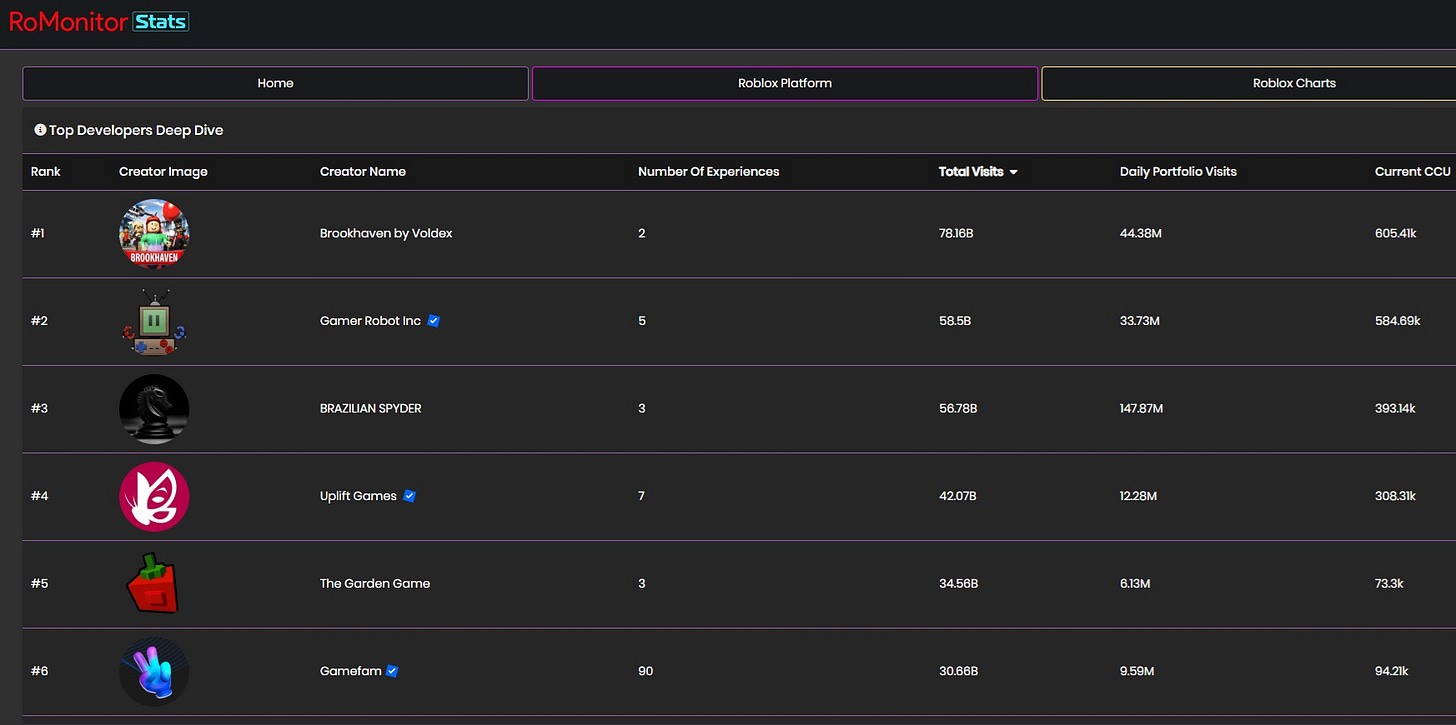

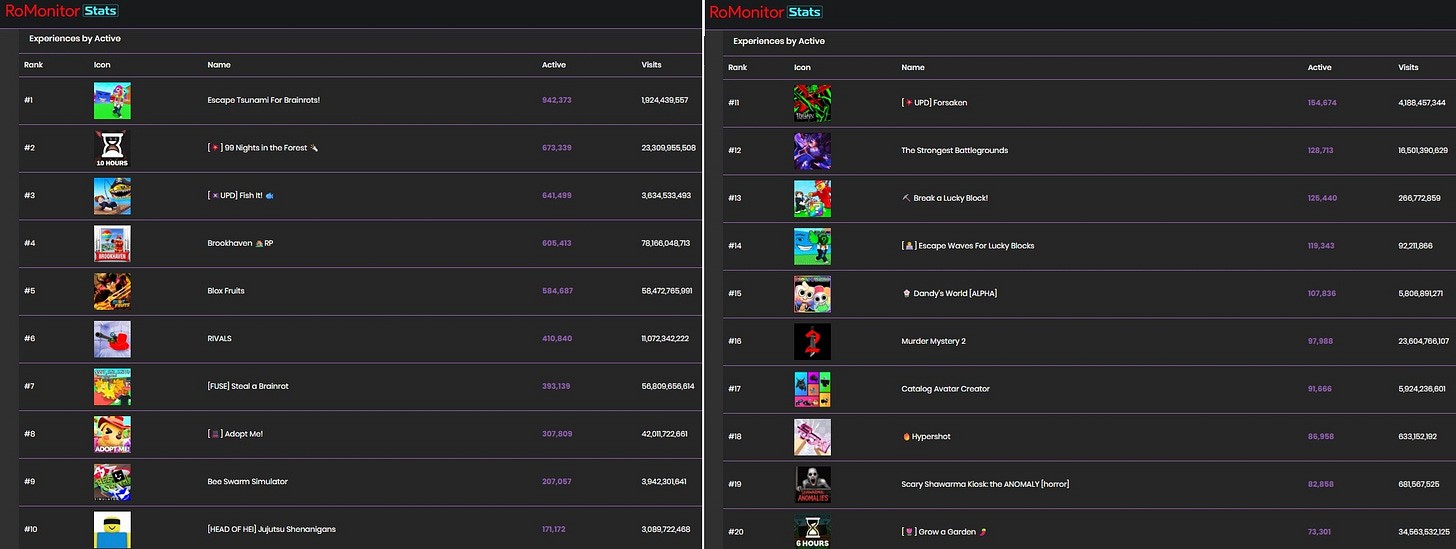

My quick review of RoMonitor on the last day of January, 2026, showed that Gamefam was sixth on the list of Roblox’s largest developers, as measured by cumulative player/user visits.

Total visits to Playfam-related experiences on Roblox sits at >30.6 billion currently. That sounds impressive—and it is—until you move up to the top slot and notice that Brookhaven has racked up >78.1 billion total visits—and has done so based on two experiences compared to Playfam’s 90.

They say the grass in Brookhaven is always greener…

For what it’s worth, RoMonitor results additionally showed that some of Roblox’s most popular experiences, including Brookhaven, easily top a million live or concurrent users (CCUs). The scale of Roblox’s player/user base can, at times, be difficult to wrap one’s head around.

RoMonitor’s #2 developer slot at the end of January, as the above figure shows, was held by Gamer Robot; their biggest title was Blox Fruits. Third place went to BRAZILIAN SPYDER, maker of Steal a Brainrot. Fourth went to Uplift Games, the developer of Adopt Me! The fifth slot went to The Garden Game, maker of Grow a Garden. All of Roblox’s top six development studios generated >6 million daily visits across their content portfolios, but BRAZILIAN SPYDER was head and shoulders above the rest, at a whopping 147+ million.

Read on to learn:

What makes Roblox’s algorithm so vital to platform creator success

Why most game studios and brands have a difficult time making sustained inroads on Roblox

How some game studios and brands—with an assist from Gamefam—have found a way to taste the rainbow…I mean, taste the Robux.

Oh, and if you haven’t subscribed, what’s the holdup, pardner?

All Hail the Opaque, Mercurial Algorithm That Serves Roblox’s Elusive Quest For Profit

You [Greg Posner] asked how important, I think, is the algorithm…My belief, based on all of the data I have available, as well as seeing the data on a number of the top five games that have come up over the last year on Roblox, as they were coming up, is that [the] algorithm is not only king, but it’s king, queen, jack, ten, nine, eight, seven, six, five, four, three, two, ace.—Joe Ferencz

In the calendar year 2024, Roblox Corp. lost approximately $935 million. Cumulatively, through early 2025, the company appears to have racked up >$4 billion in losses. In this light, it’s understandable that Roblox’s executive team has been on a quest to identify a means of converting its massive and growing audience of kids and young adults into a revenue stream that routinely exceeds the company’s operating costs, while also not killing the proverbial golden goose.

“Algorithm is currently everything on Roblox,” Gamefam’s CEO Joe Ferencz repeatedly underscored to Player Driven host Greg Posner in their late 2025 discussion. “In fact, they’re A-B testing, lately, the continue playing bar. So, even if someone played your game yesterday, they may not even see that game in the continue playing bar in its sequential order in which you played it. So, developers are having less and less control at this time over the impressions for their page.”

Ouch.

“What we’re doing at Gamefam,” Ferencz added, “is not only continuing to live operate our existing games, [but to] grow those games, by knowing how the algorithm has changed, and targeting the right metrics.”

“We have tripled the users in Super League Soccer over the last three months. We picked a metric to target. It was the right metric. We achieved growth on that metric and we have been rewarded by the algorithm with a humongous amount of new users.”

That may be true, but the “right metric” for this game undoubtedly also involved its FIFA partnership. As previously noted, Gamefam’s Super League Soccer was rebranded FIFA Super Soccer! in December. That game is now FIFA’s official Roblox experience. In fact, FIFA temporarily took over Super League Soccer in June and July of last year while the FIFA Club World Cup was underway, yielding a massive spike in new users, according to a recent GamesIndustry.biz article. It may well be that the impact of Gamefam’s “gaming of the algorithm” paled in comparison to the boost that FIFA’s promotional tailwind gave the game late last year.

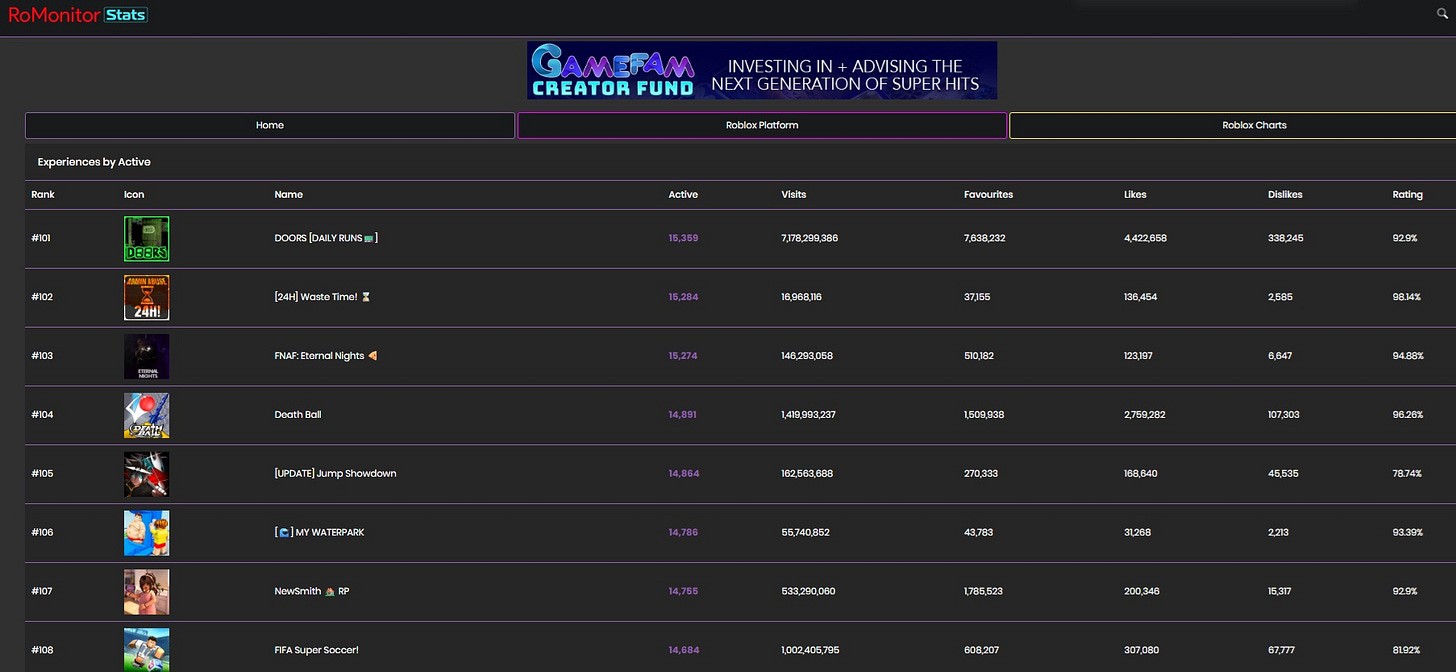

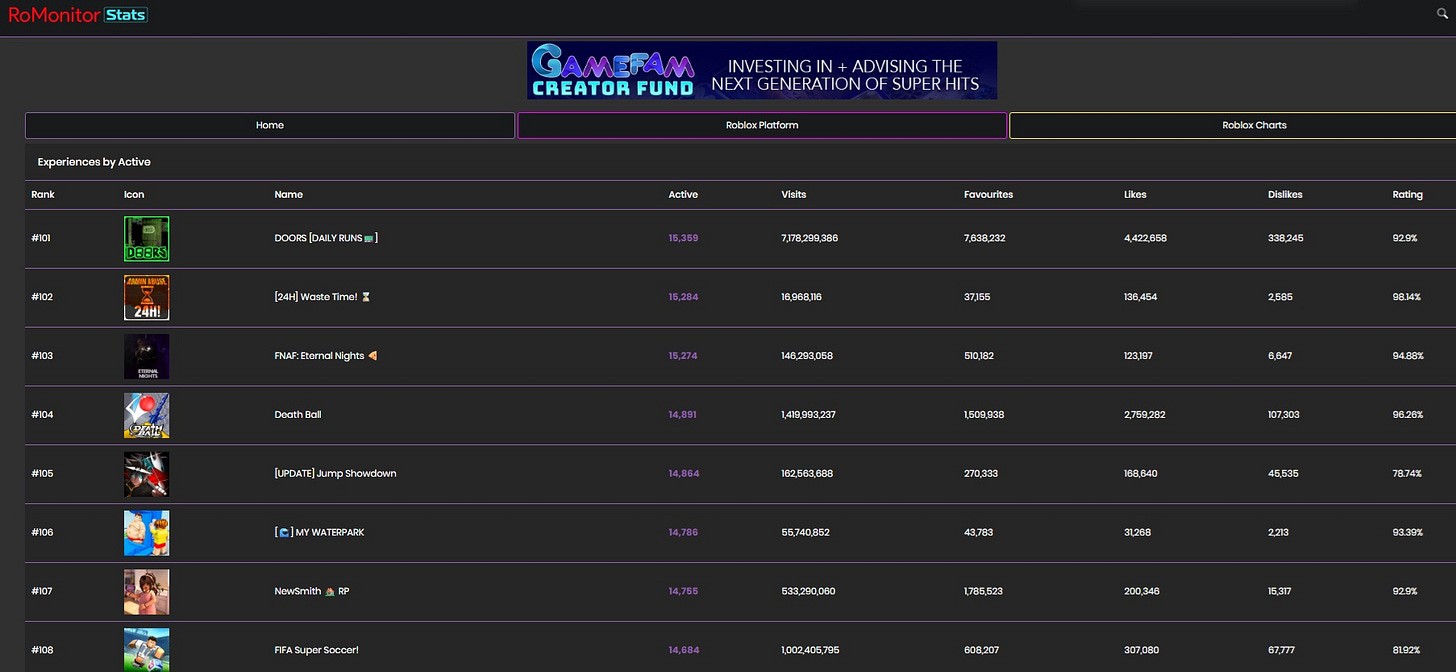

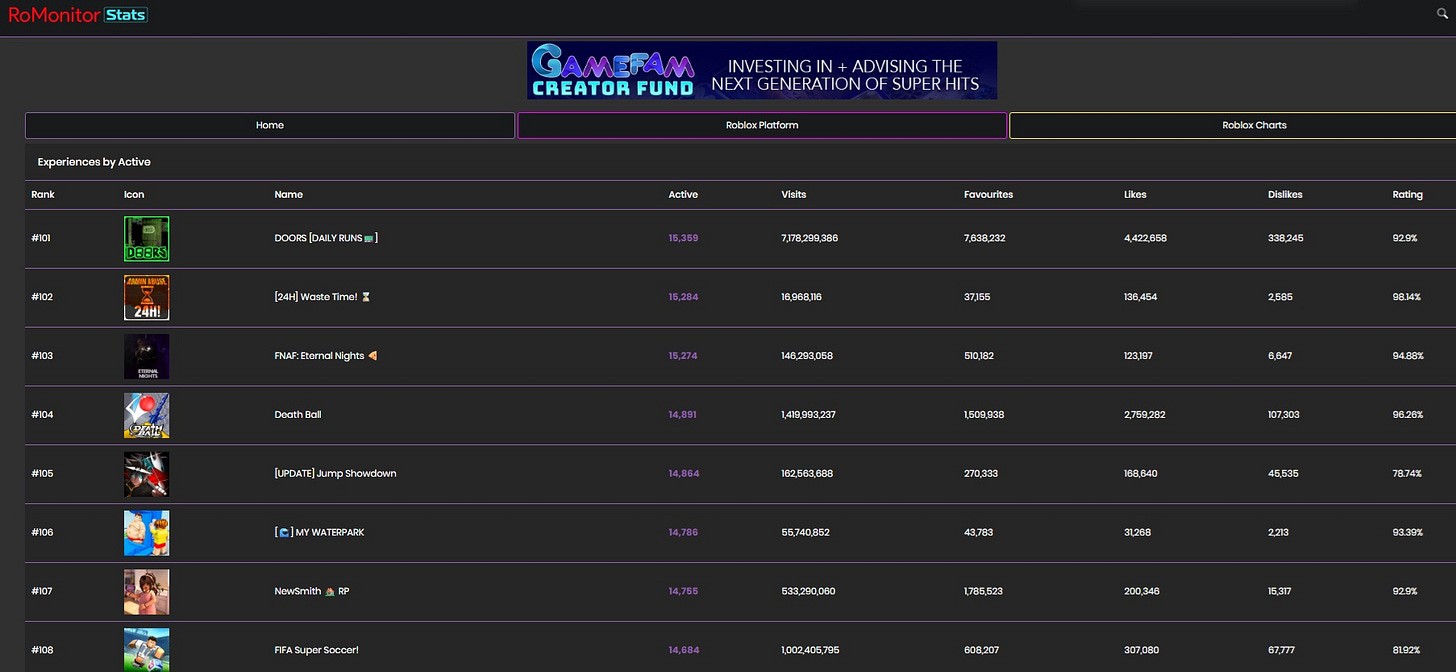

FIFA Super Soccer! may also be Gamefam’s top game in early 2026, at measured by CCUs. At a minimum, both of the other experiences that Ferencz called out to Ponser early on in their discussion—War Tycoon and Sonic Speed Simulator—had lower CCUs on RoMonitor at the end of January than did FIFA Super Soccer! As shown below, the game came in #108 on Roblox’s most popular experiences list by CCUs.

To be clear, that’s an excellent result. There are literally millions of experiences currently on Roblox. Being in or near the top 100 is a rare and difficult feat.

Ferencz told Posner that another of Gamefam’s strategies is to build and release quickly, and if an experience resonates, iterate quickly.

“We’re also making very quick casual games at the company,” Ferencz said. “If you look at the games that are winning on the platform at scale, almost all of them were made in one week or less. This is the era of trendy viral gaming, and we are participating in it.”

“For example, we have a game called Hop that we made in a few days. It’s about two frogs that are tied together at the tongue and they have to go through a platformer together. Multiplayer, right? Social gaming. And again, we spent a few days making this game and it’s already generating tens of thousands of dollars in profits for the company just after a few days.”

“That’s a great business model that we’re really excited to participate in.”

The game Ferencz referenced appears to be this one, per RoMonitor. In recent weeks, Hop’s daily visits have averaged 125,000-175,000. The game’s CCU was also close to 500 when I checked in early February. If the game has indeed generated >$10,000 in profit for Gamefam weekly in recent months, then Ferencz’s bet on Gamefam must be paying off handsomely. It does beg a larger question, however: if Hop, a game that’s way, way, way outside the top 100 by daily visits and CCUs, is so profitable for Gamefam, then how is it possible that Roblox Corp.—which by all accounts collects about half of all player/user spending—has had such a consistently negative net margin?

I’ll leave the squaring of that financial circle to those who are more adept at interpreting balance sheets that I am.

Posner then asked Ferencz how Gamefam drives traffic to such microgames.

“It’s luck of the algorithm, I guess,” responded Ferencz. “The algorithm is searching for KPIs that Roblox has decided are in the interest of their overall platform.”

“My experience as a Roblox developer is that working with Roblox [Corp.] is great. They’re fantastic partners, but they have a business to run and their business is measured on share price. And they are looking at how they can hit their internal KPIs.”

“It’s on us to be in synchronicity with what they’re trying to do, and understand, as best we can from the tea leaves, what is important to them.”

“Having a portfolio of games as we do at GameFam,” Ferencz continued, “has given us a great advantage in that [effort] because we can see things that are working in some games…‘Okay, that must be a metric that the algorithm is now prioritizing. Let’s go and target that metric in our other games.’ And so that’s the way we’re approaching it at Gamefam.”

“In my seven years on Roblox…the one thing that is most consistent is [that] the algorithm will change. There were times when the algorithm was very predictable, and we are in a time right now where the algorithm is extremely dynamic.”

The algorithm, the algorithm, the algorithm! It must feel like dancing in the dark with a partner who demands to lead and has a big repertoire of steps, and drip to boot.

“I believe that Roblox has some internal ways of segmenting users,” Ferencz told Posner. They’re “targeting different games with different users to try again to achieve the metrics that are important to Roblox.”

“It’s pretty opaque to us as developers in a lot of ways. What we do have is a lot of signals. So, Roblox has given us a lot of algorithmic signal data across different metrics….We have dashboards with, I don’t know, we probably look at 25 different charts on a daily and weekly basis that are from the Roblox native dashboards. And then we have some proprietary measurements that we do, as well, through third party data services.”

“At the end of the day, it’s impressions, right? You know, acquisition, retention, monetization. The fundamentals of free-to-play gaming are still very true on Roblox, but they, they manifest in a fundamentally different way because acquisition is essentially fully dependent on the algorithm.”

Since Roblox’s “ARPDAU and LTVs [are] relatively low compared to mobile free-to-play, you’re not going to have a game on Roblox where you’re going, as a developer, to net a $1 ARPDAU.” (Note: ARPDAU is an acronym for average revenue per daily active user and LTV is shorthand for lifetime value.)

“We’ve never seen data that even approaches that level” of ARPDAU, Ferencz continued. “What that means is you need a lot of users, right? You need a lot of user volume to make a game successful.”

The only way to get the type of volume you need to make a game commercially successful on Roblox today is through algorithmic discovery.

“Soon enough,” Ferencz added, “what we’re doing will stop working and we’ll be scratching our heads and looking around at each other and trying to, you know, look through the data and figure out, ‘Okay, what’s the next signal that now Roblox wants to prioritize?’ And then targeting that signal. And we’ve been doing this, as I said, for almost seven years now.”

Ferencz and company have undoubtedly become skilled at picking up and dancing to Roblox’s ever-changing algorithmic tune. That skill is unnecessary in 99 out of 100 traditional game development projects. In that context, studios and publishers are either part of the same company, or if not, they’re still dancing to a deeply choreographed, mutually shared, and mutually agreed upon routine. Perhaps more than anything else, it was the opaque misalignment between Roblox Corp. and its creator/developer community that stood out most starkly in Ferencz’s, Gu’s, and Posner’s discussion.

Why Roblox’s Distinctive Characteristics Make It Tough For AAA Studios and Brands to Succeed

As an influencer who makes YouTube or TikTok content, you cannot make a game sticky…All you can do is get people to sample a game on the first few days it’s out. And because the…competitive attention economy on Roblox is arguably the most competitive in the world, if the game doesn’t catch the attention of players at large, there’s nothing that can make them want to keep playing the game except, “Are they having fun? Do they like the game?” And no one can currently predict which games they’re going to like.—Joe Ferencz

“Roblox is the same slice of the internet that TikTok and YouTube and Snap and Instagram and inhabit,” Gamefam CEO Joe Ferencz told Player Driven host Greg Posner late last year.

Apart from Roblox’s fickle recommendation/discovery algorithm, traditional game studios and brands that would like to grab a slice of the platform’s attention economy pie are also challenged (1) by the curious behavior of its remarkably young user base, (2) the fact that spending is broadly gated by parents/guardians, and (3) because some of the experiences have disproportionate appeal on PCs and consoles, which raises distinctive development and balancing challenges.

For some “AAA or even AA developers,” Newzoo’s Gaming Analyst Tianyi Gu explained to Posner, “I think there’s a knowledge gap still there…[A] lot of developers think Roblox is more like a black box.”

“They really want to understand the audiences on the platform [and] also their, like, behavior on the platform,” Gu continued. Traditional developers “want to find a way to kind of, like, bring some of the Roblox players to their ecosystems, to their games.”

Not so fast, said Ferencz.

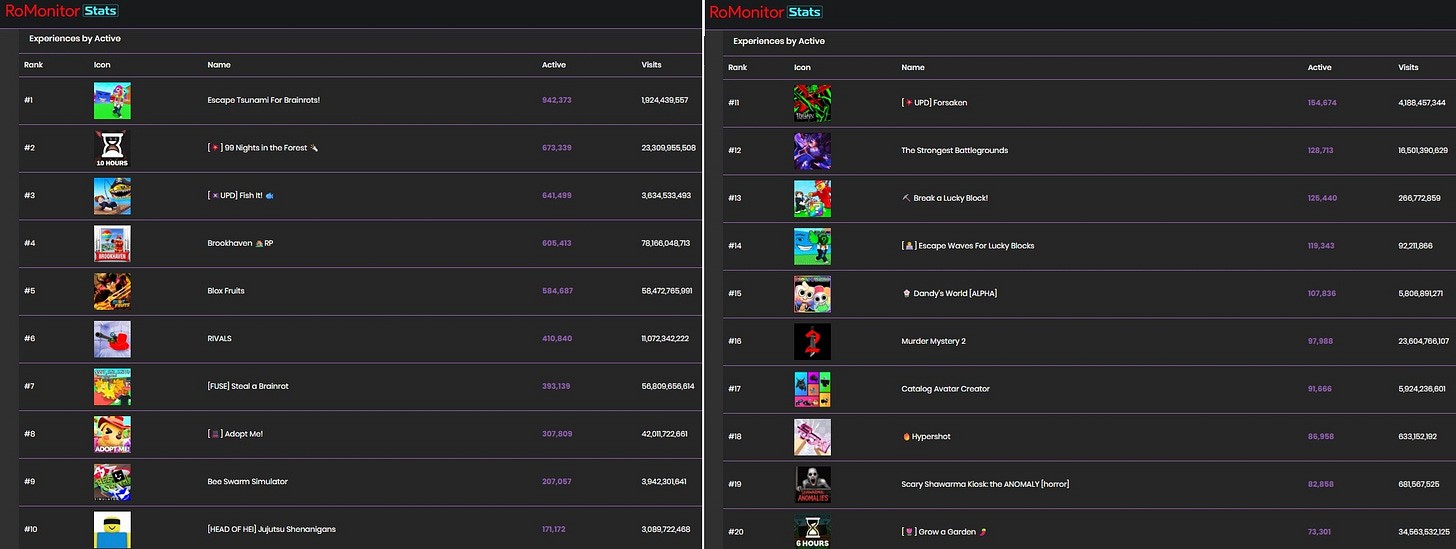

“If you look at the top games on the platform, which are, you know, Steal a Brainrot, Grow a Garden, 99 Nights in the Forest, Brookhaven,” Ferencz said, “it really depends on the age group. The younger the game skews, and the more spread out in gender demographics the game skews, the more players are going tend to be on mobile phones.”

“There are games such as [our] War Tycoon, or [Nosniy’s] RIVALS, which is a really slick shooter that carries sometimes up to a hundred thousand plus CCUs during a weekday, that are clearly attracting a much older” and male-skewing audience that more often play on PCs or consoles.

“The best way you can tell that is really looking at the Discord followers for a given game,” Ferencz added. “If you take a game like Brookhaven, for example, great game, absolutely massive franchise. It has not only very few Discord followers, but almost no Discord followers online” because its user base is quite young.

Conversely, “if you look at a game like War Tycoon, it has about the same number of followers, despite having a fraction of the users on Discord, and then a much larger number of Discord users online in absolute terms at any time.” This implies an older (and a male-skewing) audience, and a different hardware platform mix.

“If you look at the last six months specifically, or last eight months, which has been a really wild ride on Roblox, starting with Grow a Garden in April, we’ve seen the platform hitting pretty wild, insane numbers on the weekends.”

What I think is happening is a lot of early onset nostalgia. So, I think a lot of people who are now in their late teens and even early 20s who grew up with the platform are really excited to see it, as fans, like, hitting these new numbers that are just unbelievable, right? 25 million concurrent players, and in a single game, for example? 35 million concurrent players on the platform as a whole?

“I’m not sure they’re necessarily sticking around as daily players,” Ferencz continued. “They’re coming on to be part of the moments, and to sample some of the gameplay. And I think that a little bit of Roblox is becoming part of the ongoing gaming diet of a lot of older Gen Zs, and very young Millennial gamers who grew up with the platform.”

“There’s also a lot of parents co-playing in these events,” Ferencz said to Posner. “I don’t have any panel data to support that, but it’s what I hear from a lot of friends I know who have kids who are on Roblox….They all have accounts they’ve made so they can play Grow a Garden or Steal a Brainrot with their kids.”

I can vouch for this assessment. I have a ten year-old daughter who, somewhat inexplicably, happens to dislike (and has vowed to never play) Steal a Brainrot…but is all over the current #15 most popular experience, Dandy’s World.

Our daughter is as deep into Dandy’s World lore and its character relationships across TikTok, YouTube, Discord, and Roblox as any game I was into…perhaps ever.

The fan art is off the hook as well. I can only speak in depth about Dandy’s World, but that game has generated a social media whirlwind that has taken on a life of its own in the past year.

“If you look at Steal a Brainrot,” Ferencz continued, “you think to yourself, ‘Is this something that, you know, many 16 or 18 year-olds could spend time on regularly?’”

My answer to his rhetorical question is, “No.”

“What’s working is the same thing that works on TikTok,” Ferencz hypothesized. “What works on TikTok? Open up your phone, talk into it, set it up, do a dance, ship it…That’s what makes TikTok go. And analogously, that is what makes Roblox go. Code a game, ship it, see what happens.”

“I’ll give you an example of a game called DIG that I followed. It was made by part of the same people who made the game Fisch, which was a huge hit on Roblox and remains a top 20 game on the platform.” (As of early February, per RoMonitor, Fisch had slipped to #22.)

“They brought in all these YouTubers,” Ferencz continued. “They built a closed community for a paid beta, and it launched absolutely massively, with 80,000 concurrent users. That’s a good launch on any platform. That is a world-class launch.”

“And within a month it….essentially had no users at all, like, practically speaking, because the algorithm doesn’t care about launching games.”

So, DIG dug (yes, that was a pun for the OG gamers like me out there) itself a hole because its developers assumed, erroneously, that a concerted push by YouTubers would result in sustained Roblox CCU/DAU success. Even creators/developers who have tasted great success on the platform can’t replicate hits.

To me, the story of DIG implied that Roblox Corp. isn’t actually in control of its mercurial recommendation and discovery algorithm. What’s happening is that Roblox’s executives, like teachers on an elementary school playground, are endlessly chasing an emergent swarm of buzzing kids whose tastes and preferences are fickler and far more fleeting than their own.

Roblox has a streak of tiger cubs by the tail. The ever-dancing algorithm that Gamefam—and, presumably, almost every other large, native developer on Roblox—is following, to put it yet another way, is like a taut fishing line that’s pointing to a spot in the water that Roblox’s young user base has already vacated. Again, this state of affairs shares little in common with the yearslong, well-planned development cycle that has typified AAA development for decades. Big brands tend to have relatively staid marketing plans as well.

Ferencz is right: nether of these large groups of companies are inherently set up to succeed on Roblox. So what might be done about it?

Gamefam: AAA Game Studios’ and Big Brands’ Roblox…Concierge?

I think the era of huge tent, huge AAA games is, you know, maybe starting to evolve. I wouldn’t say it’s coming to an end, but it’s becoming one segment of the industry…Roblox is a now a billion-dollar-plus developer market and it’s continuing to grow. It’s been growing for 15 years. It’s not going to stop growing anytime soon…The network effects are there and it’s bigger than ever. So, it’s a really important segment, and it’s a segment that will be competing for market share from other segments over the coming years.—Joe Ferencz

Toward the end of the podcast, Posner asked Gu and Ferencz about “the biggest missteps” AAA studios make in their approach to Roblox.

“Discovery on Roblox is all driven by algorithm,” Gu responded. “That’s very, very different in the, like, AAA or traditional game development world, [where] what people are used to is more like…spend years making the game, and then they launch the game, they market the game.”

“Like Joe said, like, developing Roblox games these days takes about a couple of days.”

“I’m saying that not because we are partnering with Gamefam on the Roblox data,” Gu clarified. As Gu and Newzoo pointed out “in the report itself, I think it’s a wise option for AAA developers, at this moment, if they really want to tap into the Roblox platform, [that] it’s not really wise for them to actually start developing standalone experience themselves.”

“They don’t really understand the platform from their decades, years of experiences,” Gu concluded. “Partnering with native studios like Gamefam, I think, would be, like, you know, the much wiser option to go.”

Joe eagerly took that baton and ran with it.

“We welcome the partnership opportunities,” said Ferencz. “So, feel free to hit me up. And thank you for the call out, Tianyi, but I think that, in short, [in] AAA, there’s no demand for AAA content on Roblox right now at scale.”

“AAA developers have no place on the platform today whatsoever.”

“If they do come to the platform, they not only have no competitive advantage in terms of gaining users or building a business, but they’re massively disadvantaged versus the native developers.”

Ouch.

Gu jumped back in and asked Ferencz about his company’s work with AAA studios.

“Gamefam has worked with some of the AAA developers in the industry,” Gu said. “For instance, the Sonic Speed Simulator. So you work with Sega.”

Ferencz backpedaled.

“We have had some great success making what I would call AAA Roblox content. So Sonic Speed Simulator, when it launched, we had a really high-fidelity game.”

“It was actually made very quickly, almost, and, by necessity, to hit the movie launch dates. And so, in that regard, maybe it caught a little bit of the Roblox magic.”

Sonic the Hedgehog 2 debuted in movie theatres in late March, 2022. Sonic Speed Simulator debuted on Roblox in mid-April.

“It was actually the biggest launch in Roblox history at the time,” Ferencz added. “Again, all algorithmically driven, reaching up to 275,000 users in its second week, which, again, was the biggest launch ever, and remains one of the biggest launches.”

Gotcha. So AAA studios can ride and taste the Roblox rainbow…if they partner with a native developer like Gamefam.

“This is a bit subjective because what does AAA mean?” Ferencz wondered. “What does higher fidelity mean? But, you know, maybe measurable via just pure investment level of development work” is a good way to define AAA.

“There was a time when bigger projects with more production value were seeming to trend on Roblox,” he added. “That all changed 180 degrees when Grow a Garden came out in April” 2025.

“That created a trend for the absolute lowest complexity and lowest production design inspired games on the platform. And that trend has taken Roblox to new heights that no one even believed would have been possible…That is where the platform is at today. Where will the platform be at in six months?”

“It is a completely unpredictable market that functions at a zeitgeist that no one can predict or engineer.”

Precisely. Roblox Corp. is riding on the back of a runaway tiger. It’s taking Ferencz and company, and thousands upon thousands of other native developers, along for its wild ride. I bet it’s a lot of fun, and maybe that community will wind up in a tropical paradise. Maybe it’ll fly off a cliff, too. Perhaps what Tigger really needs a timeout and a juice box.

Ferencz is pretty confident the first path is the most likely outcome…but he’s not 100% sold that it’ll be an All’s Well That Ends Well situation.

“Roblox is undoubtedly the best place in the world to be launching new games as micro indie teams right now. Your chance of being commercially successful and creating meaningful income, making video games as a micro indie on Roblox, has never been better.”

“The opportunity for a company like ourselves to scale profitably into the tens of millions of dollars, as we have done, by that same measure, has never been more challenging.”

“We built a competitive advantage, and we have a huge data set that we can use to continue to find opportunities. And we built the largest third-party ad network on Roblox.”

Ferencz’s last statement appears to have been an allusion to WildBrain Spark, a separate company that has an exclusive ad partnership with Gamefam on Roblox.

“Trying to become a AAA studio on Roblox,” Ferencz concluded, “trying to build games in the way that people have been doing in mobile free-to-play, or PC indie…it is very unlikely to achieve commercial scale or success” on the platform.

Gamefam and AAA studios alike, rather, are better off “continuing to partner, as a third-party publisher, with, you know, the most creative and hardworking developers in the world, a lot of whom happen to be people in their late teens and early twenties, who are so motivated to create the next Grow a Garden.”

“We love working with those people. We love the spirit and energy they bring. And that is how we are trying to, kind of, compete in the algorithm race.”

Perhaps therein lies the real secret sauce to success on Roblox: using teens and young adults to divine and interpret the ever-shifting zeitgeist of preteen gamers.

To everyone outside that demographic, perhaps, Roblox’s algorithm is inscrutable and may as well be dead. Long live the algorithm.

I was the consulting executive producer for Hot Wheels video games from 2015 to 2020. It was a two day a week, give or take, gig. We were putting Hot Wheels into so many different gaming franchises…I was getting these different trend reports on my desk and one of them was mentioning Roblox consistently…I looked it up and I said, “What the heck is this?” Roblox at that time, back in 2016, I believe, had about 30 million MAU [monthly active users]. Right now it’s got 150 million DAUs [daily active users]…In 2018, I could see it really starting to hockey stick up in terms of both users and revenue…I started bootstrapping some games. And I said, “I think this could be a real business that could make a real impact on the gaming industry.” So I started Gamefam.—Joe Ferencz

Late last year, Gamefam CEO Joe Ferencz and Newzoo Gaming Analyst Tianyi Gu joined Player Driven host Greg Posner to talk Roblox, especially in regard to the platform’s creator/developer and player community dynamics. The full episode is here (and it’s probably on your preferred podcast platform as well); what follows is a partial summary of, and a partial expansion upon the ground covered in that episode.

Two housekeeping notes before we dig into the meat and veggies of the discussion.

First, Ferencz and Gu were on a joint press tour at the time, touting Newzoo’s recently released Free Global Games Market Report 2025. Among other topics, the report included several Roblox-related insights that, in turn, were partly based on data that Gamefam collected. More specifically, Gamefam runs a service called RoMonitor that pulls data from Roblox’s APIs and nests that data in a slick tool that’s used to assess the performance of Roblox experiences and the creators/developers behind them. (If you’re unfamiliar with Roblox, it’s a social video game-oriented platform that offers a suite of tools that are used by a large community of external creators/studios to build the experiences that Roblox’s huge, young-skewing player/user base enjoys, and these creators collect a share of related player/user spending.)

Second, Gamefam has a vested interest in putting a positive spin on what’s happening on Roblox because (1) the company makes and supports first-party games and experiences on the platform and so, broadly speaking, the company does better if Roblox does better, and (2) Gamefam is in the business of helping video game studios and nongaming brands that aren’t on Roblox get onto the platform and, hopefully, achieve their business objectives. Gamefam’s home page currently states that the company aims to unleash “the potential of metaverse gaming for brands,” and touts the fact that the company has run 115+ campaigns for a range of brands.

With that context out of the way, let’s get to it.

Two topics Ferencz and Gu agreed upon right off the bat were that the typical Roblox player skews quite young and that mobile phones and tablets remain their preferred access channel. The aforementioned Newzoo report, for example, found that 29% of Roblox users were 10-15 years old (although Gu added Newzoo didn’t survey players <10 and said self-reporting in this age group can make the results sketchy; Roblox Corp. itself reported that 40% of its players/users worldwide were <13 in 2024).

However, “the 13+ group is growing faster,” Gu explained to Posner during their late 2025 exchange. Ge added added that most players “access the Roblox platform, or content on Roblox, through a mobile. And for Roblox players, they actually also engage with other gaming content through PC and console.”

Roblox Corp. reported that 80% of the platform’s DAUs accessed it through a mobile device in 2024, 17% were on PCs, and 3% used game consoles.

“Roblox released recently on PlayStation,” Gu continued. The company recently “reported out that it already captured about 3% of total playtime on PlayStation.”

In addition to touting RoMonitor, Ferencz was quick to honk Gamefam’s horn early in the discussion.

“We were the first ever professional Roblox studio,” Ferencz said. “We built the company by both making games and acquiring games. And so, you know, some of our biggest franchises right now are War Tycoon, the number one military game on Roblox, and Sonic Speed Simulator, the number one all-time IP game on Roblox, and Super League Soccer, which is a huge soccer game” that was recently rebranded FIFA Super Soccer!

My quick review of RoMonitor on the last day of January, 2026, showed that Gamefam was sixth on the list of Roblox’s largest developers, as measured by cumulative player/user visits.

Total visits to Playfam-related experiences on Roblox sits at >30.6 billion currently. That sounds impressive—and it is—until you move up to the top slot and notice that Brookhaven has racked up >78.1 billion total visits—and has done so based on two experiences compared to Playfam’s 90.

They say the grass in Brookhaven is always greener…

For what it’s worth, RoMonitor results additionally showed that some of Roblox’s most popular experiences, including Brookhaven, easily top a million live or concurrent users (CCUs). The scale of Roblox’s player/user base can, at times, be difficult to wrap one’s head around.

RoMonitor’s #2 developer slot at the end of January, as the above figure shows, was held by Gamer Robot; their biggest title was Blox Fruits. Third place went to BRAZILIAN SPYDER, maker of Steal a Brainrot. Fourth went to Uplift Games, the developer of Adopt Me! The fifth slot went to The Garden Game, maker of Grow a Garden. All of Roblox’s top six development studios generated >6 million daily visits across their content portfolios, but BRAZILIAN SPYDER was head and shoulders above the rest, at a whopping 147+ million.

Read on to learn:

What makes Roblox’s algorithm so vital to platform creator success

Why most game studios and brands have a difficult time making sustained inroads on Roblox

How some game studios and brands—with an assist from Gamefam—have found a way to taste the rainbow…I mean, taste the Robux.

Oh, and if you haven’t subscribed, what’s the holdup, pardner?

All Hail the Opaque, Mercurial Algorithm That Serves Roblox’s Elusive Quest For Profit

You [Greg Posner] asked how important, I think, is the algorithm…My belief, based on all of the data I have available, as well as seeing the data on a number of the top five games that have come up over the last year on Roblox, as they were coming up, is that [the] algorithm is not only king, but it’s king, queen, jack, ten, nine, eight, seven, six, five, four, three, two, ace.—Joe Ferencz

In the calendar year 2024, Roblox Corp. lost approximately $935 million. Cumulatively, through early 2025, the company appears to have racked up >$4 billion in losses. In this light, it’s understandable that Roblox’s executive team has been on a quest to identify a means of converting its massive and growing audience of kids and young adults into a revenue stream that routinely exceeds the company’s operating costs, while also not killing the proverbial golden goose.

“Algorithm is currently everything on Roblox,” Gamefam’s CEO Joe Ferencz repeatedly underscored to Player Driven host Greg Posner in their late 2025 discussion. “In fact, they’re A-B testing, lately, the continue playing bar. So, even if someone played your game yesterday, they may not even see that game in the continue playing bar in its sequential order in which you played it. So, developers are having less and less control at this time over the impressions for their page.”

Ouch.

“What we’re doing at Gamefam,” Ferencz added, “is not only continuing to live operate our existing games, [but to] grow those games, by knowing how the algorithm has changed, and targeting the right metrics.”

“We have tripled the users in Super League Soccer over the last three months. We picked a metric to target. It was the right metric. We achieved growth on that metric and we have been rewarded by the algorithm with a humongous amount of new users.”

That may be true, but the “right metric” for this game undoubtedly also involved its FIFA partnership. As previously noted, Gamefam’s Super League Soccer was rebranded FIFA Super Soccer! in December. That game is now FIFA’s official Roblox experience. In fact, FIFA temporarily took over Super League Soccer in June and July of last year while the FIFA Club World Cup was underway, yielding a massive spike in new users, according to a recent GamesIndustry.biz article. It may well be that the impact of Gamefam’s “gaming of the algorithm” paled in comparison to the boost that FIFA’s promotional tailwind gave the game late last year.

FIFA Super Soccer! may also be Gamefam’s top game in early 2026, at measured by CCUs. At a minimum, both of the other experiences that Ferencz called out to Ponser early on in their discussion—War Tycoon and Sonic Speed Simulator—had lower CCUs on RoMonitor at the end of January than did FIFA Super Soccer! As shown below, the game came in #108 on Roblox’s most popular experiences list by CCUs.

To be clear, that’s an excellent result. There are literally millions of experiences currently on Roblox. Being in or near the top 100 is a rare and difficult feat.

Ferencz told Posner that another of Gamefam’s strategies is to build and release quickly, and if an experience resonates, iterate quickly.

“We’re also making very quick casual games at the company,” Ferencz said. “If you look at the games that are winning on the platform at scale, almost all of them were made in one week or less. This is the era of trendy viral gaming, and we are participating in it.”

“For example, we have a game called Hop that we made in a few days. It’s about two frogs that are tied together at the tongue and they have to go through a platformer together. Multiplayer, right? Social gaming. And again, we spent a few days making this game and it’s already generating tens of thousands of dollars in profits for the company just after a few days.”

“That’s a great business model that we’re really excited to participate in.”

The game Ferencz referenced appears to be this one, per RoMonitor. In recent weeks, Hop’s daily visits have averaged 125,000-175,000. The game’s CCU was also close to 500 when I checked in early February. If the game has indeed generated >$10,000 in profit for Gamefam weekly in recent months, then Ferencz’s bet on Gamefam must be paying off handsomely. It does beg a larger question, however: if Hop, a game that’s way, way, way outside the top 100 by daily visits and CCUs, is so profitable for Gamefam, then how is it possible that Roblox Corp.—which by all accounts collects about half of all player/user spending—has had such a consistently negative net margin?

I’ll leave the squaring of that financial circle to those who are more adept at interpreting balance sheets that I am.

Posner then asked Ferencz how Gamefam drives traffic to such microgames.

“It’s luck of the algorithm, I guess,” responded Ferencz. “The algorithm is searching for KPIs that Roblox has decided are in the interest of their overall platform.”

“My experience as a Roblox developer is that working with Roblox [Corp.] is great. They’re fantastic partners, but they have a business to run and their business is measured on share price. And they are looking at how they can hit their internal KPIs.”

“It’s on us to be in synchronicity with what they’re trying to do, and understand, as best we can from the tea leaves, what is important to them.”

“Having a portfolio of games as we do at GameFam,” Ferencz continued, “has given us a great advantage in that [effort] because we can see things that are working in some games…‘Okay, that must be a metric that the algorithm is now prioritizing. Let’s go and target that metric in our other games.’ And so that’s the way we’re approaching it at Gamefam.”

“In my seven years on Roblox…the one thing that is most consistent is [that] the algorithm will change. There were times when the algorithm was very predictable, and we are in a time right now where the algorithm is extremely dynamic.”

The algorithm, the algorithm, the algorithm! It must feel like dancing in the dark with a partner who demands to lead and has a big repertoire of steps, and drip to boot.

“I believe that Roblox has some internal ways of segmenting users,” Ferencz told Posner. They’re “targeting different games with different users to try again to achieve the metrics that are important to Roblox.”

“It’s pretty opaque to us as developers in a lot of ways. What we do have is a lot of signals. So, Roblox has given us a lot of algorithmic signal data across different metrics….We have dashboards with, I don’t know, we probably look at 25 different charts on a daily and weekly basis that are from the Roblox native dashboards. And then we have some proprietary measurements that we do, as well, through third party data services.”

“At the end of the day, it’s impressions, right? You know, acquisition, retention, monetization. The fundamentals of free-to-play gaming are still very true on Roblox, but they, they manifest in a fundamentally different way because acquisition is essentially fully dependent on the algorithm.”

Since Roblox’s “ARPDAU and LTVs [are] relatively low compared to mobile free-to-play, you’re not going to have a game on Roblox where you’re going, as a developer, to net a $1 ARPDAU.” (Note: ARPDAU is an acronym for average revenue per daily active user and LTV is shorthand for lifetime value.)

“We’ve never seen data that even approaches that level” of ARPDAU, Ferencz continued. “What that means is you need a lot of users, right? You need a lot of user volume to make a game successful.”

The only way to get the type of volume you need to make a game commercially successful on Roblox today is through algorithmic discovery.

“Soon enough,” Ferencz added, “what we’re doing will stop working and we’ll be scratching our heads and looking around at each other and trying to, you know, look through the data and figure out, ‘Okay, what’s the next signal that now Roblox wants to prioritize?’ And then targeting that signal. And we’ve been doing this, as I said, for almost seven years now.”

Ferencz and company have undoubtedly become skilled at picking up and dancing to Roblox’s ever-changing algorithmic tune. That skill is unnecessary in 99 out of 100 traditional game development projects. In that context, studios and publishers are either part of the same company, or if not, they’re still dancing to a deeply choreographed, mutually shared, and mutually agreed upon routine. Perhaps more than anything else, it was the opaque misalignment between Roblox Corp. and its creator/developer community that stood out most starkly in Ferencz’s, Gu’s, and Posner’s discussion.

Why Roblox’s Distinctive Characteristics Make It Tough For AAA Studios and Brands to Succeed

As an influencer who makes YouTube or TikTok content, you cannot make a game sticky…All you can do is get people to sample a game on the first few days it’s out. And because the…competitive attention economy on Roblox is arguably the most competitive in the world, if the game doesn’t catch the attention of players at large, there’s nothing that can make them want to keep playing the game except, “Are they having fun? Do they like the game?” And no one can currently predict which games they’re going to like.—Joe Ferencz

“Roblox is the same slice of the internet that TikTok and YouTube and Snap and Instagram and inhabit,” Gamefam CEO Joe Ferencz told Player Driven host Greg Posner late last year.

Apart from Roblox’s fickle recommendation/discovery algorithm, traditional game studios and brands that would like to grab a slice of the platform’s attention economy pie are also challenged (1) by the curious behavior of its remarkably young user base, (2) the fact that spending is broadly gated by parents/guardians, and (3) because some of the experiences have disproportionate appeal on PCs and consoles, which raises distinctive development and balancing challenges.

For some “AAA or even AA developers,” Newzoo’s Gaming Analyst Tianyi Gu explained to Posner, “I think there’s a knowledge gap still there…[A] lot of developers think Roblox is more like a black box.”

“They really want to understand the audiences on the platform [and] also their, like, behavior on the platform,” Gu continued. Traditional developers “want to find a way to kind of, like, bring some of the Roblox players to their ecosystems, to their games.”

Not so fast, said Ferencz.

“If you look at the top games on the platform, which are, you know, Steal a Brainrot, Grow a Garden, 99 Nights in the Forest, Brookhaven,” Ferencz said, “it really depends on the age group. The younger the game skews, and the more spread out in gender demographics the game skews, the more players are going tend to be on mobile phones.”

“There are games such as [our] War Tycoon, or [Nosniy’s] RIVALS, which is a really slick shooter that carries sometimes up to a hundred thousand plus CCUs during a weekday, that are clearly attracting a much older” and male-skewing audience that more often play on PCs or consoles.

“The best way you can tell that is really looking at the Discord followers for a given game,” Ferencz added. “If you take a game like Brookhaven, for example, great game, absolutely massive franchise. It has not only very few Discord followers, but almost no Discord followers online” because its user base is quite young.

Conversely, “if you look at a game like War Tycoon, it has about the same number of followers, despite having a fraction of the users on Discord, and then a much larger number of Discord users online in absolute terms at any time.” This implies an older (and a male-skewing) audience, and a different hardware platform mix.

“If you look at the last six months specifically, or last eight months, which has been a really wild ride on Roblox, starting with Grow a Garden in April, we’ve seen the platform hitting pretty wild, insane numbers on the weekends.”

What I think is happening is a lot of early onset nostalgia. So, I think a lot of people who are now in their late teens and even early 20s who grew up with the platform are really excited to see it, as fans, like, hitting these new numbers that are just unbelievable, right? 25 million concurrent players, and in a single game, for example? 35 million concurrent players on the platform as a whole?

“I’m not sure they’re necessarily sticking around as daily players,” Ferencz continued. “They’re coming on to be part of the moments, and to sample some of the gameplay. And I think that a little bit of Roblox is becoming part of the ongoing gaming diet of a lot of older Gen Zs, and very young Millennial gamers who grew up with the platform.”

“There’s also a lot of parents co-playing in these events,” Ferencz said to Posner. “I don’t have any panel data to support that, but it’s what I hear from a lot of friends I know who have kids who are on Roblox….They all have accounts they’ve made so they can play Grow a Garden or Steal a Brainrot with their kids.”

I can vouch for this assessment. I have a ten year-old daughter who, somewhat inexplicably, happens to dislike (and has vowed to never play) Steal a Brainrot…but is all over the current #15 most popular experience, Dandy’s World.

Our daughter is as deep into Dandy’s World lore and its character relationships across TikTok, YouTube, Discord, and Roblox as any game I was into…perhaps ever.

The fan art is off the hook as well. I can only speak in depth about Dandy’s World, but that game has generated a social media whirlwind that has taken on a life of its own in the past year.

“If you look at Steal a Brainrot,” Ferencz continued, “you think to yourself, ‘Is this something that, you know, many 16 or 18 year-olds could spend time on regularly?’”

My answer to his rhetorical question is, “No.”

“What’s working is the same thing that works on TikTok,” Ferencz hypothesized. “What works on TikTok? Open up your phone, talk into it, set it up, do a dance, ship it…That’s what makes TikTok go. And analogously, that is what makes Roblox go. Code a game, ship it, see what happens.”

“I’ll give you an example of a game called DIG that I followed. It was made by part of the same people who made the game Fisch, which was a huge hit on Roblox and remains a top 20 game on the platform.” (As of early February, per RoMonitor, Fisch had slipped to #22.)

“They brought in all these YouTubers,” Ferencz continued. “They built a closed community for a paid beta, and it launched absolutely massively, with 80,000 concurrent users. That’s a good launch on any platform. That is a world-class launch.”

“And within a month it….essentially had no users at all, like, practically speaking, because the algorithm doesn’t care about launching games.”

So, DIG dug (yes, that was a pun for the OG gamers like me out there) itself a hole because its developers assumed, erroneously, that a concerted push by YouTubers would result in sustained Roblox CCU/DAU success. Even creators/developers who have tasted great success on the platform can’t replicate hits.

To me, the story of DIG implied that Roblox Corp. isn’t actually in control of its mercurial recommendation and discovery algorithm. What’s happening is that Roblox’s executives, like teachers on an elementary school playground, are endlessly chasing an emergent swarm of buzzing kids whose tastes and preferences are fickler and far more fleeting than their own.

Roblox has a streak of tiger cubs by the tail. The ever-dancing algorithm that Gamefam—and, presumably, almost every other large, native developer on Roblox—is following, to put it yet another way, is like a taut fishing line that’s pointing to a spot in the water that Roblox’s young user base has already vacated. Again, this state of affairs shares little in common with the yearslong, well-planned development cycle that has typified AAA development for decades. Big brands tend to have relatively staid marketing plans as well.

Ferencz is right: nether of these large groups of companies are inherently set up to succeed on Roblox. So what might be done about it?

Gamefam: AAA Game Studios’ and Big Brands’ Roblox…Concierge?

I think the era of huge tent, huge AAA games is, you know, maybe starting to evolve. I wouldn’t say it’s coming to an end, but it’s becoming one segment of the industry…Roblox is a now a billion-dollar-plus developer market and it’s continuing to grow. It’s been growing for 15 years. It’s not going to stop growing anytime soon…The network effects are there and it’s bigger than ever. So, it’s a really important segment, and it’s a segment that will be competing for market share from other segments over the coming years.—Joe Ferencz

Toward the end of the podcast, Posner asked Gu and Ferencz about “the biggest missteps” AAA studios make in their approach to Roblox.

“Discovery on Roblox is all driven by algorithm,” Gu responded. “That’s very, very different in the, like, AAA or traditional game development world, [where] what people are used to is more like…spend years making the game, and then they launch the game, they market the game.”

“Like Joe said, like, developing Roblox games these days takes about a couple of days.”

“I’m saying that not because we are partnering with Gamefam on the Roblox data,” Gu clarified. As Gu and Newzoo pointed out “in the report itself, I think it’s a wise option for AAA developers, at this moment, if they really want to tap into the Roblox platform, [that] it’s not really wise for them to actually start developing standalone experience themselves.”

“They don’t really understand the platform from their decades, years of experiences,” Gu concluded. “Partnering with native studios like Gamefam, I think, would be, like, you know, the much wiser option to go.”

Joe eagerly took that baton and ran with it.

“We welcome the partnership opportunities,” said Ferencz. “So, feel free to hit me up. And thank you for the call out, Tianyi, but I think that, in short, [in] AAA, there’s no demand for AAA content on Roblox right now at scale.”

“AAA developers have no place on the platform today whatsoever.”

“If they do come to the platform, they not only have no competitive advantage in terms of gaining users or building a business, but they’re massively disadvantaged versus the native developers.”

Ouch.

Gu jumped back in and asked Ferencz about his company’s work with AAA studios.

“Gamefam has worked with some of the AAA developers in the industry,” Gu said. “For instance, the Sonic Speed Simulator. So you work with Sega.”

Ferencz backpedaled.

“We have had some great success making what I would call AAA Roblox content. So Sonic Speed Simulator, when it launched, we had a really high-fidelity game.”

“It was actually made very quickly, almost, and, by necessity, to hit the movie launch dates. And so, in that regard, maybe it caught a little bit of the Roblox magic.”

Sonic the Hedgehog 2 debuted in movie theatres in late March, 2022. Sonic Speed Simulator debuted on Roblox in mid-April.

“It was actually the biggest launch in Roblox history at the time,” Ferencz added. “Again, all algorithmically driven, reaching up to 275,000 users in its second week, which, again, was the biggest launch ever, and remains one of the biggest launches.”

Gotcha. So AAA studios can ride and taste the Roblox rainbow…if they partner with a native developer like Gamefam.

“This is a bit subjective because what does AAA mean?” Ferencz wondered. “What does higher fidelity mean? But, you know, maybe measurable via just pure investment level of development work” is a good way to define AAA.

“There was a time when bigger projects with more production value were seeming to trend on Roblox,” he added. “That all changed 180 degrees when Grow a Garden came out in April” 2025.

“That created a trend for the absolute lowest complexity and lowest production design inspired games on the platform. And that trend has taken Roblox to new heights that no one even believed would have been possible…That is where the platform is at today. Where will the platform be at in six months?”

“It is a completely unpredictable market that functions at a zeitgeist that no one can predict or engineer.”

Precisely. Roblox Corp. is riding on the back of a runaway tiger. It’s taking Ferencz and company, and thousands upon thousands of other native developers, along for its wild ride. I bet it’s a lot of fun, and maybe that community will wind up in a tropical paradise. Maybe it’ll fly off a cliff, too. Perhaps what Tigger really needs a timeout and a juice box.

Ferencz is pretty confident the first path is the most likely outcome…but he’s not 100% sold that it’ll be an All’s Well That Ends Well situation.

“Roblox is undoubtedly the best place in the world to be launching new games as micro indie teams right now. Your chance of being commercially successful and creating meaningful income, making video games as a micro indie on Roblox, has never been better.”

“The opportunity for a company like ourselves to scale profitably into the tens of millions of dollars, as we have done, by that same measure, has never been more challenging.”

“We built a competitive advantage, and we have a huge data set that we can use to continue to find opportunities. And we built the largest third-party ad network on Roblox.”

Ferencz’s last statement appears to have been an allusion to WildBrain Spark, a separate company that has an exclusive ad partnership with Gamefam on Roblox.

“Trying to become a AAA studio on Roblox,” Ferencz concluded, “trying to build games in the way that people have been doing in mobile free-to-play, or PC indie…it is very unlikely to achieve commercial scale or success” on the platform.

Gamefam and AAA studios alike, rather, are better off “continuing to partner, as a third-party publisher, with, you know, the most creative and hardworking developers in the world, a lot of whom happen to be people in their late teens and early twenties, who are so motivated to create the next Grow a Garden.”

“We love working with those people. We love the spirit and energy they bring. And that is how we are trying to, kind of, compete in the algorithm race.”

Perhaps therein lies the real secret sauce to success on Roblox: using teens and young adults to divine and interpret the ever-shifting zeitgeist of preteen gamers.

To everyone outside that demographic, perhaps, Roblox’s algorithm is inscrutable and may as well be dead. Long live the algorithm.

I was the consulting executive producer for Hot Wheels video games from 2015 to 2020. It was a two day a week, give or take, gig. We were putting Hot Wheels into so many different gaming franchises…I was getting these different trend reports on my desk and one of them was mentioning Roblox consistently…I looked it up and I said, “What the heck is this?” Roblox at that time, back in 2016, I believe, had about 30 million MAU [monthly active users]. Right now it’s got 150 million DAUs [daily active users]…In 2018, I could see it really starting to hockey stick up in terms of both users and revenue…I started bootstrapping some games. And I said, “I think this could be a real business that could make a real impact on the gaming industry.” So I started Gamefam.—Joe Ferencz

Late last year, Gamefam CEO Joe Ferencz and Newzoo Gaming Analyst Tianyi Gu joined Player Driven host Greg Posner to talk Roblox, especially in regard to the platform’s creator/developer and player community dynamics. The full episode is here (and it’s probably on your preferred podcast platform as well); what follows is a partial summary of, and a partial expansion upon the ground covered in that episode.

Two housekeeping notes before we dig into the meat and veggies of the discussion.

First, Ferencz and Gu were on a joint press tour at the time, touting Newzoo’s recently released Free Global Games Market Report 2025. Among other topics, the report included several Roblox-related insights that, in turn, were partly based on data that Gamefam collected. More specifically, Gamefam runs a service called RoMonitor that pulls data from Roblox’s APIs and nests that data in a slick tool that’s used to assess the performance of Roblox experiences and the creators/developers behind them. (If you’re unfamiliar with Roblox, it’s a social video game-oriented platform that offers a suite of tools that are used by a large community of external creators/studios to build the experiences that Roblox’s huge, young-skewing player/user base enjoys, and these creators collect a share of related player/user spending.)

Second, Gamefam has a vested interest in putting a positive spin on what’s happening on Roblox because (1) the company makes and supports first-party games and experiences on the platform and so, broadly speaking, the company does better if Roblox does better, and (2) Gamefam is in the business of helping video game studios and nongaming brands that aren’t on Roblox get onto the platform and, hopefully, achieve their business objectives. Gamefam’s home page currently states that the company aims to unleash “the potential of metaverse gaming for brands,” and touts the fact that the company has run 115+ campaigns for a range of brands.

With that context out of the way, let’s get to it.

Two topics Ferencz and Gu agreed upon right off the bat were that the typical Roblox player skews quite young and that mobile phones and tablets remain their preferred access channel. The aforementioned Newzoo report, for example, found that 29% of Roblox users were 10-15 years old (although Gu added Newzoo didn’t survey players <10 and said self-reporting in this age group can make the results sketchy; Roblox Corp. itself reported that 40% of its players/users worldwide were <13 in 2024).

However, “the 13+ group is growing faster,” Gu explained to Posner during their late 2025 exchange. Ge added added that most players “access the Roblox platform, or content on Roblox, through a mobile. And for Roblox players, they actually also engage with other gaming content through PC and console.”

Roblox Corp. reported that 80% of the platform’s DAUs accessed it through a mobile device in 2024, 17% were on PCs, and 3% used game consoles.

“Roblox released recently on PlayStation,” Gu continued. The company recently “reported out that it already captured about 3% of total playtime on PlayStation.”

In addition to touting RoMonitor, Ferencz was quick to honk Gamefam’s horn early in the discussion.

“We were the first ever professional Roblox studio,” Ferencz said. “We built the company by both making games and acquiring games. And so, you know, some of our biggest franchises right now are War Tycoon, the number one military game on Roblox, and Sonic Speed Simulator, the number one all-time IP game on Roblox, and Super League Soccer, which is a huge soccer game” that was recently rebranded FIFA Super Soccer!

My quick review of RoMonitor on the last day of January, 2026, showed that Gamefam was sixth on the list of Roblox’s largest developers, as measured by cumulative player/user visits.

Total visits to Playfam-related experiences on Roblox sits at >30.6 billion currently. That sounds impressive—and it is—until you move up to the top slot and notice that Brookhaven has racked up >78.1 billion total visits—and has done so based on two experiences compared to Playfam’s 90.

They say the grass in Brookhaven is always greener…

For what it’s worth, RoMonitor results additionally showed that some of Roblox’s most popular experiences, including Brookhaven, easily top a million live or concurrent users (CCUs). The scale of Roblox’s player/user base can, at times, be difficult to wrap one’s head around.

RoMonitor’s #2 developer slot at the end of January, as the above figure shows, was held by Gamer Robot; their biggest title was Blox Fruits. Third place went to BRAZILIAN SPYDER, maker of Steal a Brainrot. Fourth went to Uplift Games, the developer of Adopt Me! The fifth slot went to The Garden Game, maker of Grow a Garden. All of Roblox’s top six development studios generated >6 million daily visits across their content portfolios, but BRAZILIAN SPYDER was head and shoulders above the rest, at a whopping 147+ million.

Read on to learn:

What makes Roblox’s algorithm so vital to platform creator success

Why most game studios and brands have a difficult time making sustained inroads on Roblox

How some game studios and brands—with an assist from Gamefam—have found a way to taste the rainbow…I mean, taste the Robux.

Oh, and if you haven’t subscribed, what’s the holdup, pardner?

All Hail the Opaque, Mercurial Algorithm That Serves Roblox’s Elusive Quest For Profit

You [Greg Posner] asked how important, I think, is the algorithm…My belief, based on all of the data I have available, as well as seeing the data on a number of the top five games that have come up over the last year on Roblox, as they were coming up, is that [the] algorithm is not only king, but it’s king, queen, jack, ten, nine, eight, seven, six, five, four, three, two, ace.—Joe Ferencz

In the calendar year 2024, Roblox Corp. lost approximately $935 million. Cumulatively, through early 2025, the company appears to have racked up >$4 billion in losses. In this light, it’s understandable that Roblox’s executive team has been on a quest to identify a means of converting its massive and growing audience of kids and young adults into a revenue stream that routinely exceeds the company’s operating costs, while also not killing the proverbial golden goose.

“Algorithm is currently everything on Roblox,” Gamefam’s CEO Joe Ferencz repeatedly underscored to Player Driven host Greg Posner in their late 2025 discussion. “In fact, they’re A-B testing, lately, the continue playing bar. So, even if someone played your game yesterday, they may not even see that game in the continue playing bar in its sequential order in which you played it. So, developers are having less and less control at this time over the impressions for their page.”

Ouch.

“What we’re doing at Gamefam,” Ferencz added, “is not only continuing to live operate our existing games, [but to] grow those games, by knowing how the algorithm has changed, and targeting the right metrics.”

“We have tripled the users in Super League Soccer over the last three months. We picked a metric to target. It was the right metric. We achieved growth on that metric and we have been rewarded by the algorithm with a humongous amount of new users.”

That may be true, but the “right metric” for this game undoubtedly also involved its FIFA partnership. As previously noted, Gamefam’s Super League Soccer was rebranded FIFA Super Soccer! in December. That game is now FIFA’s official Roblox experience. In fact, FIFA temporarily took over Super League Soccer in June and July of last year while the FIFA Club World Cup was underway, yielding a massive spike in new users, according to a recent GamesIndustry.biz article. It may well be that the impact of Gamefam’s “gaming of the algorithm” paled in comparison to the boost that FIFA’s promotional tailwind gave the game late last year.

FIFA Super Soccer! may also be Gamefam’s top game in early 2026, at measured by CCUs. At a minimum, both of the other experiences that Ferencz called out to Ponser early on in their discussion—War Tycoon and Sonic Speed Simulator—had lower CCUs on RoMonitor at the end of January than did FIFA Super Soccer! As shown below, the game came in #108 on Roblox’s most popular experiences list by CCUs.

To be clear, that’s an excellent result. There are literally millions of experiences currently on Roblox. Being in or near the top 100 is a rare and difficult feat.

Ferencz told Posner that another of Gamefam’s strategies is to build and release quickly, and if an experience resonates, iterate quickly.

“We’re also making very quick casual games at the company,” Ferencz said. “If you look at the games that are winning on the platform at scale, almost all of them were made in one week or less. This is the era of trendy viral gaming, and we are participating in it.”

“For example, we have a game called Hop that we made in a few days. It’s about two frogs that are tied together at the tongue and they have to go through a platformer together. Multiplayer, right? Social gaming. And again, we spent a few days making this game and it’s already generating tens of thousands of dollars in profits for the company just after a few days.”

“That’s a great business model that we’re really excited to participate in.”

The game Ferencz referenced appears to be this one, per RoMonitor. In recent weeks, Hop’s daily visits have averaged 125,000-175,000. The game’s CCU was also close to 500 when I checked in early February. If the game has indeed generated >$10,000 in profit for Gamefam weekly in recent months, then Ferencz’s bet on Gamefam must be paying off handsomely. It does beg a larger question, however: if Hop, a game that’s way, way, way outside the top 100 by daily visits and CCUs, is so profitable for Gamefam, then how is it possible that Roblox Corp.—which by all accounts collects about half of all player/user spending—has had such a consistently negative net margin?

I’ll leave the squaring of that financial circle to those who are more adept at interpreting balance sheets that I am.

Posner then asked Ferencz how Gamefam drives traffic to such microgames.

“It’s luck of the algorithm, I guess,” responded Ferencz. “The algorithm is searching for KPIs that Roblox has decided are in the interest of their overall platform.”

“My experience as a Roblox developer is that working with Roblox [Corp.] is great. They’re fantastic partners, but they have a business to run and their business is measured on share price. And they are looking at how they can hit their internal KPIs.”

“It’s on us to be in synchronicity with what they’re trying to do, and understand, as best we can from the tea leaves, what is important to them.”

“Having a portfolio of games as we do at GameFam,” Ferencz continued, “has given us a great advantage in that [effort] because we can see things that are working in some games…‘Okay, that must be a metric that the algorithm is now prioritizing. Let’s go and target that metric in our other games.’ And so that’s the way we’re approaching it at Gamefam.”

“In my seven years on Roblox…the one thing that is most consistent is [that] the algorithm will change. There were times when the algorithm was very predictable, and we are in a time right now where the algorithm is extremely dynamic.”

The algorithm, the algorithm, the algorithm! It must feel like dancing in the dark with a partner who demands to lead and has a big repertoire of steps, and drip to boot.

“I believe that Roblox has some internal ways of segmenting users,” Ferencz told Posner. They’re “targeting different games with different users to try again to achieve the metrics that are important to Roblox.”

“It’s pretty opaque to us as developers in a lot of ways. What we do have is a lot of signals. So, Roblox has given us a lot of algorithmic signal data across different metrics….We have dashboards with, I don’t know, we probably look at 25 different charts on a daily and weekly basis that are from the Roblox native dashboards. And then we have some proprietary measurements that we do, as well, through third party data services.”

“At the end of the day, it’s impressions, right? You know, acquisition, retention, monetization. The fundamentals of free-to-play gaming are still very true on Roblox, but they, they manifest in a fundamentally different way because acquisition is essentially fully dependent on the algorithm.”

Since Roblox’s “ARPDAU and LTVs [are] relatively low compared to mobile free-to-play, you’re not going to have a game on Roblox where you’re going, as a developer, to net a $1 ARPDAU.” (Note: ARPDAU is an acronym for average revenue per daily active user and LTV is shorthand for lifetime value.)

“We’ve never seen data that even approaches that level” of ARPDAU, Ferencz continued. “What that means is you need a lot of users, right? You need a lot of user volume to make a game successful.”

The only way to get the type of volume you need to make a game commercially successful on Roblox today is through algorithmic discovery.

“Soon enough,” Ferencz added, “what we’re doing will stop working and we’ll be scratching our heads and looking around at each other and trying to, you know, look through the data and figure out, ‘Okay, what’s the next signal that now Roblox wants to prioritize?’ And then targeting that signal. And we’ve been doing this, as I said, for almost seven years now.”

Ferencz and company have undoubtedly become skilled at picking up and dancing to Roblox’s ever-changing algorithmic tune. That skill is unnecessary in 99 out of 100 traditional game development projects. In that context, studios and publishers are either part of the same company, or if not, they’re still dancing to a deeply choreographed, mutually shared, and mutually agreed upon routine. Perhaps more than anything else, it was the opaque misalignment between Roblox Corp. and its creator/developer community that stood out most starkly in Ferencz’s, Gu’s, and Posner’s discussion.

Why Roblox’s Distinctive Characteristics Make It Tough For AAA Studios and Brands to Succeed

As an influencer who makes YouTube or TikTok content, you cannot make a game sticky…All you can do is get people to sample a game on the first few days it’s out. And because the…competitive attention economy on Roblox is arguably the most competitive in the world, if the game doesn’t catch the attention of players at large, there’s nothing that can make them want to keep playing the game except, “Are they having fun? Do they like the game?” And no one can currently predict which games they’re going to like.—Joe Ferencz

“Roblox is the same slice of the internet that TikTok and YouTube and Snap and Instagram and inhabit,” Gamefam CEO Joe Ferencz told Player Driven host Greg Posner late last year.

Apart from Roblox’s fickle recommendation/discovery algorithm, traditional game studios and brands that would like to grab a slice of the platform’s attention economy pie are also challenged (1) by the curious behavior of its remarkably young user base, (2) the fact that spending is broadly gated by parents/guardians, and (3) because some of the experiences have disproportionate appeal on PCs and consoles, which raises distinctive development and balancing challenges.

For some “AAA or even AA developers,” Newzoo’s Gaming Analyst Tianyi Gu explained to Posner, “I think there’s a knowledge gap still there…[A] lot of developers think Roblox is more like a black box.”

“They really want to understand the audiences on the platform [and] also their, like, behavior on the platform,” Gu continued. Traditional developers “want to find a way to kind of, like, bring some of the Roblox players to their ecosystems, to their games.”

Not so fast, said Ferencz.

“If you look at the top games on the platform, which are, you know, Steal a Brainrot, Grow a Garden, 99 Nights in the Forest, Brookhaven,” Ferencz said, “it really depends on the age group. The younger the game skews, and the more spread out in gender demographics the game skews, the more players are going tend to be on mobile phones.”

“There are games such as [our] War Tycoon, or [Nosniy’s] RIVALS, which is a really slick shooter that carries sometimes up to a hundred thousand plus CCUs during a weekday, that are clearly attracting a much older” and male-skewing audience that more often play on PCs or consoles.

“The best way you can tell that is really looking at the Discord followers for a given game,” Ferencz added. “If you take a game like Brookhaven, for example, great game, absolutely massive franchise. It has not only very few Discord followers, but almost no Discord followers online” because its user base is quite young.

Conversely, “if you look at a game like War Tycoon, it has about the same number of followers, despite having a fraction of the users on Discord, and then a much larger number of Discord users online in absolute terms at any time.” This implies an older (and a male-skewing) audience, and a different hardware platform mix.

“If you look at the last six months specifically, or last eight months, which has been a really wild ride on Roblox, starting with Grow a Garden in April, we’ve seen the platform hitting pretty wild, insane numbers on the weekends.”

What I think is happening is a lot of early onset nostalgia. So, I think a lot of people who are now in their late teens and even early 20s who grew up with the platform are really excited to see it, as fans, like, hitting these new numbers that are just unbelievable, right? 25 million concurrent players, and in a single game, for example? 35 million concurrent players on the platform as a whole?

“I’m not sure they’re necessarily sticking around as daily players,” Ferencz continued. “They’re coming on to be part of the moments, and to sample some of the gameplay. And I think that a little bit of Roblox is becoming part of the ongoing gaming diet of a lot of older Gen Zs, and very young Millennial gamers who grew up with the platform.”

“There’s also a lot of parents co-playing in these events,” Ferencz said to Posner. “I don’t have any panel data to support that, but it’s what I hear from a lot of friends I know who have kids who are on Roblox….They all have accounts they’ve made so they can play Grow a Garden or Steal a Brainrot with their kids.”

I can vouch for this assessment. I have a ten year-old daughter who, somewhat inexplicably, happens to dislike (and has vowed to never play) Steal a Brainrot…but is all over the current #15 most popular experience, Dandy’s World.

Our daughter is as deep into Dandy’s World lore and its character relationships across TikTok, YouTube, Discord, and Roblox as any game I was into…perhaps ever.

The fan art is off the hook as well. I can only speak in depth about Dandy’s World, but that game has generated a social media whirlwind that has taken on a life of its own in the past year.

“If you look at Steal a Brainrot,” Ferencz continued, “you think to yourself, ‘Is this something that, you know, many 16 or 18 year-olds could spend time on regularly?’”

My answer to his rhetorical question is, “No.”

“What’s working is the same thing that works on TikTok,” Ferencz hypothesized. “What works on TikTok? Open up your phone, talk into it, set it up, do a dance, ship it…That’s what makes TikTok go. And analogously, that is what makes Roblox go. Code a game, ship it, see what happens.”

“I’ll give you an example of a game called DIG that I followed. It was made by part of the same people who made the game Fisch, which was a huge hit on Roblox and remains a top 20 game on the platform.” (As of early February, per RoMonitor, Fisch had slipped to #22.)

“They brought in all these YouTubers,” Ferencz continued. “They built a closed community for a paid beta, and it launched absolutely massively, with 80,000 concurrent users. That’s a good launch on any platform. That is a world-class launch.”

“And within a month it….essentially had no users at all, like, practically speaking, because the algorithm doesn’t care about launching games.”